Algorithmic trading

Create and refine your own trading algorithms, or use off-the-shelf solutions, when you choose the world's No. 1 CFD provider¹.

What is algorithmic trading?

Algorithmic trading is when you use computer codes and software to open and close trades according to set rules such as points of price movement in an underlying market. Once the current market conditions match any predetermined criteria, trading algorithms (algos) can execute a buy or sell order on your behalf –saving you time by eliminating the need to manually scan the markets.

With us, you can trade with algorithms through our partnerships with cutting-edge platforms including ProRealTime and MetaTrader 4 (MT4), as well as with our native APIs. We also offer advanced technical analysis and charting tools to make algorithmic trading easy for you, whether you want to build and fully customise your own algorithms or use off-the-shelf solutions.

Why use algorithmic trading?

Remove human error

Trade without letting emotions get in the way of realising profits or cutting losses

Act on events

Act on infrequent events, such as the Dow closing 500 below its 20-day moving average

Improved strategy

Finely tune your risk management by using algorithms to implement stops and limits on your behalf

Low maintenance

Set your algorithms up and let them trade around your schedule

Backtest

Refine your algorithms against historical data to establish the best combination of buy or sell parameters

Instant execution

Maximise your exposure to the underlying market with automated buy and sell orders

Algorithmic trading with IG

Build your own algorithms, or use off-the-shelf solutions, to trade CFDs

Rely on advanced technology to combat gaming and reduce signalling

Use strategies to monitor the order book and manage your execution

Add advanced algorithmic strategies to your trading at no extra cost

Get expert support 24 hours a day, from Monday to Friday

Choose different platforms depending on your algorithmic trading preferences

What’s the best algorithmic trading platform for me?

That depends on what you want from your platform – many traders use a combination, to accomplish a range of goals.

- ProRealTime

- MetaTrader 4

- Native APIs

For easy algorithm building

ProRealTime is the leading web-based charting package, and you can use it to create your own trading algorithms. ProRealTime is designed to make it easy to build your own algorithms.

Tools within ProRealTime – including the optimisation suite and unique coding language – make it easy to create, backtest and refine your own algorithms from scratch. This means your algorithms will operate according to your exact specifications while running on the ProRealTime platform.

For pre-made algorithms

MT4 is a tried-and-tested trading platform, with a large community of users who are actively creating and refining trading algorithms. These are easily available to you on the MT4 marketplace, which offers a wide range of off-the-shelf-solutions.

MT4 is known for its indicators and add-ons, some of which you’ll get for free when you use our MT4 offering. These can help you with chart analysis, as well as enabling you to fully customise the MT4 platform to your own needs.

For building from scratch

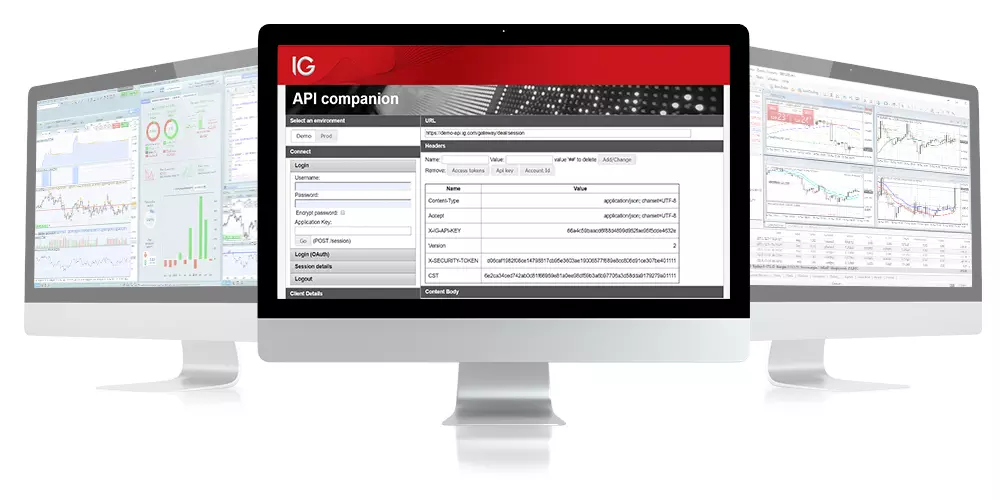

An application programming interface (API) enables you to automate trades, build integrations and create trading algorithms and apps from scratch. Our web API is an easy way to get market data and historical prices.

