BP shares: 5 perspectives to consider

BP’s share price is now being influenced by five key factors: its Rosneft exit, Brent Crude prices, the green transition, its financial outlook, and potential windfall taxes.

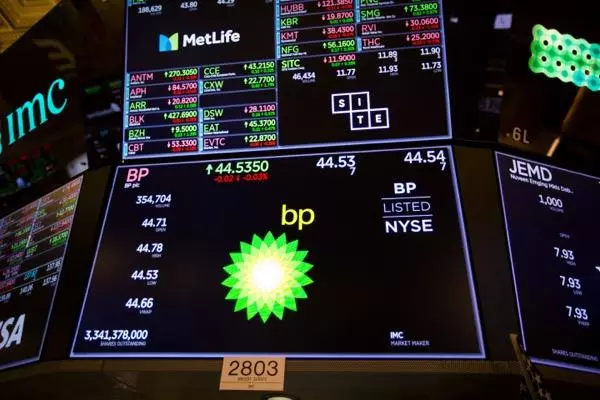

Year-to-date, BP's share price has risen by nearly 10% to 385p, as bumper 2021 profits and the rising price of oil offsets the fallout from Russia’s war with Ukraine.

And as Q1 concludes, the FTSE 100 oil major will be buffeted by five factors heading into the remainder of 2022.

1) Full-year results

2021’s results saw profits soar to an eight-year high of $12.8 billion, as CEO Bernard Looney exalted his company as a ‘cash machine.’ Of course, BP lost $5.7 billion the year before, as demand for oil collapsed and Brent Crude went negative for the first time ever.

BP plans to commit 60% of surplus cash flow to share buybacks in 2022, if it maintains a strong investment-grade credit rating, and Brent stays above $60 a barrel. It expects to ‘deliver share buybacks of around $4.0 billion per annum and have capacity for an annual increase in the dividend per ordinary share of around 4% through 2025.’

2) Rosneft exit

BP is exiting its 19.75% stake in Russian state-backed Rosneft, with Russia’s attack on Ukraine representing a ‘fundamental change.’ The move is costing an immediate $25 billion, predominantly due to ‘the difference between the fair value of bp’s Rosneft shareholding at 31 March 2022 and the carrying value of the asset.’ BP is struggling to find a buyer, and will certainly take a large loss, not least because Russian oil is still selling far below global market value.

In addition to synergy savings and loss of expertise, BP is losing profits that amounted to $2.4 billion and dividends worth $640 million from Rosneft in 2021. Moreover, a third of BP’s oil production came from Russia last year, representing a million barrels a day.

3) Brent Crude

Brent Crude is at $106 a barrel, far below its $139 high earlier this month. As the US and UK introduce bans on Russia’s black gold, the rest of the western world is taking steps to reduce their own reliance on the world’s second-largest oil exporter.

However, the global benchmark is set for significant volatility. The Caspian pipeline, representing 1.2% of global supply, may be closed for two months following storm damage. OPEC leader Saudi Arabia plans to increase production ahead of the cartel’s next meeting, and Canada has also pledged to increase output.

As negotiations for a renewed nuclear deal with Iran progresses, it too could restart exporting. And with tens of millions in lockdown across China, including in Shanghai, demand could drop in the short term.

Brent only averaged $70 last year, and a return to this price point is not impossible. Of course, a host of financial institutions are predicting the opposite.

4) Green transition

After the COP26 climate conference, Looney is working on ‘focusing and high grading our hydrocarbons business, growing in convenience and mobility and building with discipline a low carbon energy business - now with over 5GW in offshore wind projects - and significant opportunities in hydrogen.

Further, the company has announced a strategic partnership to develop offshore wind in Japan and plans to invest £1 billion in UK EV charging infrastructure over the next decade. BP does not expect these green businesses to be profitable before 2025.

However, while arguing for ‘performing while transforming,’ BP’s CEO has warned of a ‘costly, disorderly’ transition.

With the UK’s economy weakened by the pandemic and high inflation, Chancellor Rishi Sunak and Prime Minister Boris Johnson are at odds over the government’s flagship energy strategy to spend £13 billion on eight new nuclear power stations.

Johnson wants the UK to up nuclear electricity generation from 16% to 25% by 2050. However, this long-term benefit must be balanced with the short-term cost, with the EV revolution soon leaving a black hole in government finances.

5) Windfall taxes

The more immediate political problem is the prospect of windfall taxes. The UK faces the worst cost-of-living crisis since 1956, with the Office for Budget Responsibility predicting living standards will fall by 2.2% this year. And Bank of England governor Andrew Bailey has warned of a ‘historic’ energy shock to consumer finances, ‘larger than every single year in the 1970s.’

With energy costs rising by 54% in a few days, and a further increase to £3,000 a year predicted for October, BP may become an easy target. Looney’s pay alone doubled to £4.5 million in 2021.

CPI inflation is at 6.2% and interest rates are rising, but Sunak has resisted calls from Labour to impose windfall taxes. However, the political calculation may change after local elections in June.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only