European indices update: DAX and FTSE fight to maintain altitude

The European Central Bank and Bank of England are bracing for probable interest rate hikes following persisting inflation woes. While DAX retains potential for continued growth, FTSE confronts a potentially deeper decline.

Lagarde's hawkish tone echoes in ECB's path ahead

Last week, hawkish comments from ECB President Lagarde at the ECB's Sintra conference solidified expectations of an rate hike in July.

Lagarde's comments came ahead of the release of EA inflation data, which would have provided little comfort to ECB hawks.

While EA headline inflation eased to 5.5% YoY in June from 6.1%, it remains well above the ECB's target of 2%. Additionally, core inflation increased in June to 5.4% YoY from 5.3% prior. Neither reading gives much reason to push back on market pricing of another two 25bp rate hikes, which would take the ECB's official deposit rate to 4% by year-end.

UK markets reel from inflation shock

In the UK, markets are still dealing with the fallout of May's recent horrific inflation data print. The rates market is almost fully priced for another 125 bp of rate hikes from the BoE over the next eight months, taking the BoE's official cash rate to 6.25%.

Just one month ago, the market was looking for the BoE's terminal rate to land at 5.50%. The savage repricing higher in the rates market has revived fears of a recession and weighed on the FTSE in the process.

DAX technical analysis

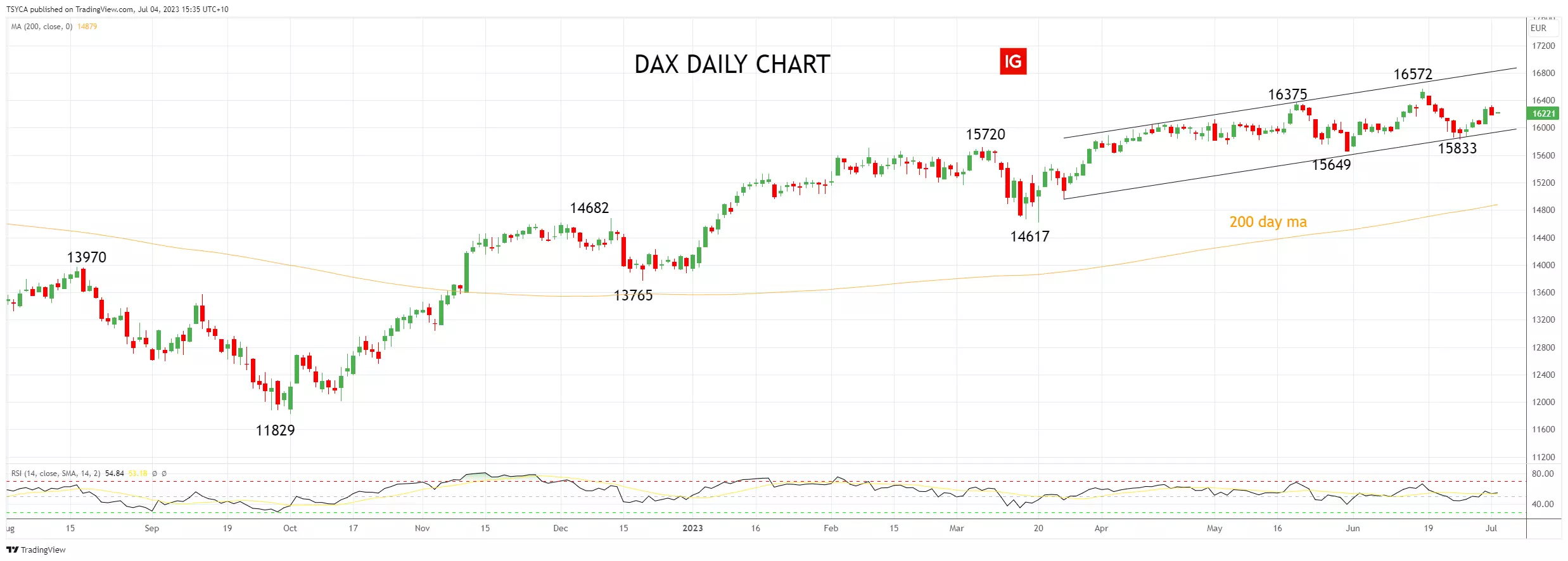

Last month the DAX printed a fresh all-time high at 16572 before bearish divergence via the RSI indicator undermined the move and kept the DAX trading within the confines of its upward-sloping trend channel.

Providing the DAX remains above support from the bottom of the trend channel 15950ish and last week's 15,833 low allow for the DAX to continue to edge higher.

Aware that should the DAX see a sustained break of 15,950ish and then falls below the recent swing low at 15,833 low, a deeper decline is expected towards support at 15,300/300 before the 200-day moving average (MA) of 14,900.

DAX daily chart

FTSE technical analysis

The dour macro backdrop in the UK outlined above has weighed more heavily on the FTSE in recent weeks as it builds acceptance under the 200-day MA, currently at 7543.

Presuming the FTSE remains below the 200-day MA and then breaks below uptrend support at 7400, a deeper decline is expected towards support at 7200, coming from year-to-date lows.

Until then, however, further sideways-range trading within the triangle mapped below is possible.

FTSE daily chart

- Source: TradingView. The figures stated are as of July 4th, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.