Knock-outs trading

Capped risk; unlimited profit potential. Trade global markets with knock-outs - whether you're bullish or bearish.

How do knock-outs work?

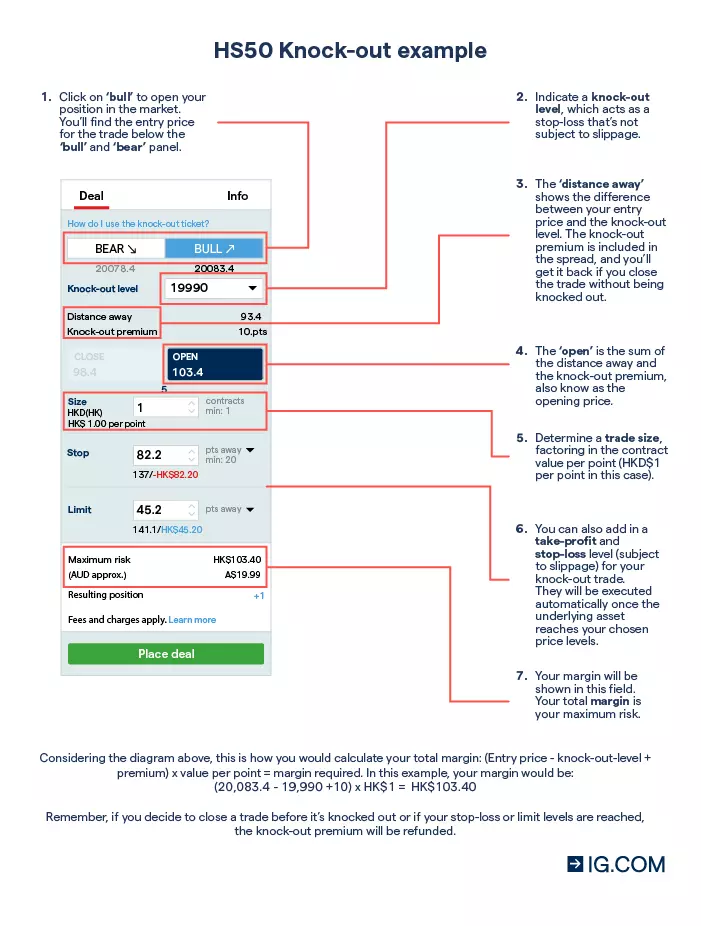

Knock-outs are a limited-risk product with an expiry. They move one-for-one with the underlying price1, and close automatically if your chosen knock-out level is hit. By choosing your knock-out level and your trade size, you can manage your maximum risk for each trade.

You can trade knock-outs whether you think the market will rise or fall – buying a bull knock-out means you think the market will rise, and a bear knock-out trade means you think it will fall. You can close your position at any time before expiry - unless the knock-out level is reached, in which case the position will be automatically closed.

Why trade knock-outs?

Higher leverage

Set your knock-out level and trade size to control your risk taken

Simple pricing

The knock-out price moves one-for-one with IG’s underlying price1

Lower risk

Your total margin is equal to your total risk

Knock-outs vs CBBCs

Compared with the traditional CBBC (CBBC), the bull-bear option provided by the IG CFD account has the following differences and advantages.

Knock-outs |

CBBC |

|

Trading hour |

24-hour trading (based on IG underlying market) |

Spot trading session (9:15am to 4:30pm, including market closure) |

Underlying markets |

Global indices, FX, Commodities, Global shares, Cryptocurrencies |

Hang Seng Index, Hong Kong shares, US indices |

Spread |

Hong Kong HS50 spread is as low as 5 points |

Usually around 10 points for Hang Seng Index |

Call price/knock-out level |

Set your own knock-out level. Hong Kong HS50 knock-out level as low as 20 pips from current market price |

Hang Seng Index strike price is usually around 700 pips from current market price and it is set by issuers |

