Market update: sentiment and outlook analysis for the Japanese yen against major currencies

Analysing IG client sentiment, we uncover bullish prospects in a bearish USD/JPY, GBP/JPY, and AUD/JPY market, highlighting the value of contrarian strategies in trading.

In the swift-moving trading realm, there's a tendency to follow the crowd, leaping onto the bandwagon as prices climb or hastily selling during panic. Yet, seasoned traders understand the value of contrarian thinking. Tools like IG client sentiment offer insights into market psychology, pinpointing when extreme bullish or bearish trends can present contrarian opportunities.

Naturally, contrarian indicators should not be treated as foolproof indicators. Their best use lies in supplementing a comprehensive trading approach. Integrating contrarian signals with thorough technical and fundamental analysis helps traders develop a more nuanced perspective on market movements that might be invisible to the majority. Let's delve into this concept by analysing IG client sentiment and its implications for the Japanese yen.

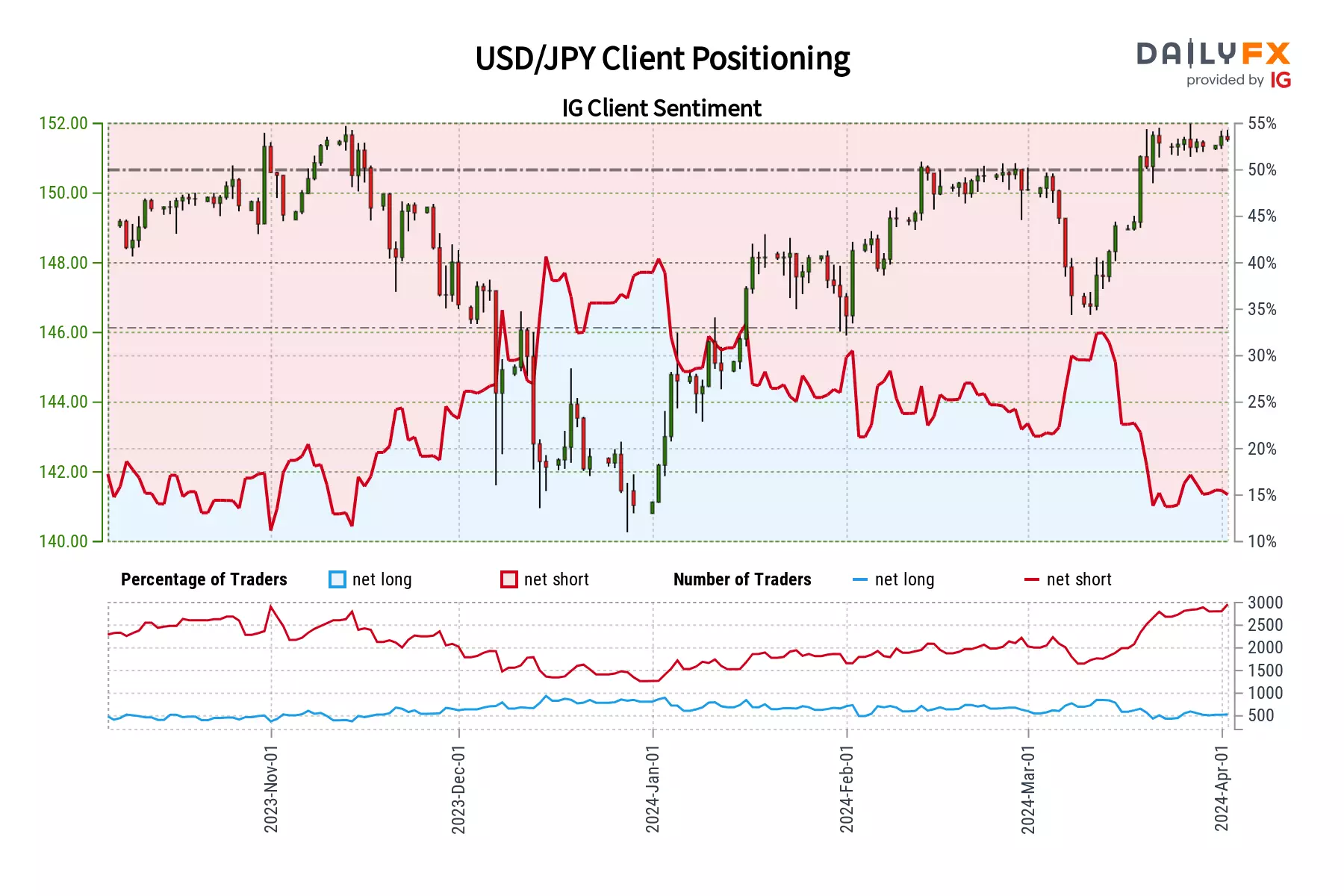

USD/JPY technical analysis

IG data reveals an intensely bearish stance towards the USD/JPY among retail traders. Currently, 84.14% hold net-short positions, showcasing a significant 5.31 to 1 short-to-long ratio. This bearish sentiment has intensified further, with net-short positions rising 4.67% since yesterday and 5.30% compared to last week. Conversely, net-long positions have seen moderate growth yesterday (2.39%) but remain below last week's levels.

