Alphabet Q2 Earnings: Three Key Areas to Watch

Alphabet, Google's parent company, is ready to reveal its Q2 2023 earnings July 25th, after the US market closes. Investors are keeping their eyes laser-focused on these three crucial areas.

Alphabet Q2 Earnings - When is the Earning Date?

Alphabet is scheduled to report its 'second quarter (Q2) 2023 earnings on Tuesday, July 25, after the US market closes.

Alphabet Q2 Earnings - What to Expect?

Revenue: Alphabet’s revenue for the quarter covering March to June 2023 is expected to reach $72.67 billion, 4% higher than the level in the same period last year.

EPS: The internet search leader is expected to deliver quarterly earnings of $1.34 per share, presenting a 3.8% year-over-year (YoY) growth and 25% higher than the previous quarter.

Alphabet Q2 Earnings - Three Key Areas to Watch

Advertising Revenue

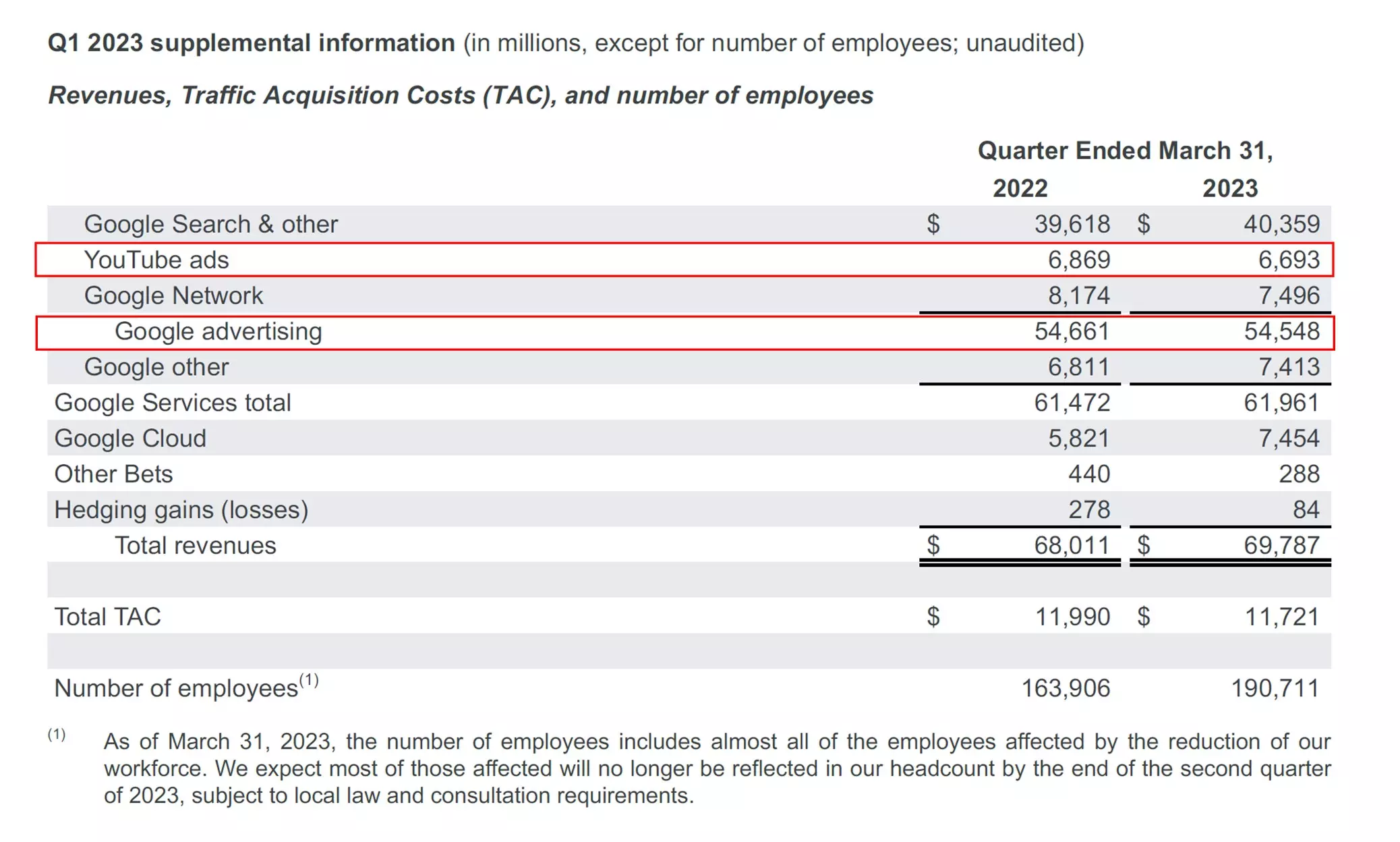

Despite beating the market's expectations in the previous quarter, advertising income, which is the major source of revenue for Alphabet, dropped for the second straight quarter.

YouTube advertising revenues were down 3%, while network advertising revenues were down 8%, reflecting the ongoing headwind in the online advertising space. For the quarter to be reported, whether or not Alphabet could reverse the downtrend would be the first key area to closely watch.

