Market update: USD/JPY surges as US inflation beats forecasts. What's next now?

Tuesday's robust U.S. CPI data sends USD/JPY soaring, sparking speculation on interest rate shifts. Will the momentum continue? Expert analysis and technical insights reveal potential trading opportunities ahead.

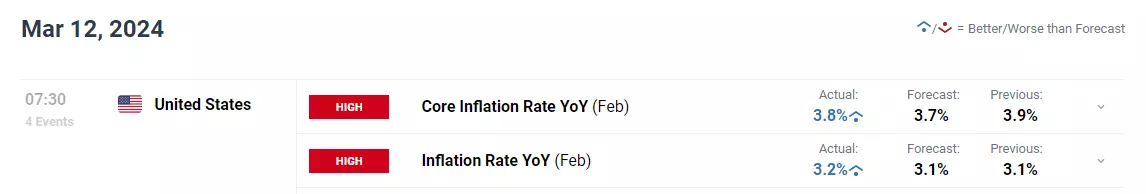

USD/JPY, already on an upward trajectory Tuesday morning, accelerated higher after February’s US consumer price index figures surpassed projections, an event that boosted US Treasury yields across the curve. For context, both headline and core CPI beat forecasts, with the former coming in at 3.2% y-o-y and the latter at 3.8% y-o-y, one-tenth of a percent above estimates in both instances.

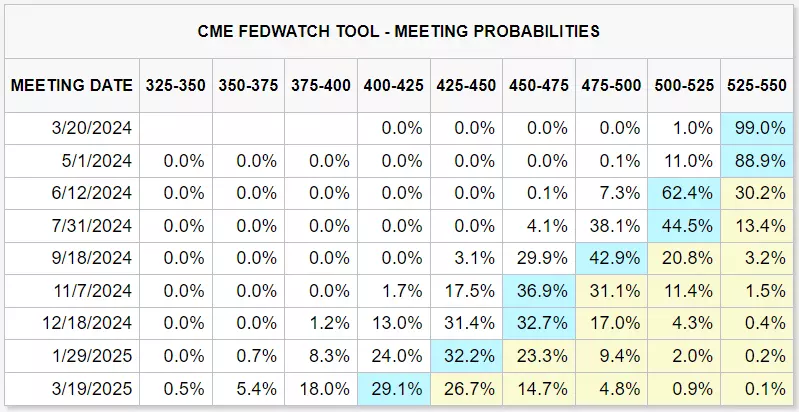

While Tuesday’s data failed to materially alter the odds of the first FOMC rate cut arriving in June, the report unearthed a troubling revelation: inflationary pressures are proving highly resistant and are running well above pre-Covid trends. This will not give the Fed the confidence it necessitates to begin policy easing. Markets may not agree with this assessment right now, but they have been wrong many times.

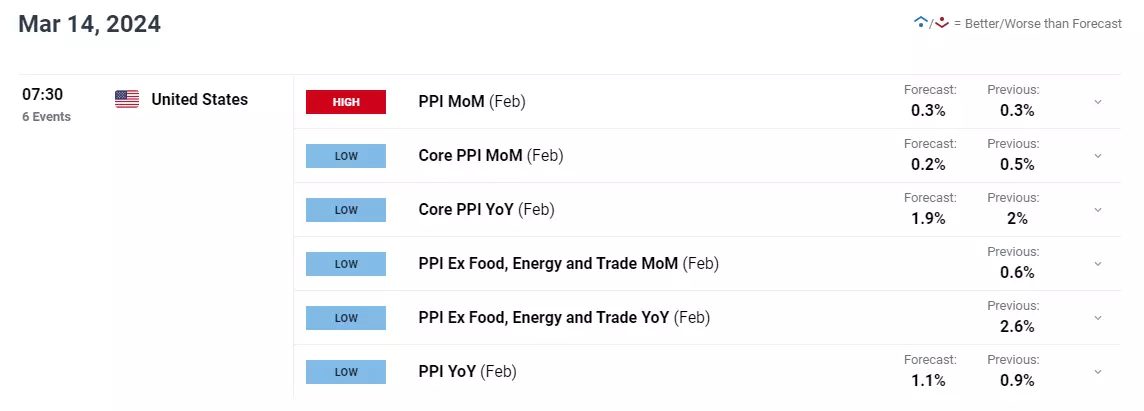

For further clarity on the outlook for consumer prices, it is important to keep an eye on Thursday's PPI numbers. Another upside surprise like today's could be the wake-up call Wall Street needs to recognise it has been underestimating inflation risks. This could fuel a hawkish repricing of interest rate expectations, propelling bond yields and the US dollar upwards in the process.

USD/JPY technical analysis

USD/JPY rebounded on Tuesday, pushing past resistance around the 147.50 level. If this breakout is confirmed on the daily candle, prices could start consolidating higher over the coming days, setting the stage for a possible move toward 148.90. On further strength, the spotlight will be on 149.70.

On the other hand, if sellers return and drive the exchange rate back below 147.50, the pair could slowly head back towards confluence support spanning from 146.50 to 146.00. Below this technical zone, all eyes will be on the 145.00 handle.

USD/JPY price action chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Discover how to trade the markets

Learn how indices work – and discover the wide range of markets you can trade CFDs on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on the FTSE 100, 1.2 on the Germany 40, and 0.4 on the US 500

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.