Indices trading

Take your position on over 80 indices markets with the world's No.1 CFD provider.1,2

For trading account opening enquiries, please call +41 (0) 58 810 77 42. We’re available Monday to Friday, 9:00am–6:00pm.

Why trade indices with us?

Seize exclusive opportunities on more 24-hour indices than any other provider

Benefit from our deep liquidity – increasing the chance of your larger trades being accepted

Get spreads from 1 point on the FTSE 100, 1.2 on the Germany 40, and 0.4 on the US 500

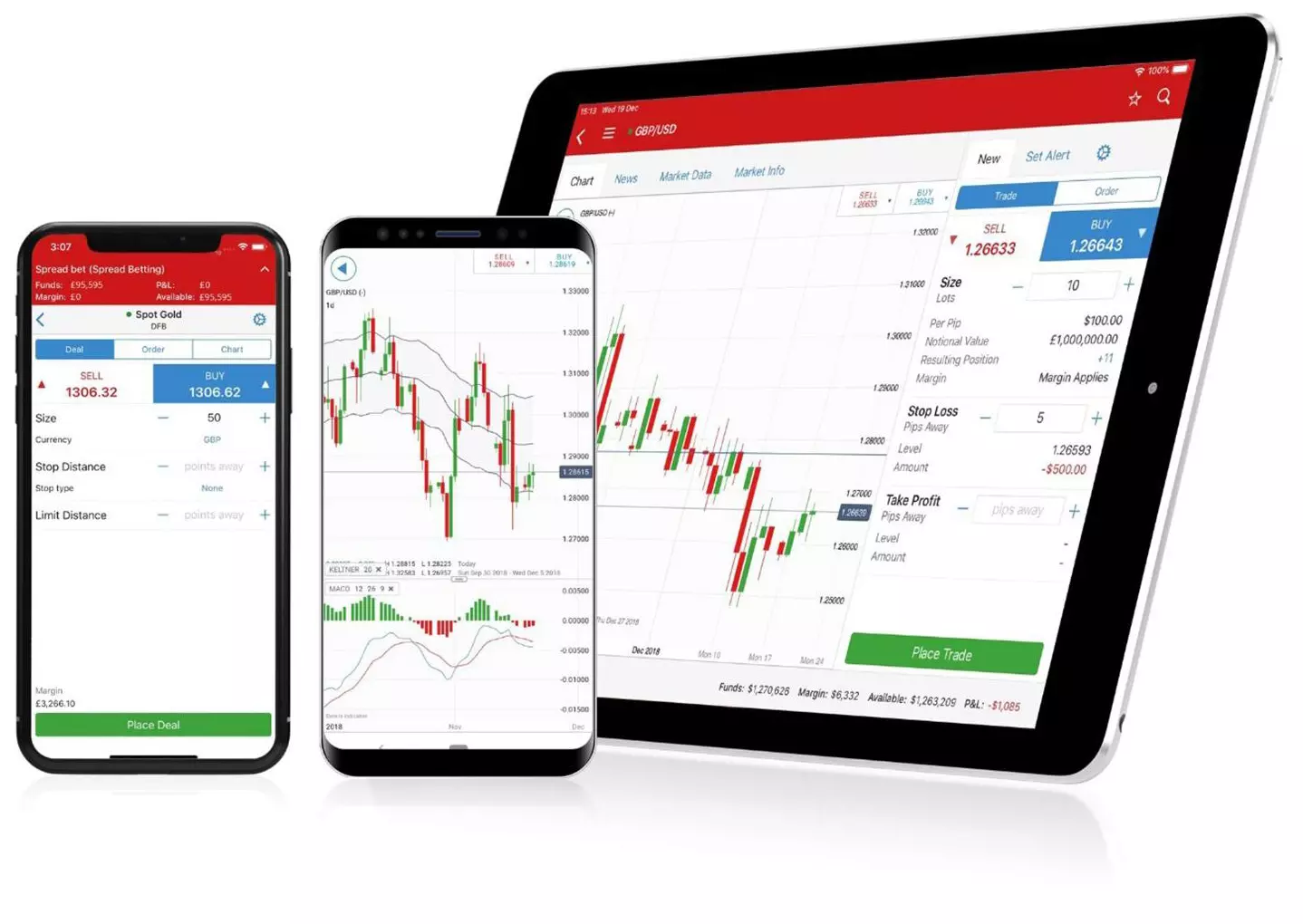

Deal on our award-winning platform and mobile app3

Give yourself an edge with the weekend trading on several key indices4

Go short or long to capitalise on falling or raising markets

More index trading hours, more opportunity

We offer over 30 more weekly trading hours than our nearest competitor, so you can:

Open or edit positions when other traders can’t

Hedge your weekday positions with a weekend one on the same market

Act on breaking news, macroeconomic events and earnings reports as they happen

- FTSE 100

- Germany 40

- Wall Street

This data is based on analysis of the FTSE 100, Germany 40 and Wall Street offering from our UK competitors' websites and is correct to the best of our ability as of 30 July 2020. Some trading hours have been rounded up or down to the nearest hour. This table for comparative purposes only, and the data is subject to change.

Discover our indices markets

- Popular indices

- New indices

- Weekend indices

Find an index to trade

Search real-time prices, find your next trade.

