Macro Intelligence: China's economic surge amid US tensions and Australia trade talks

Explore how China's surprising 3.9% GDP growth in Q3 influences global markets and investor sentiment. Understand the ongoing geopolitical risks with the US and what Australia's renewed diplomatic efforts mean for trade.

In this week's edition of IG Macro Intelligence, we delve into China's economic recovery and why one investment firm deems Sino-American geopolitical tension as a pivotal risk for markets.

Economic outlook

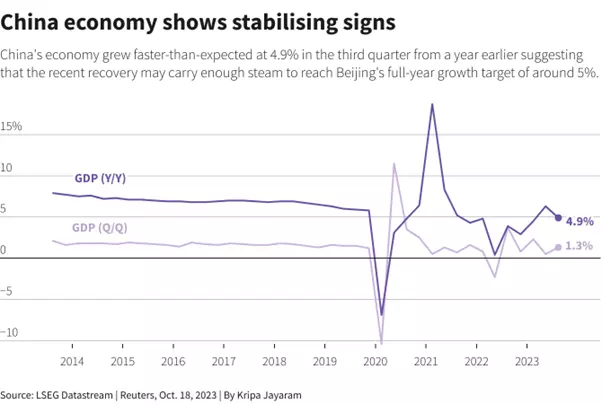

The world's second-largest economy is evidencing signs of a fiscal rebound. Official data reveals that China's Gross Domestic Product (GDP) expanded at a quicker-than-anticipated 3.9% YoY in the third quarter. Quarter-on-quarter, GDP growth accelerated to 1.3% from 0.5% in Q2.

The figures suggest China may attain its 5% annual growth target, buoyed by recent governmental stimuli. Nonetheless, challenges persist.

Domestically, China confronts an escalating property crisis, elevated youth unemployment, and flagging private sector confidence. Globally, China faces the headwinds of a global economic deceleration and continuing tensions with the U.S.

Geopolitical risks

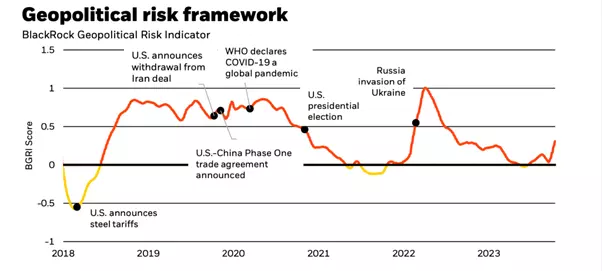

Sino-American relations in the realms of trade and technology continue to pose risks for investors. BlackRock's Geopolitical Risk Indicator has surged to its zenith in a year, signifying mounting market apprehension about geopolitical matters.

BlackRock cites the “strategic competition” between Washington and Beijijng as the top geopolitical risk facing markets in its latest report. The investment firm labels the tensions as an “attention score” of 1.5; which is higher than the market risk it sees caused by a major terror attack or major cyber attack.

By contrast, the attention score given to tensions in the Gulf exacerbated by the Israel-Hamas war is -0.65. An escalation in the Russia-NATO conflict has an attention score of 0.37.

Taiwan as the nexus of geopolitical tensions and volatility

The report authors identify Taiwan as a crucial geopolitical flashpoint. They state, "The US is offering enhanced military and economic backing to Taiwan, while China manifests a readiness to exert pressure on the island. Military action is not anticipated in the near term, yet the risk appears to be escalating. A pivotal event will be the Taiwanese presidential elections slated for January 2024."

Chinese state-operated media, The Global Times, divulged over the weekend that mainland taxation authorities have executed audits and are scrutinising land utilisation by technology behemoth Foxconn. Its billionaire founder, Terry Gou, is actively campaigning for the Taiwanese presidency.

Foxconn is the primary assembler of Apple's iPhones at its Chinese manufacturing plants. Equities in Foxconn's publicly-traded subsidiary, Hon Hai, experienced the most significant quarterly slump during Monday's trading session, underscoring the market volatility triggered by geopolitical discord.

Ongoing endeavours to mitigate tensions between Washington and Beijing are in the pipeline, with indicators hinting at a potential summit between Presidents Biden and Xi this November. Additionally, Bloomberg disclosed that Chinese Foreign Minister Wang Yi is slated for high-level diplomatic discussions in Washington this week.

Australia-China relations

Australian Prime Minister Anthony Albanese will visit China from 4 to 7 November, aiming to bolster Australia-China relations. China remains Australia's chief trading partner. Albanese's trip marks the first by an Australian leader since 2016 and coincides with the 50th anniversary of Gough Whitlam's inaugural visit in 1973.

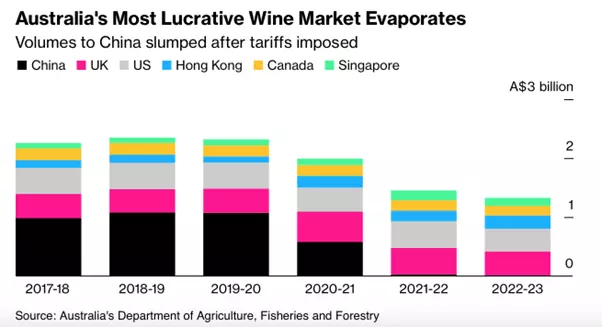

Canberra and Beijing are collaborating to dismantle trade barriers. Tariffs on Australian barley have been rescinded, and the Australian government anticipates resolving its World Trade Organization (WTO) dispute over wine tariffs with China.

Prior to the tariffs, China was Australia's most lucrative market for wine, valued over $1 billion AUD in both 2018-2019 and 2019-2020, according to the Department of Agriculture.

The tariff review is projected to last five months, with Canberra optimistic about a positive resolution. "If the duties are not abolished post-review, Australia will recommence the WTO dispute," states the Prime Minister's Office.

Shares in Treasury Wine Estates, the proprietor of Penfold's, surged upon the market's reopening on Monday, following the announcement. Goldman Sachs reaffirms their BUY rating on TWE, projecting that the winemaker could regain $400 million AUD in pre-tariff sales.

UBS maintains a BUY stance, while Barrenjoey analysts remain underweight on the stock, citing the five-month review period's potential impact on near-term earnings.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.