Google Cloud

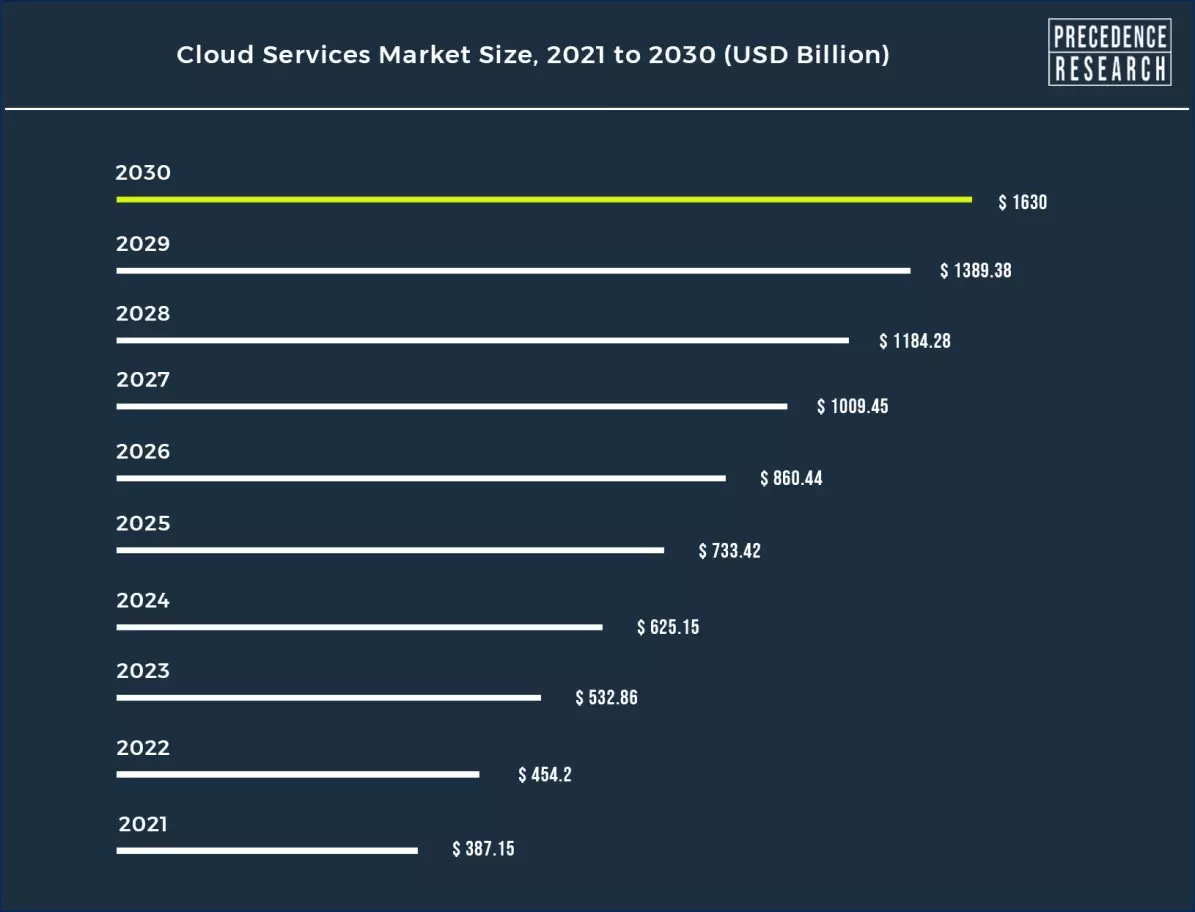

The cloud service is one of the fastest-growing areas that all tech giants can't afford to miss. According to Precedence Research, the global cloud service market is projected to grow 20% annually through 2030 and reach US$1630 Billion.

