Bank of Japan (BoJ) preview: On hold for vaccines

The Bank of Japan meets for the first time this year across January 20-21 and is expected to hold monetary policy unchanged as the country grapple with elevated Covid-19 cases and await vaccine distribution.

BoJ caught between a second state of emergency and vaccine wait

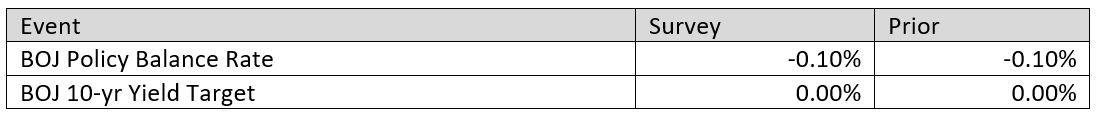

The consensus expectation continues to see the BoJ hold monetary policy unchanged into 2021, with policy rate expected to stay in negative territory at -0.1%. The negative interest rate policy (NIRP) will be coupled with yield curve control (YCC), whereby 10-year JGBs yield target would be maintained at around 0.00%. This had been the monetary policy regime established since September 2016 and may well remain the setting through 2021.

Enhanced measures including asset purchases and liquidity injection had meanwhile been noted into 2020 with the Covid-19 pandemic hit. These measures are expected to stay through most of 2021, although the BoJ had updated in their December 2020 meeting that the various measures may be reviewed with findings made public in their March 2021 meeting.

Given the renewed state of emergency, the Japanese economy is expected to see deterioration in economic momentum that may eventuate in only minor changes in the upcoming March review, if at all. At the same time, few are looking for further support on the BoJ’s end between now and March despite the resurgence of Covid-19 cases and the accompanying movement restriction advices. This is with the vaccine distribution wait that could begin as early as February for Japan to eventually see to recovery taking off.

One area whereby change may be keenly expected would be the Bank of Japan’s outlook report with a downward revision of growth likely with the renewed state of emergency seen into January. GDP estimate for fiscal 2020, which ends March 2021, may be revised lower from the current -5.5% year-on-year consensus. Broadly, the fact is that the Bank of Japan also has little room to manoeuvre as they wait out the Covid-19 storm and for the vaccines to arrive and clear the clouds.

USD/JPY vulnerable to bond yields movements

USD/JPY (大口) had inched up to start the year as a result of the rising US Treasury yields. 10-year US Treasuries had shot above 1.0% shortly into 2021 and oscillated 1.1% levels into mid-January. This had widened the spread with 10-year JGBs and thus having the differentials driving up the USD/JPY pair.

That said, prices had remained in the multi-month downtrend channel awaiting fresh leads. A continued rise in US yields could see the USD/JPY pair test the downtrend resistance here and a break could signal a deviation from the current trend. Such a scenario would more likely be driven by US leads including the passage of the $1.9 trillion rescue plan unveiled by President-elect Joe Biden ahead of his January 20 inauguration.

Given the ongoing pandemic and the Fed’s stance, however, the bias remains towards only a moderate climb for US yields from where it is currently situated. As such, prices may find the path of least resistance being sideways with immediate support at 102.60 and resistance around 104.40 levels.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only