Bitcoin trading

Take control of your bitcoin trading with the world’s No.1 CFD provider.1

For trading account opening enquiries, please call +41 (0) 58 810 77 42. We’re available Monday to Friday, 9:00am–6:00pm.

Why trade bitcoin with us?

Deal on our award-winning trading platform and app2

Rest assured that you’re trading with an FINMA-authorised and regulated provider

Seize opportunities instantly with alerts by email, SMS or push

Safeguard your capital with our range of risk management tools

Get full exposure with a small deposit when you trade on leverage3

Talk to our expert support team around the clock

Price comparison of a bitcoin trade

| Assuming bitcoin is priced at $9000 |

|

Plus5004 | CMC | |||

| Headquarters | UK | Israel | UK | |||

| Founded | 1974 | 2008 | 1983 | |||

| Typical observed spread | 36 | 36 | 37 | |||

| Long | Short* | Long | Short* | Long | Short* | |

| Overnight funding on £1/pt (ex spread) | £4.93 | -£1.23 | £4.23 | £2.14 | £6.16 | -£1.23 |

| Total cost of round trade held overnight | £40.93 | £34.77 | £40.24 | £38.15 | £43.16 | £35.77 |

| Total cost of trade held for 1 year5 | £1836.00 | -£414.00 | £1796.02 | £1213.95 | £2287.00 | -£413.00 |

* Negative values imply clients receive

Figures are based on a notional value of £9000 representative of a £1/pt bet when bitcoin is priced at $9000. Data is based on analysis of bitcoin offering from prominent UK competitor websites and is correct to the best of our ability as of 6 May 2020. Above data includes the forced expiry for Plus500 where clients are charged spread to close and to re-open the trade. Data is subject to change.

What are the benefits of trading bitcoin?

Go short or long

Trade on bitcoin’s price falling or rising

No need for an exchange account

Get the best prices - which we source for you - from multiple exchanges

React to volatility

Seize opportunity on a market famed for its volatility, even when others are flat

Remember, when trading bitcoin, you aren't taking ownership. Find out more about how to trade bitcoin with us.

How to trade bitcoin with us

When you trade bitcoin with us, you’ll be speculating on its price with derivatives like CFDs.

These products make it possible to take a position on bitcoin’s price without owning any physical coins – which means you can go short or long, depending on the market trend.

To go short on bitcoin, you’d select ‘sell’ and expect the price to fall. To go long, you’d select ‘buy’ and expect the price to rise.

As well as bitcoin, we offer other cryptocurrencies including bitcoin cash and ether – all of which you can trade with CFDs.

Prices above are subject to our website terms and conditions. Prices are indicative only.

Bitcoin full product details

Bitcoin CFD example

You're interested in trading bitcoin (USD) via a CFD. Our price is currently 10,400 to sell bitcoin, or 10,438 to buy it.

You believe that bitcoin’s price will fall against the dollar, so you sell five contracts at 10,400 (the equivalent to selling five bitcoins at $10,400).

The bitcoin price falls and our new price is 10,312/10,350. You decide to take your profit by buying at 10,350.

$10,400 - $10,350 = $50 move or 50 points

Your gross profit is $50 x 5 = $250

If the market had rallied 50 points instead, your gross loss would be $250.

Ways to trade bitcoin with us

You can use CFDs to trade bitcoin with IG Bank – discover the unique advantages of them.

