Amazon Q4 earnings preview: what to expect?

Amazon is set to report its Q4, 2023 earnings on February 1st, 2024 after US markets close.

Amazon earnings date:

Amazon is scheduled to release its Q4, 2023 earnings on February 1st, 2024, after the closure of US markets.

Amazon Q4 expectations and key watches:

The anticipated earnings report for the upcoming quarter indicates a substantial improvement in earnings per share (EPS), projected to be $0.79. This marks a significant increase from the same quarter in 2022, where the EPS was only $0.12 per share.

Regarding revenue, Amazon's Q4 guidance from the previous earnings report suggests that net sales are expected to range between $160.0 billion and $167.0 billion. This represents a growth rate of 7% to 12% compared to the fourth quarter of 2022, also a double digit growth from the previous quarter.

Additionally, the forecast for operating income falls between $7.0 billion and $11.0 billion, a notable increase from the $2.7 billion reported in the fourth quarter of 2022.

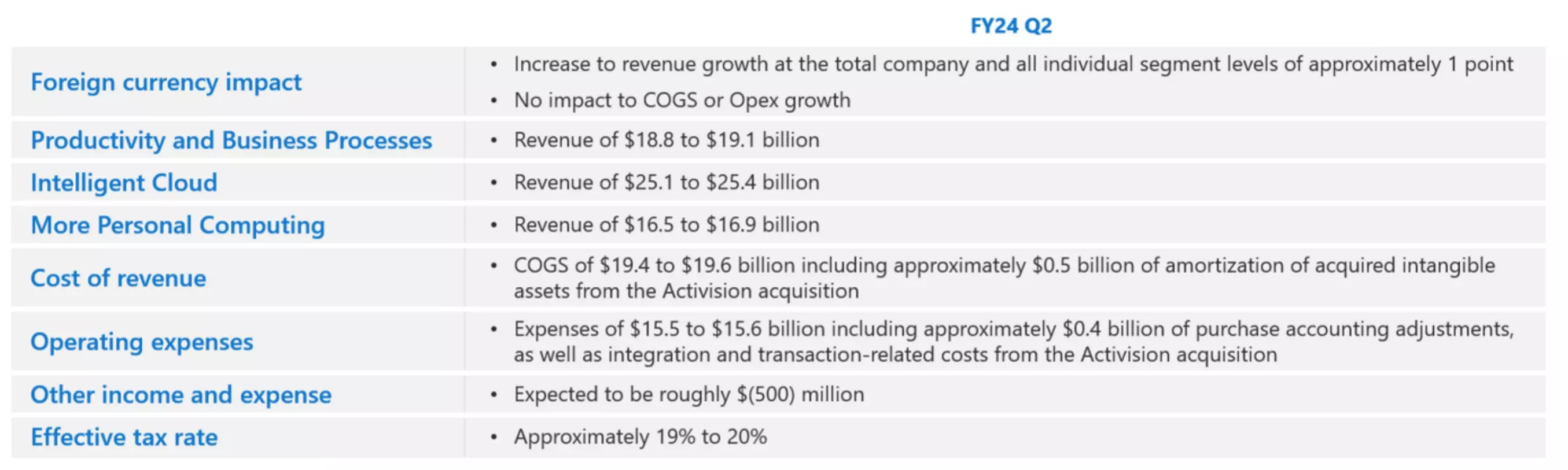

In terms of key business units, Amazon's leading cloud service, AWS, is expected to showcase robust growth once again. AWS’s sale is anticipated to grow 15% year-over-year Q4, a slight improvement from the previous period's 12%, while maintaining an impressive operating margin above 30%. Despite encountering intense competition from Microsoft’s Azure and a stabilizing growth rate and Google Cloud, Amazon’s leading position in the cloud service has been further fortified by the AI surge, with existing customers now initiating generative AI workloads on AWS.

