South Africa 40 Cash Index update and cash adjustment reminder

The South Africa 40 Cash Index price looks to be failing at resistance, although the longer term trend remains up.

Circled blue, we see the South Africa 40 Cash Index is finding short term resistance on the 72840 level. Should todays candle close lower (as is current), 71125 becomes the initial support target from the move.

We do however still consider the longer-term trend to be up and would therefore prefer to wait for weakness to play out before looking for long entry on a bullish reversal at one of the labelled support levels on our chart.

Alternatively, we would be looking for long entry on a price close above the 72840-resistance level. In this scenario, 74180 would become the initial resistance target from the move.

Cash adjustment / dividend

There is a 28.1-point cash adjustment expected on the South Africa 40 Cash Index on Tuesday the 2nd of May 2023.

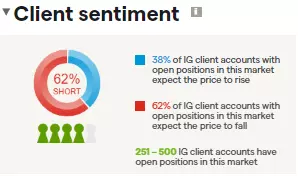

IG client sentiment

As of 3pm on Tuesday the 2nd of May 2023, the majority (62%) of IG clients with open positions on the South Africa 40 Cash Index expect the price to fall, while 38% of clients with open positions expect the price to rise.

Key Data to watch

The week ahead sees a relatively light domestic calendar in terms of scheduled high impact data, although there are several international events which could provide short term volatility. The most significant data points are likely to be Wednesday’s Federal Open Market Committee (FOMC) rates announcement and policy statement, Thursdays European Central Bank (ECB) meeting as well as Friday’s US Non-Farm Payroll and Unemployment Claims data.

A calendar of scheduled economic data points for the week is as follows:

| Date | Time | Region | Event | Previous |

| 3 May | 2:15pm | USD | ADP Non-Farm Employment Change | 145000 |

| 3 May | 8:00pm | USD | FOMC Statement and Fed Funds Rate | 5% |

| 4 May | 2:15pm | EUR | ECB Main Refinancing Rate | 3.5% |

| 5 May | 2:30pm | USD | Non-Farm Employment Change (April) | 236000 |

| 5 May | 2:30pm | USD | Unemployment Rate (April) | 3.5% |

| 5 May | 2:30pm | USD | Average Hourly Earnings m/m |

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only