Creating APIs is only recommended for those with a background in programming and coding, because it is the most complex of the options available here. But, APIs do offer the greatest amount of customisation, since you build them yourself from the ground up using coding language such as Java, Excel (VBA), .NET, or any other programming language that supports HTTP.

Create an IG account to access algorithmic trading

-

Fill in the form

We’ll ask a few questions about your trading knowledge to ensure you get the best experience.

-

Instant Activation for Singaporean citizen or PR

Or send in your documents and we'll validate your ID and address.

-

Fund your account and trade

You can withdraw your funds easily, whenever you like.

What are the main algorithmic trading strategies?

There are three main algorithmic trading strategies: a price action strategy, a technical analysis strategy, and a combination strategy.

- Price action strategy

- Technical analysis strategy

- Combination strategy

A price action algorithmic trading strategy will look at previous open and close or session high and low prices, and it’ll trigger a buy or sell order if similar levels were achieved in the future.

You could, for example, create an algorithm to enter buy or sell orders if the price moves above point X, or if the price falls below point Y. This is a popular algorithm with scalpers who want to make a series of quick but small profits throughout the day on highly volatile markets – a process known as high-frequency trading (HFT).

To create a price action trading algorithm, you’ll need to assess whether and when you want to go long or short. You’ll also need to consider measures to help you manage your risk, such as stops – including trailing and guaranteed stops – and limits.

You can configure a price action trading algorithm according to the market, the time frame, the size of the trade and what time of day the algorithm should operate - which can help you capture volatility as the markets open or close.

A technical analysis algorithmic trading strategy relies on technical indicators including Bollinger bands, stochastic oscillators, MACD, the relative strength index and many more.

With this strategy, you’d create an algorithm to act on the parameters of these indicators, such as closing a position when volatility levels spike.

To create a technical analysis strategy, you’ll need to research and be comfortable using different technical indicators. For example, you can create algorithms based on Bollinger bands to open or close trades during highly volatile times. Whether you open or close depends on your attitude to risk, and whether you have a long or short position in a rising or falling market.

With a technical analysis strategy, you’re less focused on price and more interested in using indicators or a combination of indicators to trigger your buy and sell orders.

A combination algorithmic trading strategy uses both price action and technical analysis, to confirm potential price movements. Algorithms can then enter buy or sell orders based on this information.

To create a combination trading strategy, you’ll need to carry out analysis of historical price action on an underlying market. This means having an understanding of different technical indicators and what they tell you about an asset’s previous price movements.

In a combination strategy, you’ll need to establish whether you want to go long or short, and when you want the algorithm to trade during the day.

You can configure a combination strategy according to the market, the time frame, the size of the trade and the different indicators that the algorithm is designed to use.

FAQs

What is the difference between automated trading and algorithmic trading?

The difference between automated trading and algorithmic trading is open to interpretation, because some people use the two terms interchangeably. That said, automated trading usually refers to automation of manual trading through stops and limits, which will automatically close out your positions when they reach a certain level, regardless of whether you are at your trading platform or not.

Algorithmic trading, on the other hand, usually refers to the process through which a trader will build and refine their own codes and formulas to scan the markets and enter or exit trades depending on current market conditions.

What are some algorithmic trading strategies?

There are several algorithmic trading strategies to choose from. Most traders will choose a price action strategy or a technical analysis strategy, but some combine the two.

A price action strategy applies price data from a market's previous open or close and high or low levels, to place trades in the future when those price points are achieved again. A technical analysis strategy relies on technical indicators to analyse charts and the algorithms will react depending on what the indicators show, such as high or low volatility.

What are the benefits of algorithmic trading?

Algorithmic trading has many benefits. Most notably, using algorithms removes the emotions from trading, because algorithms react to predetermined levels and can do so when you are not even at your trading platform.

Other benefits include the time they save you, the fact that they can react to price movements faster than manual trading – ensuring you get the best price – and the backtesting and redefining which helps to ensure that your algorithms are performing at their optimum levels.

Try these next

1 Based on revenue excluding FX (published financial statements, June 2020)