Another major area to monitor in the upcoming earnings report will be Amazon's online advertising business. In the third quarter, this segment recorded $12.06 billion in revenue, indicating a 26% increase from the corresponding period in the previous year. The fourth quarter, encompassing the traditional holiday shopping period, is expected to attract more shoppers to the ecommerce platform, providing Amazon with an additional boost to its retail and advertising income.

Amazon share price:

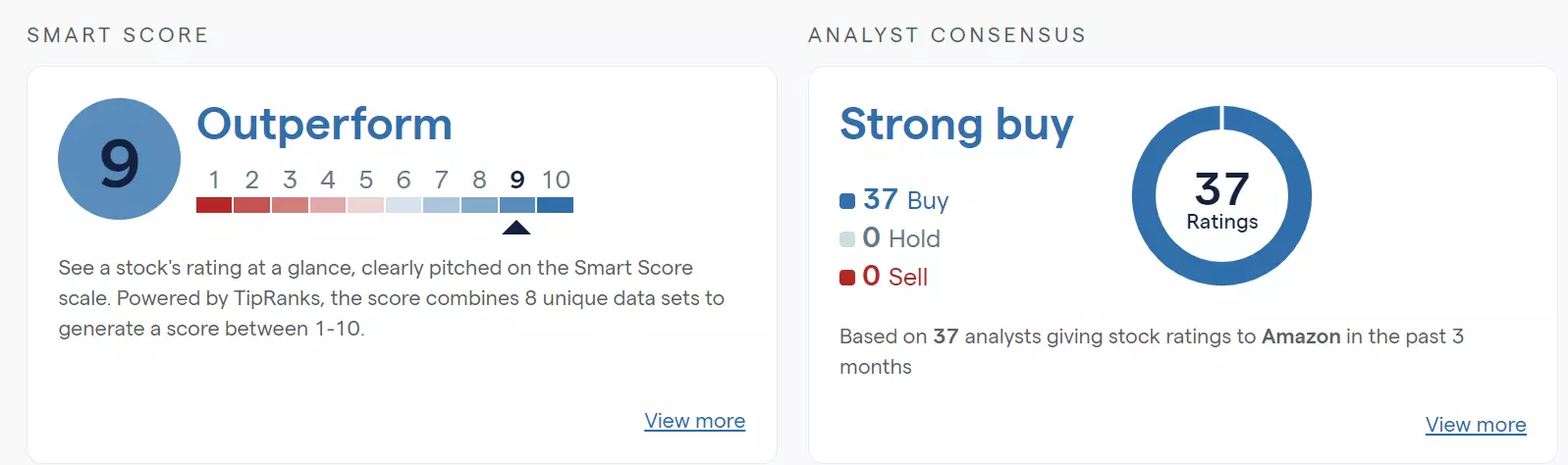

Amazon stock outperformed the S&P500 benchmark in 2023, boasting an impressive 63% yearly gain and securing its position as one of the best performers in the Magnificent Seven club. The e-commerce giant has unquestionably come out of the woods from the 2022 meltdown, impressing investors with its robust growth and promising outlook. Therefore, it’s not too surprise that based on IG platform’s TipRanks rating, the smart score for Amazon is 9 out of 10.

Over the last three months, all 37 surveyed analysts have rated Amazon as a 'buy.'

From a technical standpoint, as observed on the weekly chart, Amazon’s stock prices continue to push towards the early 2022 high, with the $160 level appearing to be a significant hurdle and testing point ahead of the earnings report.

From a longer-term perspective, the uptrend in price remains robust. Notably, the reversed head-and-shoulders pattern could unlock more upside potential once the shoulder line for this pattern, which also sits around $160, is conquered.

In the near term, based on the daily chart, imminent support can be found at $155, and a further decline may bring the 20-day SMA into view.

Amazon Weekly Chart

Amazon Daily Chart

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Act on share opportunities today

Go long or short on thousands of international stocks with CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.