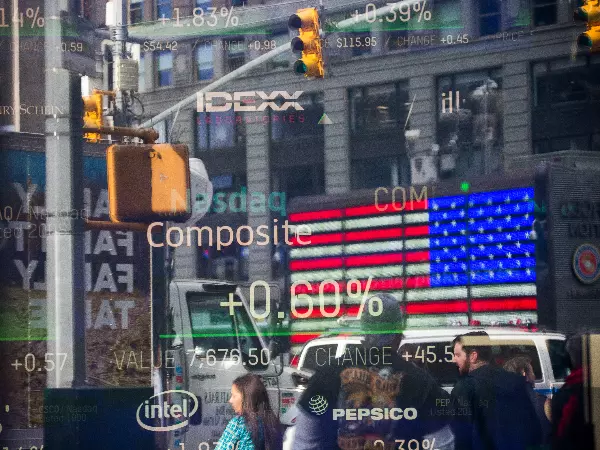

Can the S&P 500 and the Nasdaq build on their break higher?

The S&P 500 and Nasdaq surge to start the week as tech stocks rally.

US equity markets ripped higher overnight on hopes of a slower pace of Fed tightening, easing inflation and ahead of key earnings reports.

The tech-heavy Nasdaq led the charge higher for its best two-day run since November.

- Tesla surged 7.74%, taking its two-day rally to over 13%

- NVIDIA added 7.59%

- Netflix added 4.36%

- Meta added 2.8%.

In contrast to January 2022, when the Nasdaq fell 8.52% before falling a further 24%, this January, the Nasdaq is now +8.53% for the month - an interesting statistic for those who subscribe to the idea that January sets the tone for the remainder of the year.

For those who take a more bearish view of the world, there remains a lot to ponder. Despite the Fed’s rhetoric that it will raise rates by 75bp above 5% and keep rates on hold for an extended period, the market is not convinced.

An expected slowdown in growth during the second half of this year has the interest rate market pricing 55bp of rate hikes before the Fed turns in the second half of this year and cuts rates by 210 bp, taking the Fed Funds rate back to 2.75% by December 2024.

For those wondering the reason why the Fed would cut rates by 210bp, it would likely be in response to a recession which equity markets are not priced for.

What do the charts say?

Technically the S&P 500 (and the Nasdaq) have closed above the downtrend lines drawn from their January 2022 highs.

Presuming the break higher in the S&P500 sustained in the coming sessions, it opens the way for the rally to extend towards 4180 (Dec spike high) and then 4327 (Aug high).

The first cause for concern that the overnight break higher had failed would be a sustained close back below the 200-day moving average at 3970.

S&P 500 daily chart

Nasdaq

For the Nasdaq, there is more reason to be suspicious of the overnight break higher as it has yet the clear the 200-day moving average at 12,072.

If it was to see a sustained break above the downtrend and the 200-day moving average, the upside target would be the December spike higher at 12,239, followed by the August 13,740 high.

Nasdaq daily chart

Take your position on over 13,000 local and international shares via CFDs or share trading – and trade it all seamlessly from the one account. Learn more about share CFDs or shares trading with us, or open an account to get started today.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.