Market update: crude oil prices turn lower, Bearish Engulfing Candlestick pattern in focus

Crude oil prices turned lower over the past 24 hours with a Bearish Engulfing candlestick pattern now in focus; watch rising trendline, RSI divergence on four-hour.

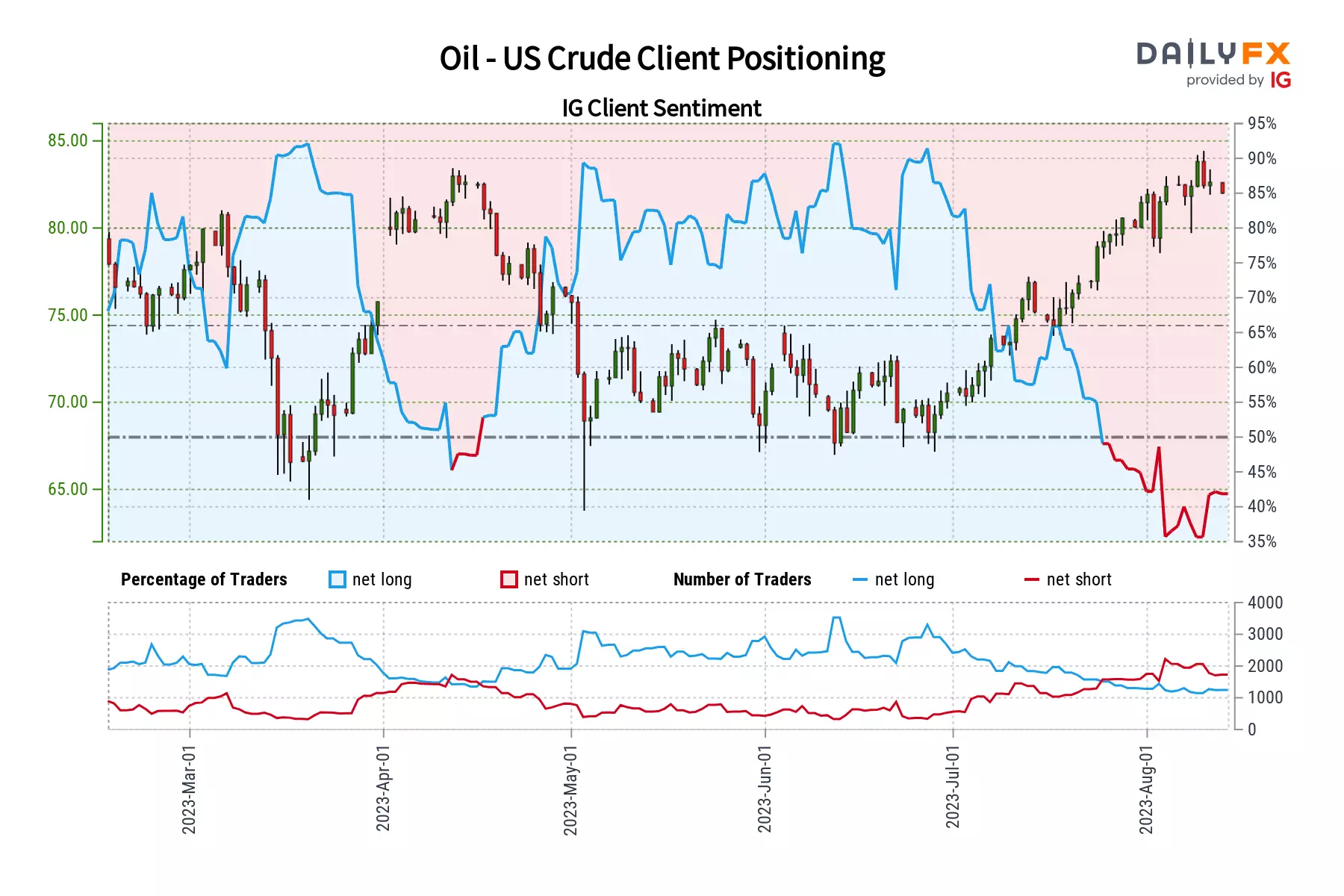

US crude sentiment outlook: bearish

WTI crude oil prices might be showing early signs of topping that might be worth paying attention to from a technical standpoint. On the daily chart, a Bearish Engulfing has emerged. Downside confirmation is lacking at this stage, however, and further downside from here could underscore the candlestick pattern.

This is as prices trade just beneath the 92.43 – 93.72 resistance zone, which is made up of highs from November. In the event of a turn lower, keep a close eye on the 61.8% Fibonacci extension level at 88.75 before the 20-day moving mverage kicks in. Otherwise, clearing resistance exposes the 100% level at 95.63.

IG Client Sentiment chart

US crude technical analysis

Zooming in on the four-hour setting may offer better insight into what key levels to watch in the event of extended losses. For starters, on this timeframe, WTI is sitting around the near-term rising trendline from the end of August. A confirmatory downside breakout would underscore an increasingly near-term bearish technical bias.

Meanwhile, negative RSI divergence shows that upside momentum is fading. That can at times precede a turn lower. Such a case would expose the 23.6% and 38.2% Fibonacci retracement levels at 89.07 and 86.87, respectively. The latter is also closely aligned with the 100-day moving average, which may reinstate the broader upside bias.

US crude daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.