US dollar nosedives as the end of the Fed's hike cycle in sight

The US dollar recorded its worst day in 2023 as the US Consumer Price Index (CPI) for October cemented the view that the Federal Reserve has done hiking interest rates.

The US dollar recorded its worst day in 2023, dipping more than 1.5% on Tuesday, as the US Consumer Price Index (CPI) for October cemented the view that the Federal Reserve has done hiking interest rates.

US CPI review

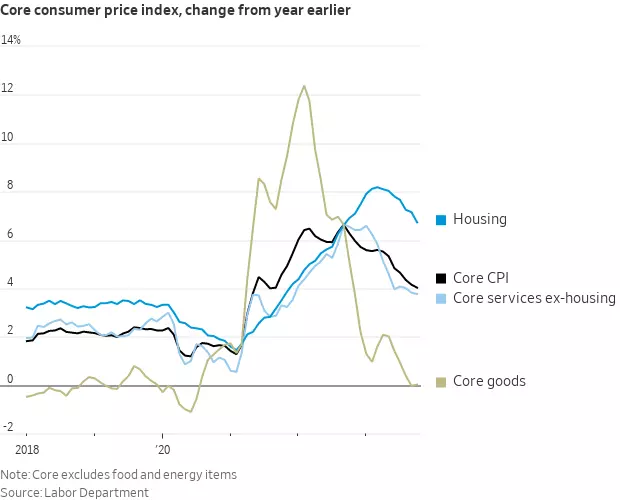

According to the Bureau of Labor Statistics, in October 2023, the United States' Consumer Price Index (CPI) increased by 3.2% year on year, marking a notable decrease from the 3.7% recorded in the previous month and falling below the anticipated rate of 3.5%.

Overall, inflation seems to be resuming a broad-based slowdown, particularly evident as gasoline prices retreated during the first month of the fourth quarter. Gasoline prices saw a significant decline of 5% in October, in stark contrast to the 2.1% increase observed in September.

So, what’s next for Fed?

This week's inflation gauge adds further weight to the perception that the Federal Reserve has concluded its interest rate hikes, especially alleviating the resurging concern sparked by recent hawkish statements from Fed policymakers. Fed Chair Powell stated last week that they are "not confident" in meeting the inflation mandate with the current monetary policy and will be cautious about the risk of being misled by a few positive months of data. Despite this, Tuesday's Consumer Price Index (CPI) has prompted investors to firmly believe that the central bank’s unprecedented tightening journey has come to an end.

According to CME Fed Watch, the market currently perceives the probability of a rate hike in December/January as close to none. Furthermore, the likelihood of the first rate cut in June is approaching 50% now.

USD technical analysis

From a techinical point of view, the strong momentum for the greenback since July has clearly run out of steam, as evidenced by the breach of the months-long trendline as well as mid-term moving averages. The final layer of support before confirming a bearish turn for the price will focus on the 200-day moving average, which sits near 103/103.1 at the moment. Further down lies the psychological 100 mark. On the flip side, the 50-day SMA at 104.3 should serve as the imminent resistance line.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Discover how to trade the markets

Learn how indices work – and discover the wide range of markets you can trade on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on FTSE 100 and Germany 40

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.