Crude oil update: Prices may extend gains as retail traders turn more bearish

Crude oil prices are eyeing best month since October so far; recently, retail traders began increasing downside WTI bets and IGCS tends to function as a contrarian indicator, will oil rise?

WTI crude oil prices rallied 2.2 percent on Tuesday, extending gains since the end of last this. The past 24 hours also marked the highest close since early May. The commodity is up about 6.2% in July so far. If gains are maintained throughout this month, it would confirm the strongest 4-week period since October, which was when WTI gained 8.4%.

The latest push higher brought the commodity to the edge of the 74.68 – 76.28 inflection zone – see chart below. As such, a rejection at resistance could send prices back lower towards the near-term rising trendline from June 28th. Confirming a breakout under the latter exposes support at 66.86 before the critical 63.60 – 65.72 zone kicks in.

Otherwise, climbing higher into the inflection zone and surpassing upper resistance at 76.28 exposes the long-term 200-day Simple Moving Average (SMA). This could hold as key resistance, maintaining the broader downside focus. Otherwise, extending gains would open the door to revisiting the 81.44 – 83.48 resistance zone that was reinforced in April.

Crude oil daily chart

Crude oil sentiment outlook - bullish

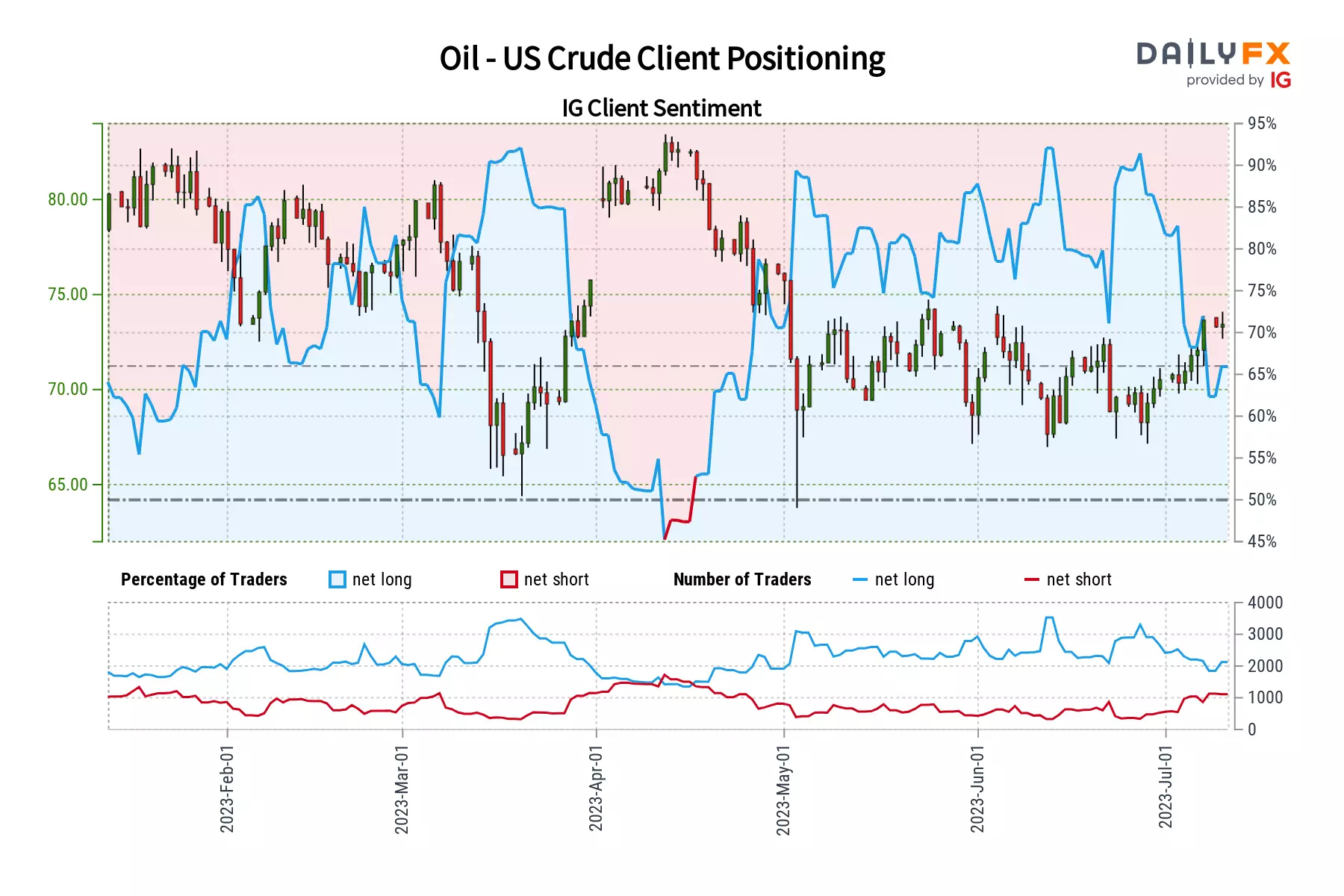

The IG Client Sentiment (IGCS) gauge shows that about 59% of retail traders are net-long crude oil. IGCS typically tends to function as a contrarian indicator. Since most traders are still biased to the upside, this suggests that prices may fall down the road.

Recently, downside exposure has increased by 14.56% and 54.41% compared to yesterday and last week, respectively. With that in mind, these changes hint that the price trend may soon reverse higher despite overall positioning.

Crude oil sentiment outlook chart

This information has been prepared by IG, a trading name of IG Markets Limited and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only