Shares CFD trading

Trade Contracts for Difference (CFD) on 13,000+ international shares, and get ahead of the competition with longer trading hours.

Trade international shares on the international account

Trade shares on margin

Gain full exposure for just a small initial deposit with our low margins

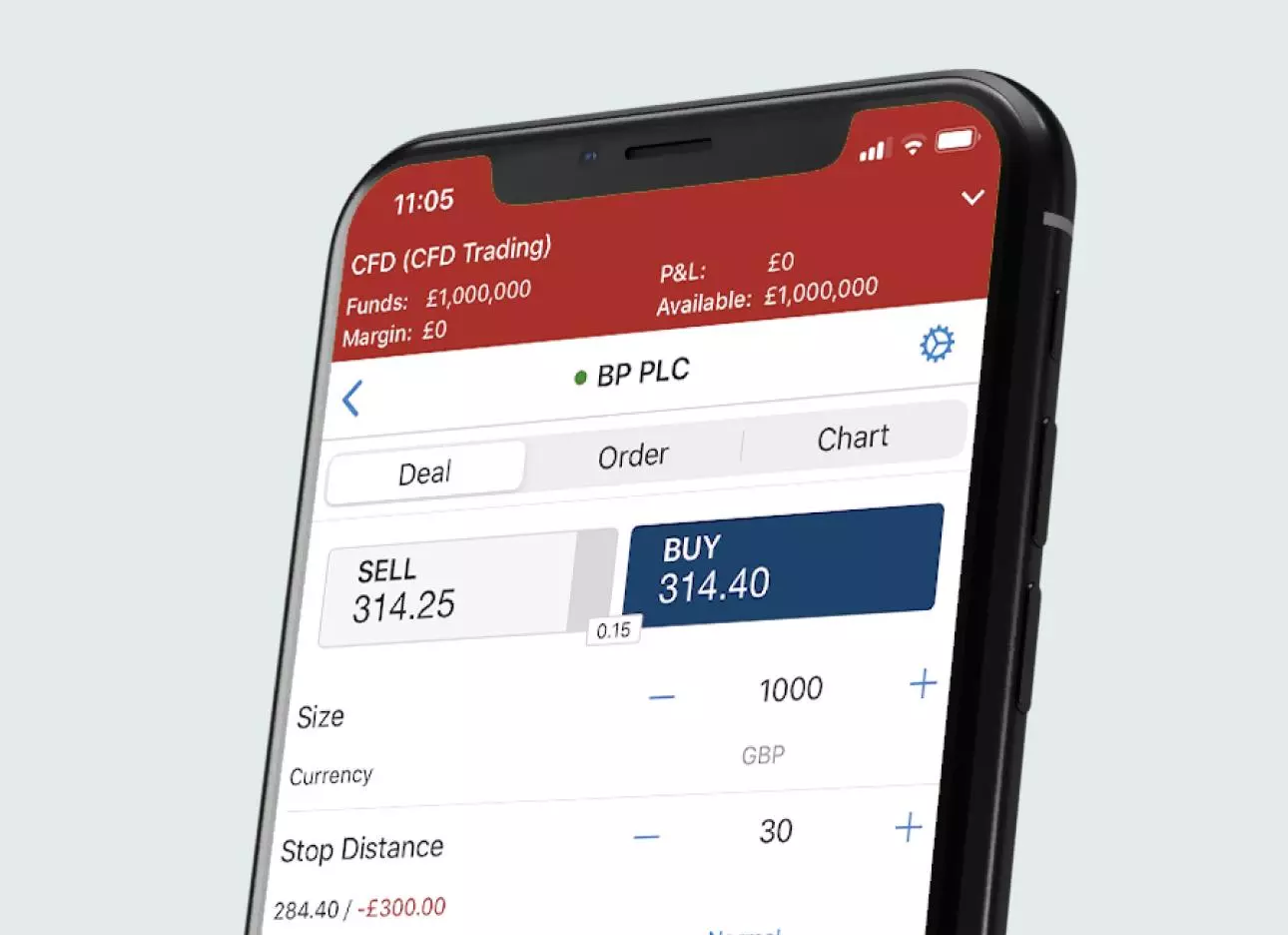

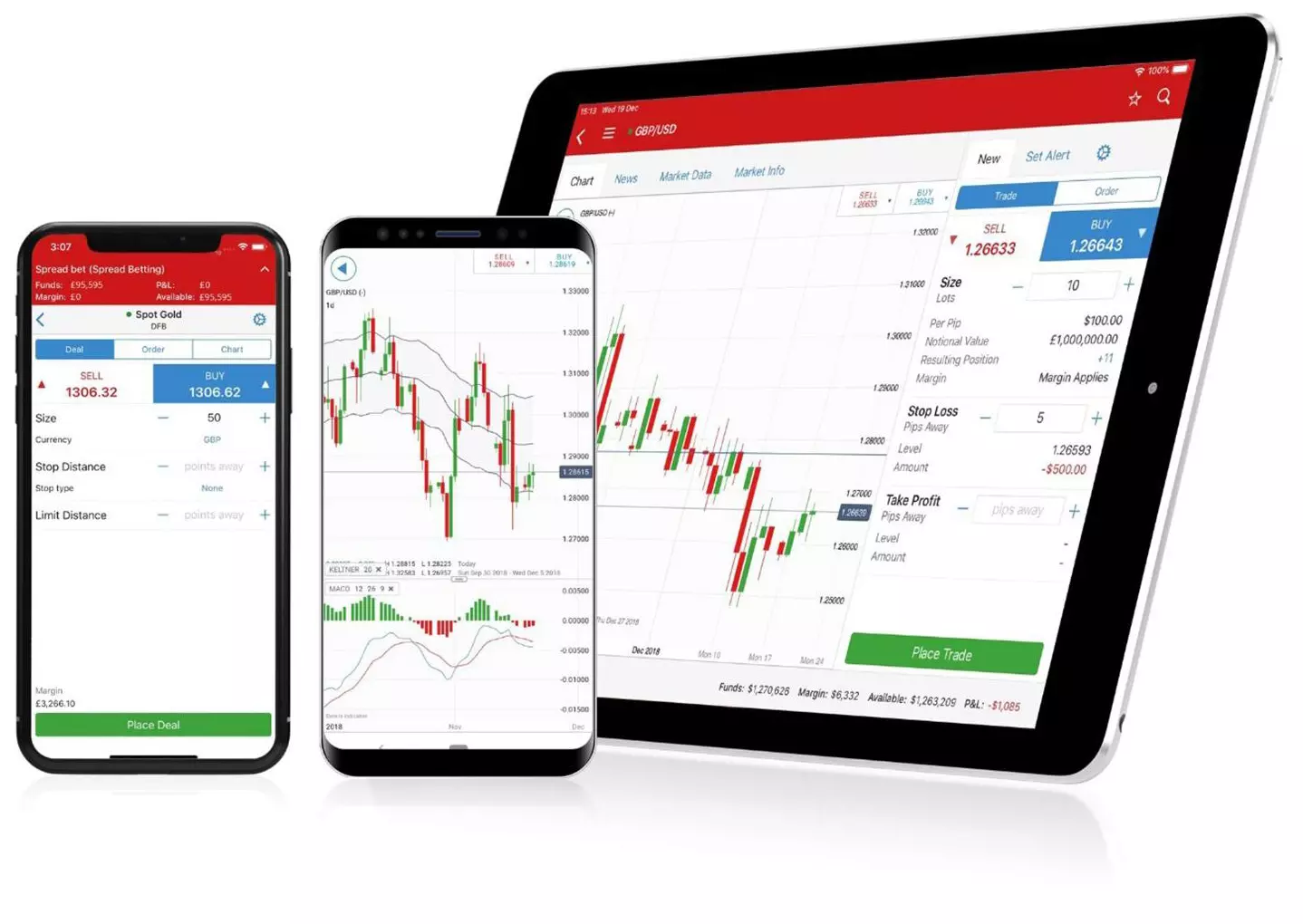

Trade on desktop and mobile

Enjoy seamless trading with our browser-based platform and mobile and tablet apps

Access 17,000+ markets

Get exposure to a wide range of popular SA, UK, US and other international stocks

Discover unique opportunities

Trade out-of-hours on over 70+ US stocks, exclusively with us

Popular stocks to watch

- SA stocks

- US stocks

- FANG stocks

- Cannabis stocks

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions and are indicative only. All shares prices are delayed by at least 15 minutes.

And many more…

Use our market finder tool to see price charts, historical data, market sentiment and analysis on the stocks you’re interested in.

Can’t find what you need? Give us a call on 010 344 0053 and we’ll see if we can add it.

Our share costs

Compare the average cost of buying, holding and selling shares with our CFD trading account.

- Tesla Motors Inc.

- Apple Inc.

- Lloyds Banking Group PLC

- BHP Group PLC

- Nintendo Co. Ltd

- Volkswagen

Tesla Motors Inc.

Buy 17 shares at $750 with a FX rate of 1.305 (GBP/USD)

| CFD trading | |

| Action | Buy 17 shares |

| Capital required to open | $2550 |

| Charge to open | $15.00 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | $1.48 |

| Charge to close | $15.00 (commission) |

| Total fees | £24.24 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

Apple Inc.

