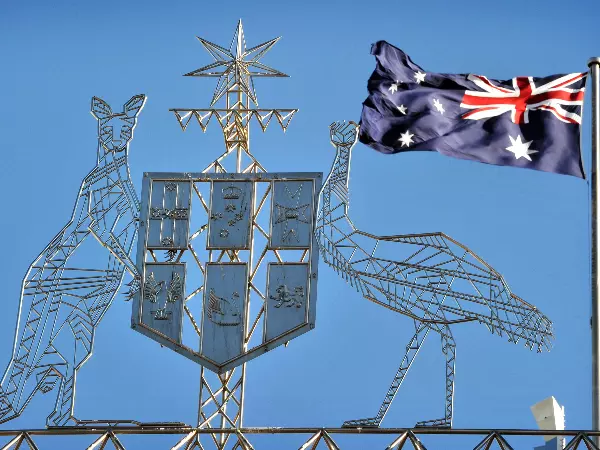

Australian dollar lifted in risk-on environment post-election as Labor win office

The Australian dollar launched higher on Monday post-election, a change of government does little for the economic outlook for now and the RBA tightening continues alongside the RBNZ.

The Australian dollar rallied to start the week after the Australian Federal election saw a change of government.

The Labor party will replace the Liberal/National coalition, but it is not clear at this stage if they will lead outright, or if they will need to form a minority government.

The two main parties ran centrists’ campaigns with the key policy differences being on climate change and the establishment of a national anti-corruption watchdog. The economic impact is seen to be fairly minimal. The broader risk-on sentiment to open Monday initially lifted equity markets and risk associated currencies such as the Aussie and the Kiwi. Equities have since given up their gains.

At a debt summit in Sydney today, Reserve Bank of Australia Assistant Governor Chris Kent confirmed that the RBA will not be re-investing the proceeds from maturing bonds. These are the bonds that were accumulated during the banks quantitative easing (QE) program in response to the pandemic. By allowing the bonds to roll off, this is quantitative tightening (QT).

Should the need arise, the bank could tighten further by selling the bonds to the market before they mature.

Although the market had been anticipating such action, it further emphasises the bank’s desire to rein in loose policy in the face of accelerating inflation. They raised the cash rate by 25 basis points at their meeting earlier this month.

The latest data shows CPI is running at 5.1% year-on-year to the end of the first quarter, well above the banks’ target range of 2-3% on average over the business cycle. The April unemployment rate came in at a 48-year low of 3.9%. Conditions are ripe for tightening and the market is pricing in a 25 basis points hike at June’s RBA meeting. A 40 basis-point lift cannot be ruled out.

In the neighbourhood, the RBNZ are meeting on Wednesday and the market is anticipating that they will hike by 50 basis points.

AUD/USD technical analysis

AUD/USD has bounced off a recent 2-year low but remains within a descending trend channel.

Bearish momentum appears to have stalled with the price crossing above the ten-day simple moving average (SMA) and could be about to sustain a move above the 21-day SMA. Underlying medium and long-term bearish momentum may continue to evolve with the price remaining below the 55-, 100- and 260-day SMAs.

Support might be at the recent low of 0.6829 while resistance could be at the recent peak of 0.7265.

AUD/JPY technical analysis

After making a seven-year high at 95.74 last month AUD/JPY pulled back to make a low at 87.30 and has consolidated since. It may bump up against resistance at the 50% Fibonacci Retracement level of this overall move at 91.50. There might also be resistance at the 21- and 55-day simple moving average (SMA) that are currently 90.99 and 90.88 respectively.

Support may lie at the recent low of 87.30 or historical levels of 86.26 and 86.07

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.