Market update: gold exhibits caution above $2,000 amid holiday-impacted, low-volume trading

Gold expected to show restrained movement over Thanksgiving amid light trading; XAU/USD faces challenges surpassing $2000 amid ceasefire, impacted by USD and treasury yields, with market adjusting rate cut expectations.

Gold expected to underwhelm this thanksgiving weekend

Gold prices experienced an early uptick in trading but struggled to sustain the momentum, given the anticipated light activity during the Thanksgiving long weekend. Despite multiple attempts, gold has faced challenges surpassing the $2000 threshold, with two instances of reaching $2010 followed by immediate downturns.

A slight strengthening of the dollar yesterday exerted pressure on gold prices, triggered by November's initial jobless claims missing expectations. Despite recent weaker fundamental data from the US over the past three weeks, the jobless claims figures suggest a robust labour market.

Navigating ceasefire dynamics between Israel and Hamas

The looming question for gold revolves around the recently brokered ceasefire between Israel and Hamas, designed to facilitate the safe passage of hostages and prisoners. This agreement marks a significant diplomatic achievement since the 7 October attack, and only time will reveal whether it signals a substantial step towards further agreements and the facilitation of aid into the most affected regions.

Resistance remains at $2010 with nearby support at $1985, followed by the 200 SMA and the $1937 level.

Gold daily chart

The weekly chart highlights the recent difficulty to surpass the $2010 level, but still reveals the bullish trend remains intact. However, the recent swing low and the inability to mark a higher high, hints at a period of potential consolidation as the RSI heads lower.

Gold weekly chart

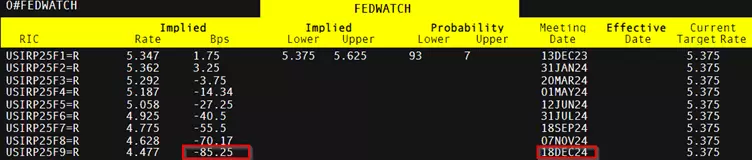

USD and yields to play further role after markets lower rate cut expectations for 2024

Following cooler-than-expected US Consumer Price Index (CPI) data, both the US dollar and treasury yields declined, triggering widespread speculation about the timing and scale of next year's potential rate cuts. At its peak, market expectations surged to 100 basis points of hikes, surpassing the Federal Reserve's recent forecast of 50 bps. The more resilient labour market data this week has helped to temper those expectations by a full 25 bps cut, now seeing 85 bps by the end of next year. Gold tends to exhibit an inverse relationship with the dollar and US yields as they represent the opportunity cost of holding the non-interest-bearing metal.

Fedwatch chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Speculate on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

Put learning into action

Try out what you’ve learned in this commodities strategy article risk-free in your demo account.

Ready to trade commodities?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Deal on our wide range of major and niche commodities

- Protect your capital with risk management tools

- Get some of the best spreads on the market – trade Spot Gold from 0.3 points

Inspired to trade?

Put what you’ve learned in this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.