Market update: US dollar forecast- technical analysis on USD/CAD, AUD/USD and NZD/USD

Analyzing key movements and levels in USD/CAD, AUD/USD, and NZD/USD post-FOMC, offering a snapshot of crucial technical patterns.

USD/CAD technical analysis

USD/CAD showed strength after the FOMC decision, but pivoted to the downside on Thursday, nudging lower towards cluster support resting at 1.3390. It is imperative for the bulls to fiercely safeguard this region; any failure to do so could potentially trigger a retracement towards the 1.3300 handle.

Conversely, if the pair regains its poise, its first challenge lies in surpassing the 50-day simple moving average. Beyond this point, the focus shifts to trendline resistance and the 200-day simple moving average, situated in the proximity of 1.3480.

USD/CAD daily chart

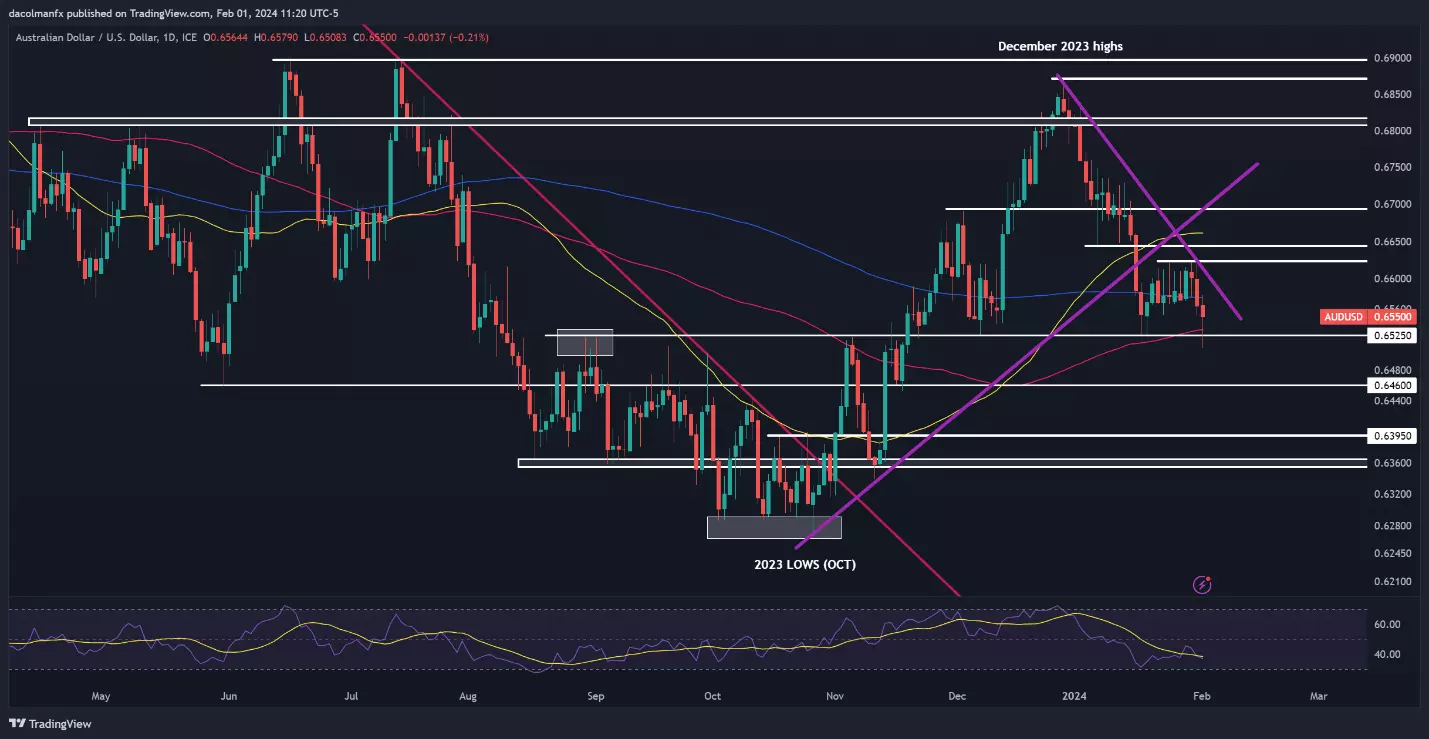

AUD/USD technical analysis

A shift towards a risk-off sentiment weighed on AUD/USD during Thursday's trading session, though the pair managed to maintain its position above technical support at 0.6525. For market conditions to be conducive to a bullish reversal, this floor must hold; any breach could trigger a move towards 0.6460.

On the flip side, if the mood brightens and the Aussie mounts a comeback, resistance awaits at 0.6600 and then 0.6625. If history is any guide, prices could be rejected from this region on a retest; however, a successful breakout could lead to a move towards 0.6645, followed by 0.6695.

AUD/USD daily chart

NZD/USD technical analysis

After a subdued performance after the Fed’s monetary policy announcement, NZD/USD rebounded on Thursday, making strides toward trendline resistance at 0.6155. While this technical ceiling is expected to act as a staunch barrier to further advances, a breakout could bring a key Fib level at 0.6180 into play.

In contrast, should sellers reemerge and trigger a market retracement, cluster support spanning from 0.6085 to 0.6050 will be the first line of defense against a bearish assault. The bears may struggle to push prices below this region, but if they succeed, a move towards 0.6000 could ensue.

NZD/USD daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Discover how to trade the markets

Learn how indices work – and discover the wide range of markets you can trade on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on FTSE 100 and Germany 40

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.