Settlement |

T+0 |

T+2 |

Price sensitivity |

Delta 1 |

Dependent on the issuer |

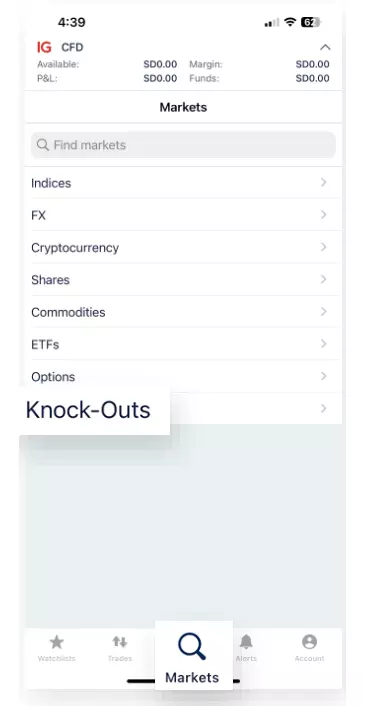

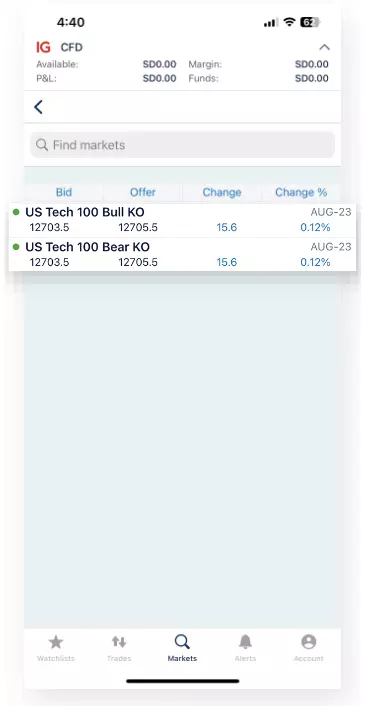

1. After logging in, click on 'knock-outs' under the 'markets' tab

On iOS (iPhone, iPad)