| CFD trading | |

| Accessible to | All clients |

| Traded in | Contracts |

| Tax status | No stamp duty |

| Commission | Commission-free |

| Platforms | Web platform, mobile trading app and MT4 |

| Learn more |

What our clients say about our demo trading account

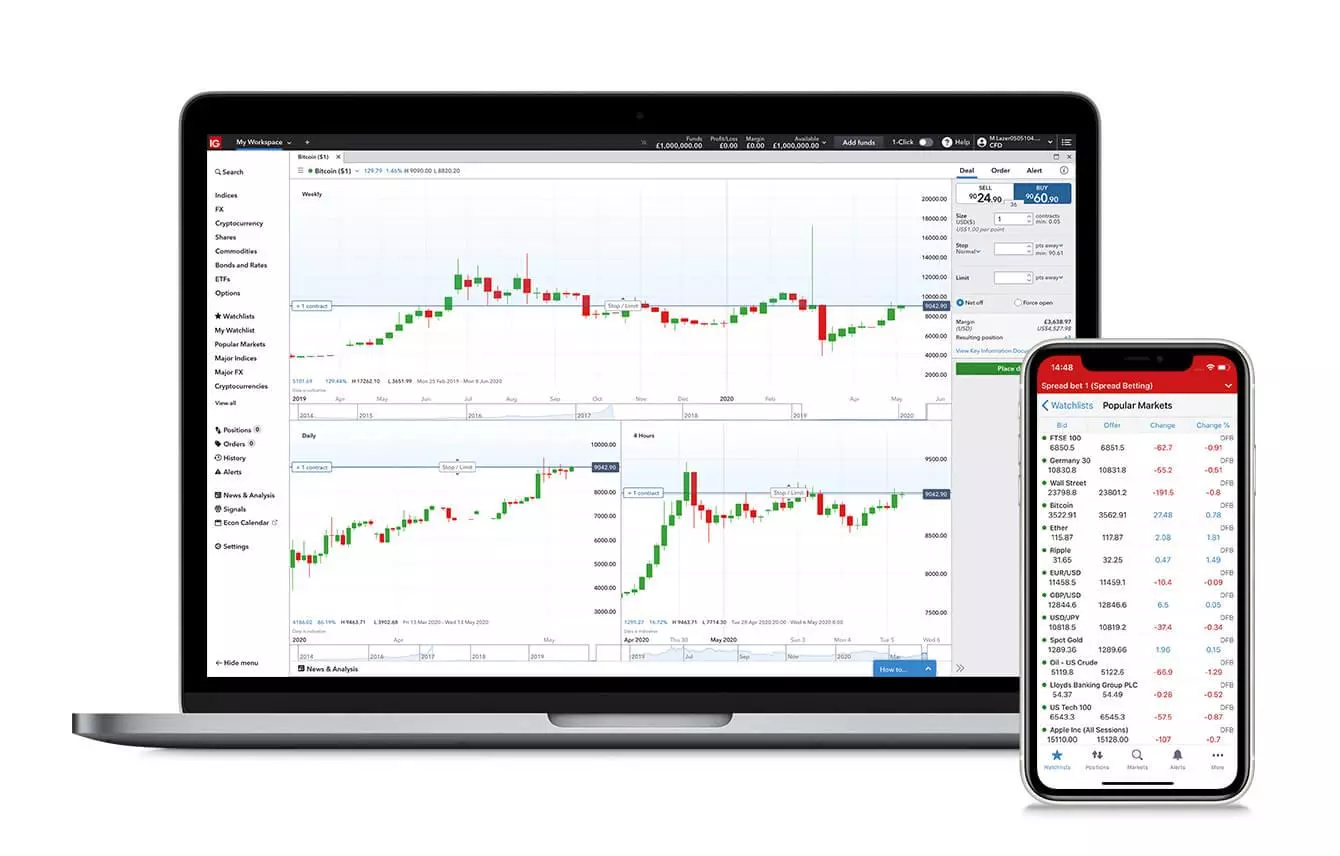

Our award-winning trading platform

Our trading platform has been voted the best in the ADVFN International Financial Awards 2020.

Web-based platform

Take control of your bitcoin trading with our clean deal ticket, clear price charts and in-platform news and analysis.

Mobile trading app

Take advantage of bitcoin opportunity wherever you are, and receive trading alerts and signals on the go – through email, SMS or push.

MetaTrader 4

Automate your trading with MT4 – one of the most popular third-party bitcoin trading platforms .

Get the latest bitcoin news

-

Bitcoin capped by technical resistance as ETF inflows and macro forces collide

2026-01-06T11:14:56+0000 -

Bitcoin's path: from record highs to capitulation lows and a tentative rebound

2025-12-10T04:59:33+0000

FAQs

When is your bitcoin market available in Switzerland?

Our bitcoin market is available around the clock, from 9am Saturday until 11pm Friday (Swiss time).

Do I need a bitcoin wallet to trade bitcoin with IG Bank?

You won’t need a bitcoin wallet to trade with us because you’ll be speculating on the price of bitcoin, rather than taking direct ownership. Any profits will be paid into your bitcoin trading account, and you can withdraw them in cash from there.

Can I trade bitcoin on the MT4 platform?

You can trade bitcoin on the MT4 platform, either through a desktop version of MT4 or with an MT4 VPS. When you download MT4 from IG Bank, you’ll get instant access to our range of free indicators and add-ons.

Try these next

Meet the world's No. 1 CFD provider1

Manage the risk of trading cryptocurrencies with a choice of stops and alerts

Compare cryptocurrencies against each other and start trading with IG Bank

1 Based on revenue (published financial statements, 2022).

2 Awarded ‘best finance app’ at the ADVFN International Financial Awards 2022.

3 While leverage can increase your potential profits, it can also increase your total losses.