We often adopt a contrarian view of market sentiment. The overwhelming bearish positioning suggests a potential for continued USD/JPY gains. The recent surge in short positions strengthens this bullish contrarian outlook.

Overall, the combination of heavily bearish sentiment and its recent intensification paints a bullish picture for the USD/JPY from a contrarian perspective. It's worth noting that contrarian signals should always be considered alongside technical and fundamental analysis before making trading decisions.

USD/JPY daily chart

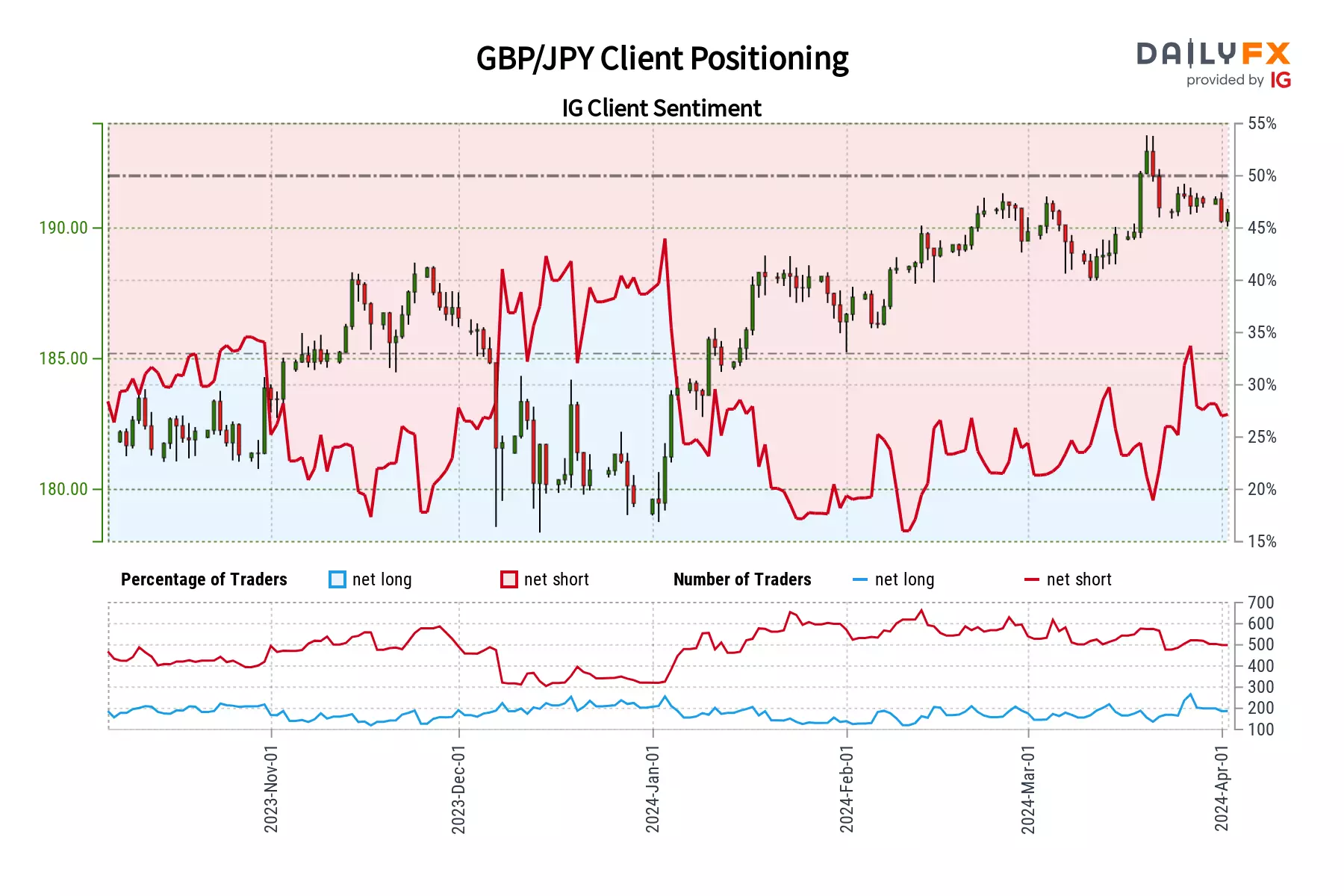

GBP/JPY technical analysis

IG client data reveals a wave of pessimism has washed over GBP/JPY traders. Currently, 72.7% hold net-short positions, translating to a notable 2.66 to 1 short-to-long ratio. This bearish stance isn't just strong; it's intensifying, with net-shorts up 4.87% since yesterday and 5.28% since last week. Meanwhile, the already small number of net-long positions decreased slightly yesterday (0.49%) and more significantly from last week's levels (-17.89%).

Taking our usual contrarian stance, this overwhelming bearishness could signal an impending GBP/JPY upswing. When a large majority of traders bet on declines, it can often precede a reversal or a corrective bounce. The combination of the entrenched bearish sentiment and its recent surge strengthens this bullish contrarian perspective.

