AUD/USD snaps its five-week losing streak; can it repeat the magic of October 2022?

The AUD/USD breaks its losing streak despite the US dollar's ascent.

AUD/USD's recent performance

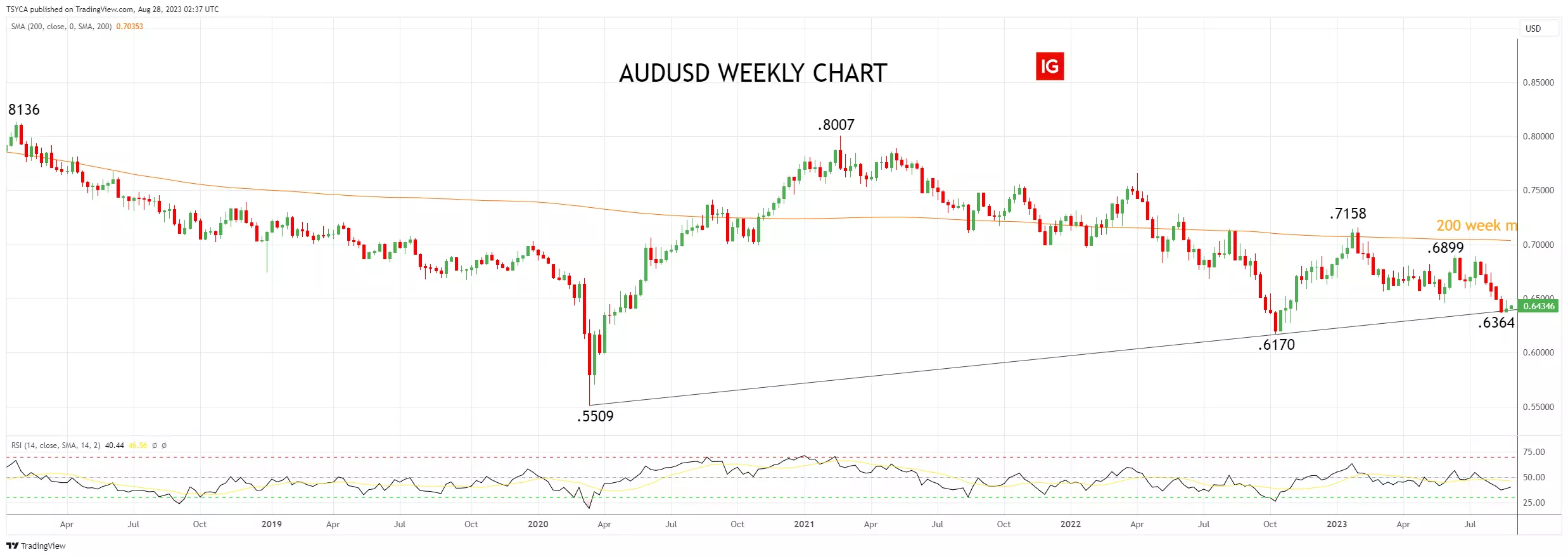

Relief for the AUD/USD last week, to snap its worst five-week losing streak since last October when the AUD/USD traded to its post-Covid Crash low of .6170. More on this below.

The show of resilience in the AUD/USD came despite the US dollar index cementing a sixth week of gains following Fed Chair Powell's speech at Jackson Hole, which noted that the Fed was data-dependent and that the Fed could lift rates again "if appropriate".

Defying broad US dollar strength, the more resilient performance in the AUD/USD last week came about as the sell-off in US equity markets and the rally in US long-end yields abated. Supported also by China announcing more incremental measures to support the economy.

While there was an easing of macro headwinds, just as importantly, at least to us, was the test and hold of crucial support at .6360/50, which we highlighted in this article on the AUD/USD here last week.

"The .6360/50 support level holds immense importance for the AUD/USD, stemming from the uptrend support from the Covid March 2020 low of .5509 and the .6170 low of October 2022. Experience shows that multi-week/month trend support levels seldom break on the first attempt."

The key upcoming drivers for the AUD/USD this week will be a speech by incoming RBA Governor Michele Bullock on Tuesday titled "Climate Change and Central Banks," - the title of which doesn't leave too much room to provide clues about monetary policy, followed by the monthly CPI Indicator on Wednesday.

What is expected from the Monthly CPI indicator?

The market is looking for the Monthly CPI indicator to fall to 5.2% YoY from 5.4% in June. An inline or softer-than-expected number will see the RBA stay on hold in September.

In contrast, a print of 5.7% or higher, representing an unwelcome reacceleration of the Monthly CPI indicator, will see the rates market move to price in some chance of an RBA rate hike by 25bp to 4.35% in September. Currently there are just 5bp of rate hikes priced into the rate market before year-end.

AUD/USD technical analysis

To recap, in last week's article on the AUD/USD, we noted that, providing the AUD/USD remains above weekly uptrend support at .6360/50 (from the March 2020 .5509 low), a bounce is likely, which could see the AUD/USD test resistance at .6500c and potentially beyond as part of a counter-trend rally.

In October 2022, after ending its five-week losing streak, the AUD/USD rallied almost ten big figures from a low of .6170 to a high of .7158 in the sixteen weeks that followed.

While we aren't expecting a move of the same magnitude, it is important to be open-minded about what can happen when sentiment becomes too extreme in the AUD/USD. While at the same time, be aware that if the .6360/50 support level goes, there isn't much in the way of downside support until .6200/.6170 (October 2022 low), before .6000c.

AUD/USD weekly chart

- TradingView: the figures stated are as of August 28, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.