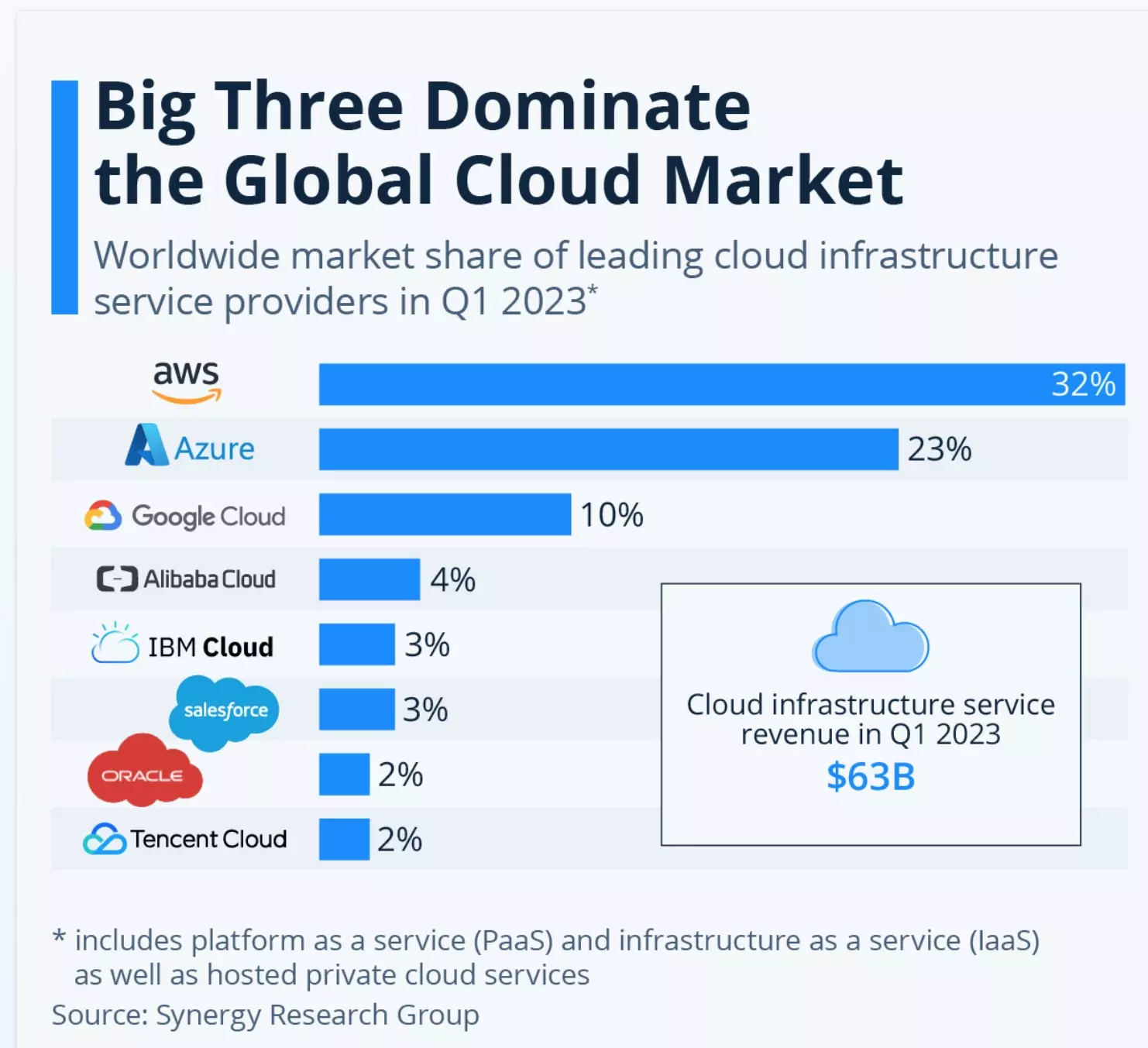

In this space, Amazon, the first mover in the industry, currently secures an estimated 32% of the global market share. However, Google Cloud is rapidly catching up as the fastest-growing player. Google’s cloud business has finally turned profitable in the previous quarter, reaching an operating income of $191 million and an operating margin of 2.6%.

However, the path ahead won’t be any easier for Google as its market share remains lagging behind Amazon and Microsoft by a fair distance. Moreover, the growth rate for Alphabet’s cloud business has notably slowed down, decreasing from 40% in 2022 to less than 30% in Q1 2023. As such, whether or not Google Cloud could sustain its hard-earned profitability and continue narrowing the market share gap with the other two strong competitors will be another must-watch.

Google DeepMind

Google DeepMind, combining the Brain Team from Google Research with DeepMind, will be listed as an individual sector for the first time in the Q2 report, highlighting Alphabet's ambition to accelerate its artificial intelligence (AI) innovation and impact. While the move is not likely to materially impact the final earnings for the to-be-reported quarter, the new structure should help investors get a glimpse of the company’s development and cost efficiency on the new technology front.

Additionally, since Microsoft's ChatGPT exploded onto the scene early this year, the global tech industry has been swept up in an AI battlefield as a platform-changing era seemingly unfolds. As for Alphabet, its longstanding dominance in the search engine realm is facing a new challenge.

With the addition of powerful AI features, Microsoft's Bing is making a comeback. Although Alphabet rushed to present its own AI version of a search engine called 'Bart,' it seems to be lacking the same level of excitement so far. As such, investors will be keen to find out any progress in the AI territory that Alphabet is going to present to defend its crown as the search engine king.

Alphabet Q2 Earnings - Technical Analysis

From a technical point of view, Alphabet's more than 30% rally since February 2023 is now approaching a critical juncture.

On the weekly chart, the price is currently supported by the 100-week average. However, it's worth noting that a further decline from this level could effectively breach the 4-month-long trend line, potentially transforming the uptrend line into a new resistance hurdle.

Turning to the daily chart, the next upside target appears to be the August 2022 peak at $122.2, however, the 50-day moving average (MA) will likely present a key challenge in achieving that goal. Immediate support can be found around $119.59, where the mid-term trendline intersects with the peak from June to July 2022. Also notably, the recent pullback in the past week is on the way to form a double-head shape, indicating that a breach of the shoulder line (at $116.20) may trigger a further downtrend.

* https://www.globenewswire.com/en/news-release/2022/06/10/2460529/0/en/Cloud-Services-Market-Size-to-Surpass-US-1630-Billion-By-2030.html

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only