GBP/JPY daily chart

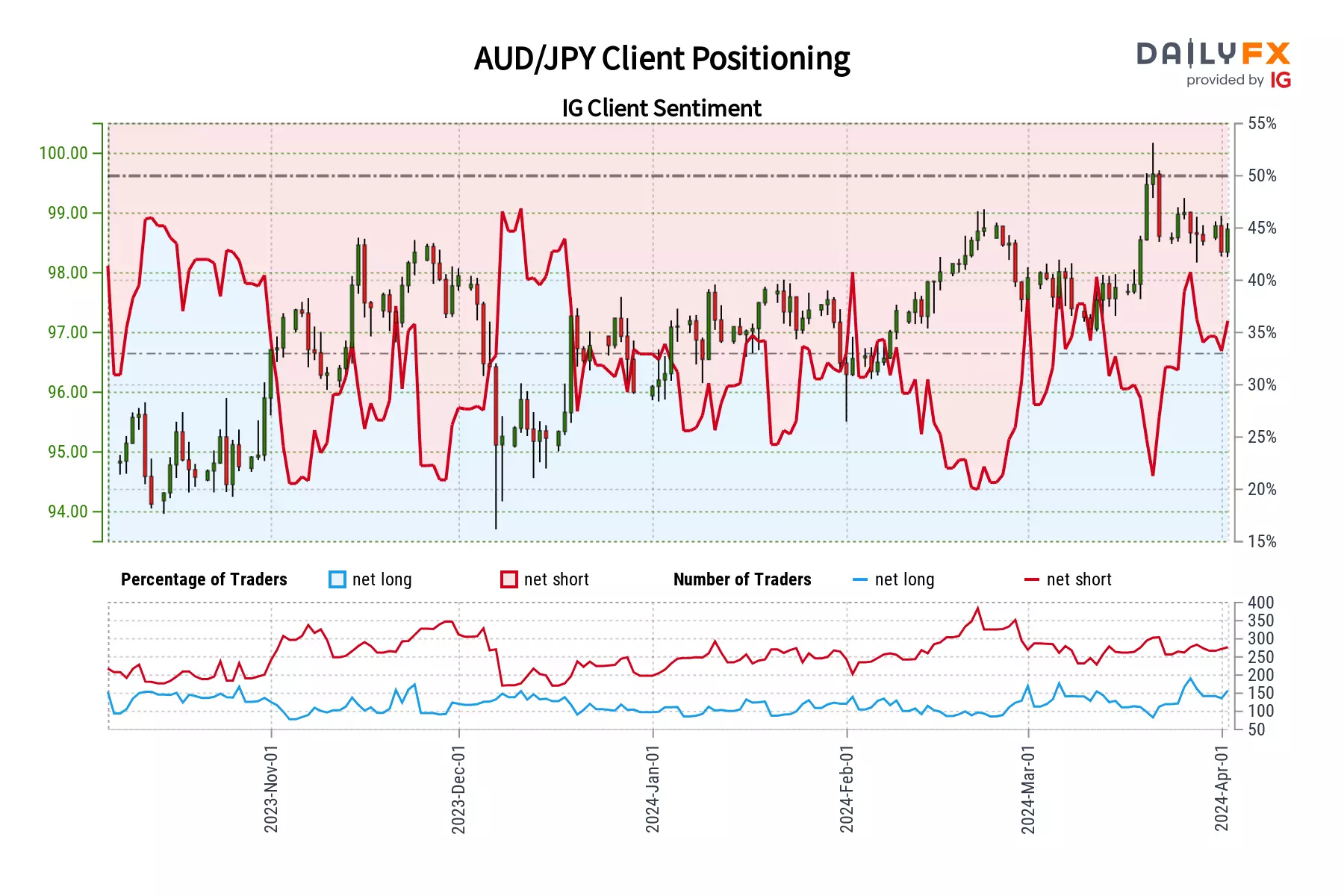

AUD/JPY technical analysis

Recent statistics from IG's retail trader data indicate that 65.19% of clients are currently positioned net-short on AUD/JPY, with the ratio of bearish to bullish positions standing at 1.87 to 1. This bearish sentiment is not only prevalent but also on the rise, with net-short positions increasing 5.76% since yesterday and a notable 12.21% compared to last week. Meanwhile, net-long positions have edged slightly higher since yesterday (0.64%) but remain significantly down (-14.21%) from last week's readings.

We often look to contrarian signals within market sentiment. The predominantly bearish positioning suggests there may be room for further AUD/JPY gains. The recent intensification of this bearishness among traders reinforces a potential bullish outlook from a contrarian perspective. As always, it's vital to integrate these signals with thorough technical and fundamental analysis for a comprehensive trading strategy.

AUD/JPY daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Explore the markets with our free course

Learn how shares work – and discover the wide range of markets you can trade CDFs on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this shares strategy article risk-free in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Trade over 12 000 popular global stocks

- Protect your capital with risk management tools

- React to breaking news with out-of-hours trading on 70 key US stocks

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.