Buy 42 shares at $308 with a FX rate of 1.305 (GBP/USD)

| CFD trading | |

| Action | Buy 42 shares |

| Capital required to open | $2587.20 |

| Charge to open | $15.00 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | $1.50 |

| Charge to close | $15.00 (commission) |

| Total fees | £24.26 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

Lloyds Banking Group PLC

Buy 16,000 shares at 62.5p

| CFD trading | |

| Action | Buy 16,000 shares |

| Capital required to open | £2000.00 |

| Charge to open | £10.00 (commission) |

| Round trip FX conversion fee | - |

| Overnight funding | £0.88 |

| Charge to close | £10.00 (commission) |

| Total fees | £20.88 |

This information is correct as of 10/01/2020.

BHP Group PLC

Buy 476 shares at A$40 with a FX rate of 1.904 (AUD/GBP)

| CFD trading | |

| Action | Buy 476 shares |

| Capital required to open | A$3808.00 |

| Charge to open | $19.04 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | $1.78 |

| Charge to close | $19.04 (commission) |

| Total fees | £21.04 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

Nintendo Co. Ltd

Buy 32 shares at ¥43470 with a FX rate of 143.25 (JPY/GBP)

| CFD trading | |

| Action | Buy 32 shares |

| Capital required to open | ¥278,208.00 |

| Charge to open | ¥1,500.00 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | ¥93.30 |

| Charge to close | ¥1,500.00 (commission) |

| Total fees | £21.70 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

Volkswagen

Buy 64 shares at €183.2 with a FX rate of 1.1746 (EUR/GBP)

| CFD trading | |

| Action | Buy 64 shares |

| Capital required to open | €2344.96 |

| Charge to open | €10.00 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | €0.67 |

| Charge to close | €10.00 (commission) |

| Total fees | £17.68 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

Open a share trading account in minutes

*Demo accounts are only available for spread betting and CFD trading.

Open a share trading account in minutes

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

React faster with powerful technology

Our platform and apps are intuitive and highly responsive, so trading opportunities are always within reach

Grow your confidence with an established provider

We’re a FTSE 250 company that’s been leading our industry for nearly 50 years, so our expertise is second to none

*Demo accounts are only available for spread betting and CFD trading.

Open a share trading account in minutes

Open a share trading account in minutes

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

React faster with powerful technology

Our platform and apps are intuitive and highly responsive, so trading opportunities are always within reach

Grow your confidence with an established provider

We’re a FTSE 250 company that’s been leading our industry for nearly 50 years, so our expertise is second to none

Shares trading costs and details

Take a look at the costs and charges of leveraged trading in the tables below.

- CFD trading costs

Margin

CFDs are leveraged, so you can gain full exposure with just a small deposit, known as margin. This deposit isn’t actually a cost to you, but it can make a big difference to the affordability of your position. Your profit and loss are based on the full value of the position – not just the margin – so leverage magnifies your profits, as well as your losses.

| Market | Retail | Leverage equivalent | Professional | Leverage equivalent |

| Apple | 20% | 1:5 | 4.5% | 1:22 |

| Barclays PLC | 20% | 1:5 | 4.5% | 1:22 |

| BHP Billiton PLC (LSE) | 20% | 1:5 | 4.5% | 1:22 |

| GlaxoSmithKline PLC | 20% | 1:5 | 4.5% | 1:22 |

| Vodafone Group PLC | 20% | 1:5 | 4.5% | 1:22 |

Commission

If you trade shares using CFDs, you’ll be dealing at the real market price. Instead of being charged a spread, you’ll pay a small commission to open and close your position.

| Market | Commission per side | Min charge (online) | Min charge (phone) |

| UK | 0.10% | £10 | £15 |

| US | 2 cents per share | $15 | $25 |

| Euro | 0.10% | €10 | €25 |

Trade shares wherever you are

Seize your opportunity on the UK’s best web-based platform and mobile trading app:2

- Web-based platform

- Mobile trading app

Seize your opportunity with our clean deal ticket, clear price charts, and in-platform news and analysis.

Take a position wherever you are, and receive trading alerts and signals on the go.

What is share trading?

With us, ’share trading’ means speculating on share prices without owning the shares themselves. ’Share dealing’, on the other hand, means buying and taking ownership of a company’s shares.

How to trade and invest in shares

Open an account to start trading or investing in shares. Once you’re set up, you can decide which shares you want to trade, research the company and industry it’s in, and then open your first position.

DMA for the experienced trader

Our direct market access (DMA) service enables you to trade CFDs on the underlying market price, and gain greater visibility and depth.

Latest shares news

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

*Demo accounts are only available for spread betting and CFD trading.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

*Demo accounts are only available for spread betting and CFD trading.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account in minutes

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

You might be interested in…

Trade 70+ US stocks after hours with us

Learn how you can improve your chances of trading profitably.

Spread bet or trade CFDs on thousands of exchange traded funds

1For CFDs based on revenue excluding FX (published half-yearly financial statements, June 2019). For forex, based on number of primary relationships with FX traders (Investment Trends UK Leveraged Trading Report released July 2019).

2Best trading platform as awarded at the ADVFN International Financial Awards and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2020.