Slight red finish for Dow and Nasdaq ahead of tech earnings

CoT bias remains in majority short territory for US indices though not heavy to the sell side, retail bias majority sell for Dow, Nasdaq, DAX, and S&P.

Dow Technical analysis, overview, strategies, and levels

Oscillations near the highs for the Dow, its previous Weekly 1st Support level holding and aiding conformist reversals, but where Daily conformist strategies failed as although prices recovered on Friday, they were in for a move beyond its 2nd Support level the day before (narrowed ranges on the Daily mean levels on volatile days are broken with far greater ease, while on the Weekly we have yet to get a significant move). Financials led the gains with JIGC-UK and Goldman Sachs on top, only a handful finishing in the red with Intel's opening lower (after Thursday's earnings where it beat estimates but was weak on guidance) putting it in the very bottom. US data late last week impressed for employment, housing, manufacturing, and services, and today we'll get durables expected to show growth.

IG client* and CoT** sentiment for Dow

CoT bias is still majority short with longs dropping by 998 lots and outdone by a 2,248 lot reduction in shorts.

Dow chart with retail and institutional sentiment

Nasdaq Technical analysis, overview, strategies, and levels

As with the Dow, Weekly conformist buy-on-reversal strategies outperformed as its previous 1st Support level held, but short-term Daily conformist strategies failed on the increase in volatility taking prices past its S/L, even if it managed to recover on Friday. Intel (also) a component of this index meant it was in the bottom following its earnings, and weakness in datacenter sales pointed to rival AMD likely picking up the slack, the component outperforming alongside Xilinx and other semiconductors like ASML and Skyworks Solutions. As for earnings, the big one for today is Tesla, though the remaining FAANG stocks (after Netflix last week) and Microsoft Corp (24 Hours) will also be on offer this week, and ought to be noted given their composition in this tech-heavy index (as well as other non-tech indices).

IG client* and CoT** sentiment for Nasdaq

As for CoT bias, they remain a slight sell 52% and unchanged from the week before with sub-1K reduction in both long and short positions.

Nasdaq chart with retail and institutional sentiment

DAX Technical analysis, overview, strategies, and levels

Despite its price retracing a bit off of the highs, conformist buy-on-reversals strategies outperformed as its previous Weekly (and on the Daily late last week) 1st Support level managed to hold, far more of its technical boxes flashing green here as opposed to the Daily where ranges have narrowed on what has been a lack of momentum on most days around these price levels. Infineon and Continental were big gainers in Friday's session, but plenty were in the red with losses heaviest for Deutsche Wohnen and Bayer. As for German economic data, manufacturing beat estimates while services was a miss, both showing above 50 readings signifying improvement. We'll get ifo's figures shortly, little change expected for the month of April save for improved expectations.

IG client*sentiment for DAX

As for sentiment, the pullback was just what retail traders needed given they held an extreme sell 81% bias at the start of last week, and start this week off with a heavy sell 69%. And as we don't get CoT figures for the DAX, they are majority short all four US indices albeit only slightly in the S&P and Nasdaq.

DAX chart with retail and institutional sentiment

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the previous trading day.

** CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

Be sure to request IG’s Weekly & Daily Market Report when you open an account with IG Dubai and get access to the full information on the FX majors, commodities, indices, and Bitcoin.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

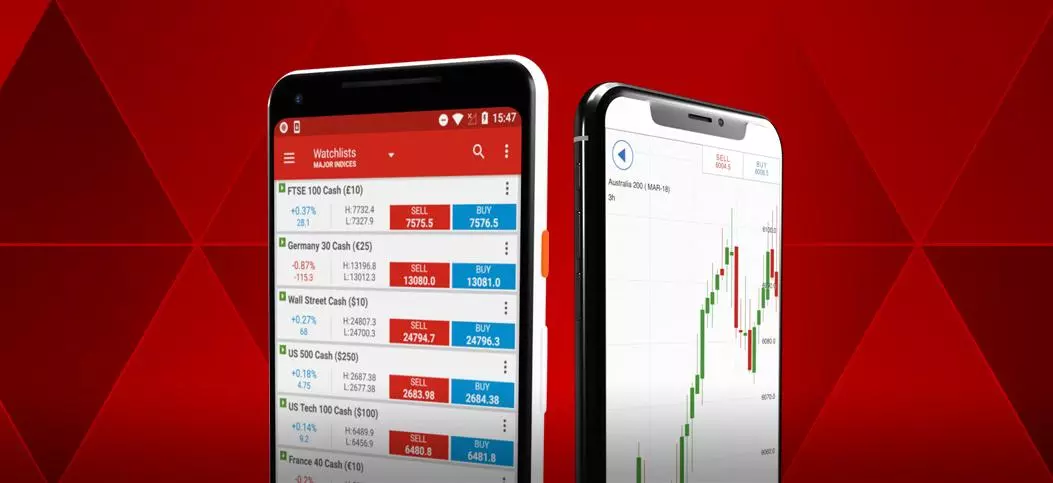

See an opportunity to trade?

Go long or short on more than 17,000 markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.