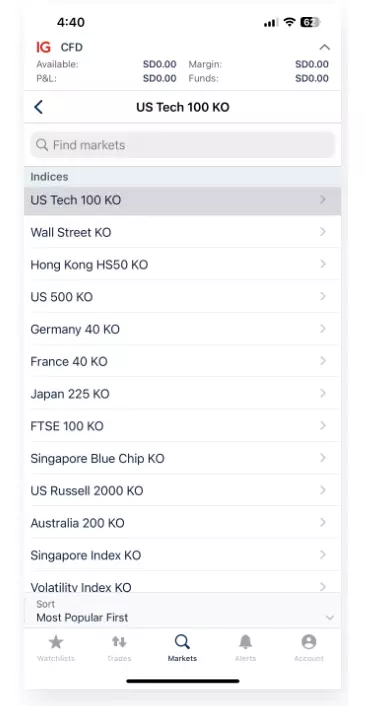

2. Select the underlying market you'd like to trade

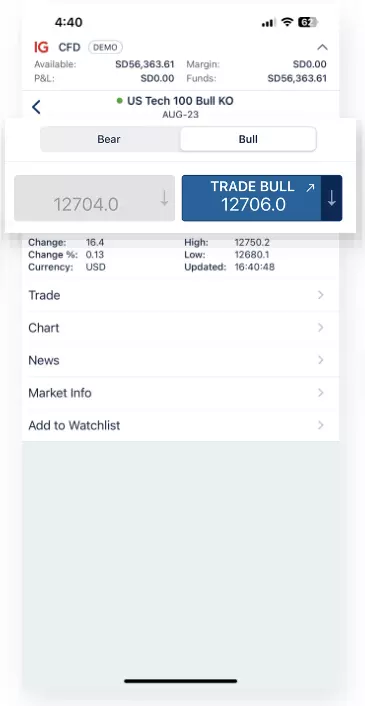

3. Choose between a 'bull' or 'bear' contract based on your directional bias

4. Click on 'trade bull' or 'trade bear' (depending on the chosen direction) to open the deal ticket

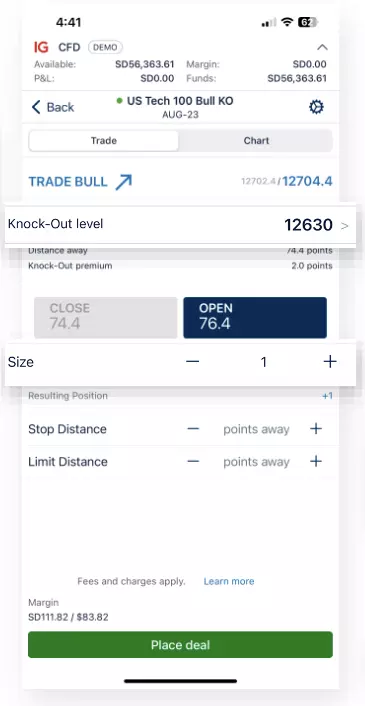

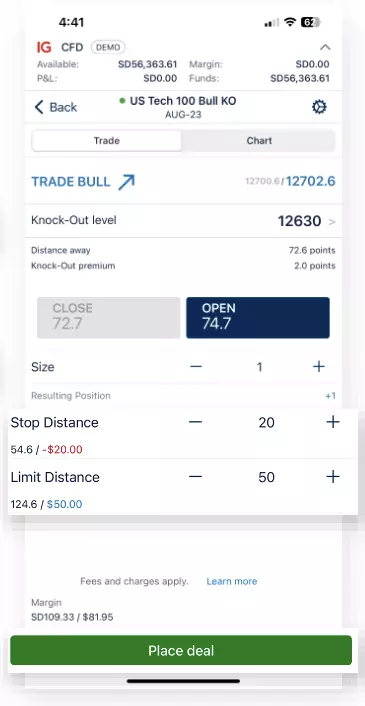

5. Indicate a knock-out level and position size of your trade

6. Input your preferred stop distance and limit distance (optional). Click on the 'place deal' button to open the trade

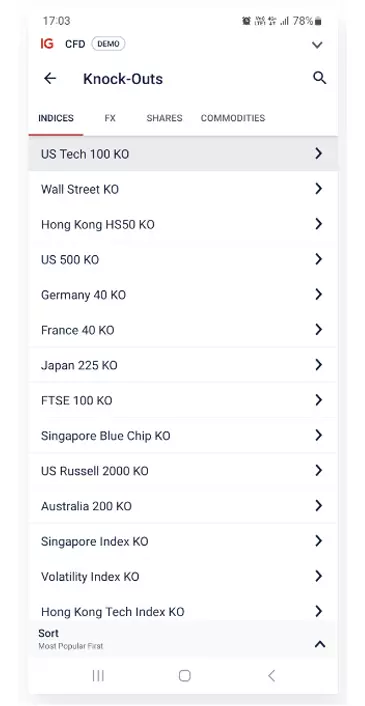

1. After logging in, under the 'markets' tab, click on the search icon on the top right-hand side of the screen

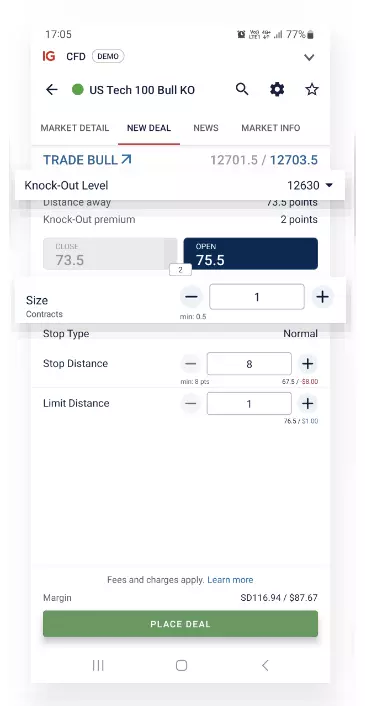

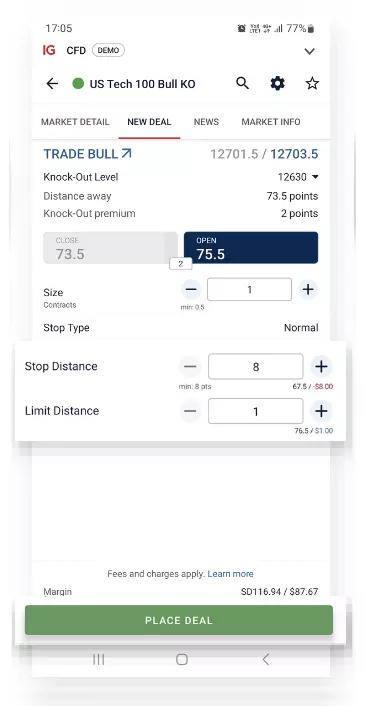

On Android

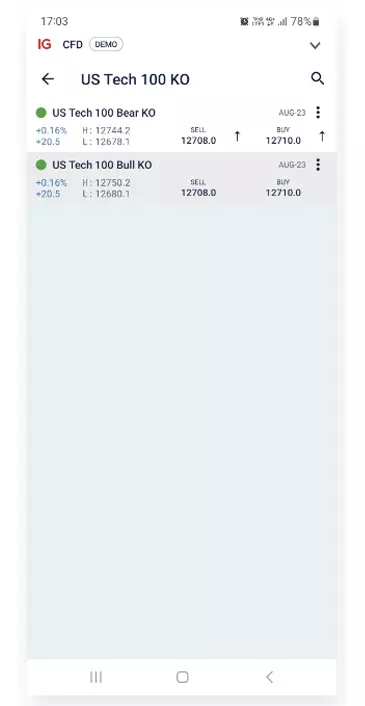

2. Click on knock-outs and select the asset class and then the underlying market you would like to trade

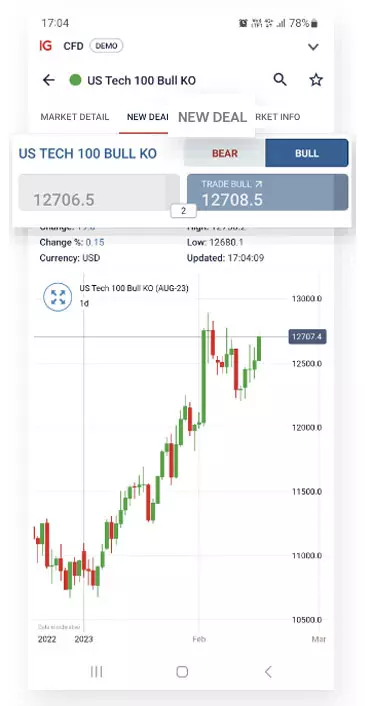

3. Select either the 'bull' or 'bear' market from two options, depending on your directional bias

4. Click on either the 'trade bull' or 'trade bear' button, or switch to the 'new deal' tab to open a ticket

5. Indicate a knock-out level and determine your position size

