Market update: GBP/USD, GBP/AUD attempt tepid recovery ahead of inflation data

GBP/USD remains subdued ahead of UK inflation data; GBP/AUD continues its move lower after China, Australia data invigorates the Aussie dollar, while the BoE may have an even bigger task if UK inflation data comes in hot.

By Zain Vawda (DailyFX analyst)

UK inflation and BoE expectations

The UK still have the highest inflation rate in comparison to the Euro Zone and the US, which does pose a bigger challenge for the Bank of England (BoE) compared to its central bank counterparts.

This, coupled with rising unemployment and a perceived slowdown in GDP growth, have market participants on the edge of their seats, as it seems likely further rate hikes may be needed to see inflation cool further. This idea has received further credence by the recent uptick in US and Canadian inflation and the rise in oil prices.

UK average earnings on the rise

The recent uptick in UK average earnings makes tomorrow's inflation print even more important as it comes a day before the BoE MPC meeting. An uptick in headline inflation would really ratchet up the heat on the Bank of England (BoE) particularly in light of the of the European Central Bank (ECB) surprise hike last week.

I had been vocal proponent of at least one more 25bps hike from the BoE: an uptick in inflation tomorrow may give me food for thought of perhaps an added 25bps hike before 2023 is out.

From the major global economies, we can see on the chart below the recent uptick in inflation both in the US and Canada. Canada was the first and most aggressive of the major central banks at the start of the hiking cycle.

Inflation comparisons between the Euro Zone (teal), US (blue), Canada (pink) and UK (orange)

Australian data improves and pessimism around China cools

The recent weakness in the GBP has been met with an improvement in Australian data of late. This has come at a time when Chinese authorities have been ramping up stimulus measures to boost the economy. The retail sales figures from China, however, did paint a slightly better picture despite the ongoing woes in the real estate sector.

The China picture was one that threatened to throw markets into disarray, but we have seen an improvement in sentiment since. Initially global fund managers were looking to wind down their exposure to Chinese markets, but this trend has been arrested of late based on the data received.

This has translated into Australian dollar strength of late, which has helped GBP/AUD put in an impressive recovery in the month of September thus far.

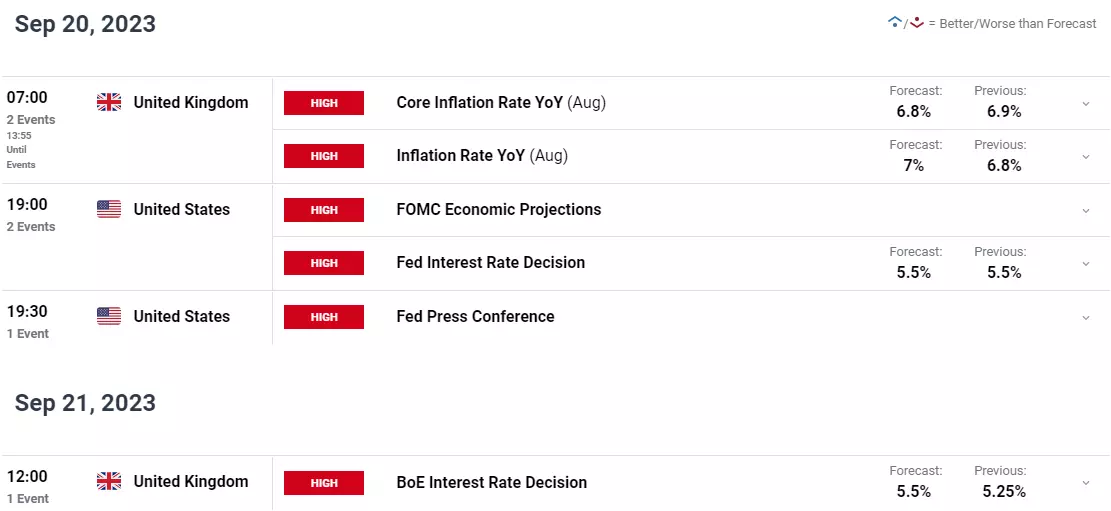

Risk events ahead chart

GBP/USD technical analysis

GBP/USD made an attempted run at the 200-day moving average (MA) this morning. The resurgence in the US session of the DXY has seen GBP/USD surrender early session gains to trade relatively flat at the time of writing.

The deterioration in UK data of late particularly gross domestic product (GDP) has weighed on cable of late with the pair now down around 700-odd pips since the July peak. GBP bulls may be in for some joy tomorrow as UK inflation looks likely to accelerate, which could serve as a catalyst and catapult cable back toward the 1.2500 handle.

The first area of resistance will be the 200-day MA around the 1.2434 mark before the psychological 1.2500 level comes into focus.

Cable has an interesting couple of days ahead with UK inflation followed by the Fed rate decision tomorrow. Then Thursday brings the Bank of England (BoE) Monetary Policy Committee (MPC) decision, the positive being that by the end of Thursday we may have a clearer picture of where GBP/USD could head as we approach Q4.

Key levels to watch:

Support levels:

- 1.2358

- 1.2312

- 1.2200

Resistance levels:

- 1.2434 (200-day MA)

- 1.2500 (Psychological Level)

- 1.2540 (20-day MA)

GBP/USD daily chart

GBP/AUD could bounce before the fall

GBP/AUD stalled just short of the psychological 2.0000 mark before putting in a significant pullback to support at the 1.9210 mark. The pair is looking like it is setting up a potential bounce from here as the overall uptrend still remains intact.

GBP/AUD has, however, broken below the long-term ascending trendline, which could hint at a bounce from here before continuing to fall. I think the driving factor here will be the outlook moving forward from both the UK and Australian economies moving forward.

The MAs as well appear to be setting up for a death cross heading into next week, a further sign of the growing potential of a deeper retracement given the size of the initial move to the upside. If we do see a continued push to the downside, immediate support is provided by the 100-day MA around the 1.9120 mark and could prove to be key next week.

GBP/AUD daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.