How to trade indices with us

When you trade indices with us, you’ll use CFDs to take advantage of price movements. Discover the unique benefits of this product:

| CFD trading | |

| Accessible to | All clients |

| Traded in | Contracts |

| Tax status | No stamp duty5 |

| Commission | Commission-free |

| Platforms | Web platform, mobile trading app and MT4 |

| Learn more |

What are indices?

Indices measure the performance of a group of shares that are listed on a stock market.

Because there are no underlying physical assets to exchange, indices are traded with financial derivatives like CFDs.

How can you trade indices with IG Bank?

- Create an IG Bank trading account

- Research the index you want to trade

- Decide how you want to trade

- Take steps to manage your risk

- Open and monitor your position

Benefits of index trading

- Speculate on a group of shares for less than the cost of trading them individually

- Get exposure to an entire sector or economy at once

- Hedge against a drop in the value of your share portfolio

What our clients say about our demo trading account

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 17 000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app2

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 17 000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app2

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Costs and details

Margin

CFD trading enable you to take a position with leverage, meaning you can get full market exposure for just a small deposit – known as margin. The margin required to open a position depends on the market.

| Market | Margin per contract | Leverage equivalent |

| Switzerland Blue Chip | 0.75% | 1:135 |

| Wall Street | 0.5% | 1:200 |

| Germany 40 | 0.5% | 1:200 |

| US Tech 100 | 0.5% | 1:200 |

| FTSE 100 | 0.5% | 1:200 |

| US 500 | 0.5% | 1:200 |

| Hong Kong HS 50 | 1.5% | 1:67 |

| Japan 225 | 0.5% | 1:200 |

| Weekend FTSE 100 Cash | 0.5% | 1:200 |

| Weekend Germany 40 Cash | 0.5% | 1:200 |

Spreads

The spread is the charge you pay us for executing your trade, calculated as the difference between the buy and sell prices of an underlying market. We’re constantly working to keep our spreads among the lowest in the industry.

| Market | CFD trading min. spread | MT4 |

| Switzerland Blue Chip | 2 | 2 |

| Wall Street | 2.4 | 2.4 |

| Germany 40 | 1.2 | 1.2 |

| US Tech 100 | 1 | 1 |

| FTSE 100 | 1 | 1 |

| US 500 | 0.4 | 0.4 |

| Hong Kong HS 50 | 5 | 5 |

| Weekend FTSE 100 Cash |

5 | - |

| Weekend Germany 40 Cash | 6 | - |

Indices costs and details

Margin

CFD trading enables you to take a position with leverage, meaning that you only need to put down a deposit – known as margin – to receive increased exposure. The margin required to open a position will vary depending on the market.

| Market | Margin per contract | Leverage equivalent |

| Switzerland Blue Chip | 0.75% | 1:135 |

| Wall Street | 0.5% | 1:200 |

| Germany 40 | 0.5% | 1:200 |

| US Tech 100 | 0.5% | 1:200 |

| FTSE 100 | 0.5% | 1:200 |

| US 500 | 0.5% | 1:200 |

| Hong Kong HS 50 | 1.5% | 1:67 |

| Japan 225 | 0.5% | 1:200 |

| Weekend FTSE 100 Cash | 0.5% | 1:200 |

| Weekend Germany 40 Cash | 0.5% | 1:200 |

Spreads

The spread is what you pay us for executing your trade, calculated as the difference between our current buy and sell prices for a market. We’re constantly working to keep our spreads among the lowest in the industry.

| Market | CFD trading min. spread | MT4 |

| Switzerland Blue Chip | 2 | 2 |

| Wall Street | 2.4 | 2.4 |

| Germany 40 | 1.2 | 1.2 |

| US Tech 100 | 1 | 1 |

| FTSE 100 | 1 | 1 |

| US 500 | 0.4 | 0.4 |

| Hong Kong HS 50 | 5 | 5 |

| Weekend FTSE 100 Cash |

5 | - |

| Weekend Germany 30 Cash |

6 | - |

Trade indices on the world’s best trading platform3

Seize your next opportunity on our award-winning platform and mobile trading app.3

- Web-based platform

- Mobile trading app

- Meta Trader 4

Take control of your indices trading with our clean deal ticket, clear price charts and in-platform news and analysis.

Trade indices opportunity wherever you are, and receive trading alerts and signals on the go through email, SMS or push.

Automate your indices trading with MT4, one of the most popular third-party indices trading platforms.

Get the latest indices news

-

Oil explodes 22% amid Middle East chaos and stagflation fears – Nasdaq and Dow eye critical support

2026-03-09T04:03:06+0000

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Try these next

Learn more about CFD trading with IG Bank.

Take control of your risk with our in-platform tools – including stops, limits and alerts.

Discover our intuitive trading platforms and all the features offered.

1 We offer 81 indices markets for CFD trading.

2 Based on revenue (published financial statements, 2022).

3 Best trading platform and best trading app as awarded at the ADVFN International Financial Awards 2020.

4 24/7 excludes the hours from 11pm Friday to 9am Saturday (Swiss time), and 20 minutes just before the weekday market opens on Sunday night.

5 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the Switzerland.