6. Input your preferred stop loss and/or limit distance (optional). Upon confirming all fields, click on the 'place deal' button

Set up your knock-outs on mobile

How much do knock-outs cost?

The opening price of a knock-out is the difference between IG’s underlying price at which you open your position and the knock-out level you select. A small knock-out premium is included in our spread, which means you’ll receive it back if you close the trade without being knocked out.

Get full product details on the cost of knock-outs, including spreads and funding charges, by following the link below.

On which markets can I trade knock-outs?

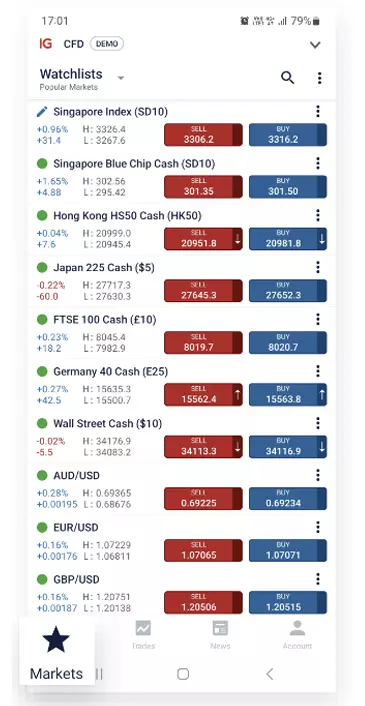

IG offers this product across a range of popular markets, available 24 hours a day, including:

Major forex pairs

Global stock indices

Commodities

Shares

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

You might be interested in…

Learn more about leveraged trading and how we can help you to manage your risk

Discover our transparent fee structure – including spreads, commissions and margins

Get some tips on how to get started trading CFDs

1 This is not the case when the knock-out premium changes. If the knock-out premium changes, the price of the knock-out will move by the amount the premium changes.