Ahead of the game: September 4, 2023

Your weekly financial calendar for market insights and key economic indicators.

US equity markets extended their post-Jackson Hole rebound as a soft patch of economic data in the US this week raised hopes the Federal Reserve Bank (Fed) is at the end of its rate hiking cycle.

In Australia, the ASX 200 extended its recovery from its August lows to finish the month just 1.42% lower. The rally came on the back of a retreat in US bond yields, additional policy easing in China and a softer-than-expected monthly consumer price index (CPI) indicator, which confirms the Reserve Bank of Australia (RBA) will likely keep rates on hold at 4.10% at next week's board meeting.

- US 2Q GDP was revised down from 2.4% to 2.1%

- The ADP employment report showed a 177k increase in jobs in the US in July, less than the 195k exp

- JOLTS job openings declined by 338k to 8.827m in July

- The US Fed core PCE inflation increased by 4.2% year-over-year (YoY) in August from 4.1%

- Euro Zone core inflation rose by 5.3% YoY in August, easing from 5.5% in July

- The Australian CPI increased by 4.9% MoM in July vs the 5.2% exp

- Building approvals in Australia fell by 8.1% MoM in July vs -0.5% exp

- AU second-quarter capital expenditure (Q2 Capex) increased by 2.8% vs 1% exp

- China NBS manufacturing PMI for August increased to 49.7, versus 49.2 exp

- Gold looked to snap a five-week losing streak as it traded back above $1,920

- The Wall Street ‘gauge of fear’ – the volatility index (VIX) – fell.

- AU: Company profits Q2 (Monday, September 4 at 11:30 am AEST)

- AU: RBA interest rate meeting (Tuesday, September 5 at 2:30 pm AEST)

- AU: Q2 GDP (Wednesday, September 6 at 11:30 am AEST)

- AU: Balance of trade (Thursday, September 7 at 11:30 am AEST)

- CN: Caixin service PMI (Tuesday, September 5 at 11:45 am AEST)

- CN: Balance of trade (Thursday, September 7 at 1 pm AEST)

- US: Factory orders (Wednesday, September 6 at 12:00 am AEST)

- US: ISM services PMI (Thursday, September 7 at 12:00 am AEST)

- GE: Balance of trade (Monday, September 4 at 4 pm AEST)

- GE: Factory orders (Wednesday, September 6 at 4 pm AEST)

-

AU

RBA interest rate decision

Tuesday, September 5 at 2:30 pm AEST

At its meeting in August, the RBA kept its cash on hold at 4.10% for a second consecutive month to assess the impact of a cumulative 400bp or rate hikes and evidence that a sustainable rebalancing between supply and demand is under way.

In the statement that accompanied the decision, the RBA displayed more comfort around the inflation outlook, noting that while inflation remains "still too high at 6%", recent data is "consistent with inflation returning to the 2-3% target range over the forecast horizon" based on the provisor that productivity growth "picks up".

This week, the monthly CPI indicator showed more progress in reducing inflation. Headline inflation rising by 4.9% year-over-year (YoY), from 5.4% in June. The core measure of the monthly CPI indicator, the trimmed mean rose 5.6% in July from 6.0% in June.

This week's softer-than-expected inflation number, combined with an increase in the unemployment rate to 3.7%, tame wage growth, and an expected slowing in GDP growth next week, will likely see the RBA keep rates on hold in September at 4.10%.

RBA official cash rate chart

-

AU

Q2 GDP

Wednesday, September 6 at 11:30 am AEST

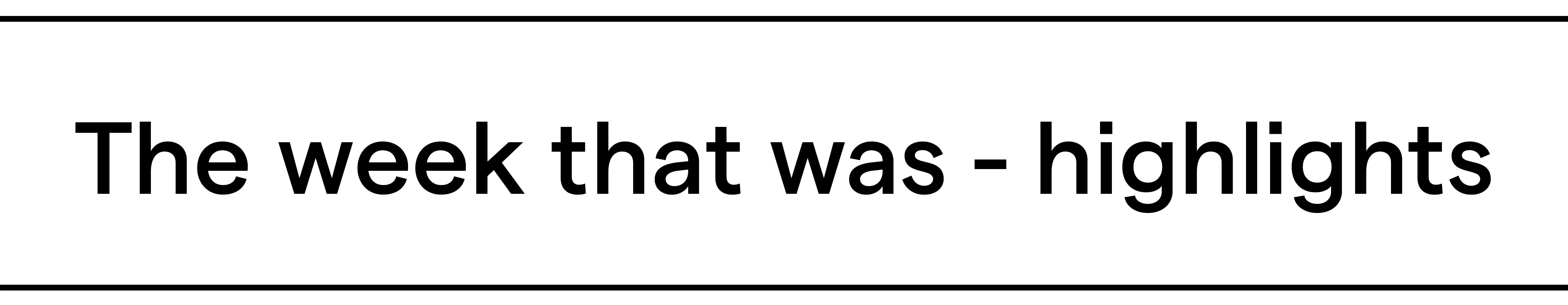

Australian GDP rose 0.2% in the March quarter of 2023 and 2.3% YoY. It was the sixth straight rise in quarterly GDP but the slowest growth since the Covid-19 Delta lockdowns in September quarter 2021. Private and public gross fixed capital formation were the main drivers of GDP growth.

This quarter, GDP is expected to increase by 0.4%, and the annual growth rate is expected to increase by 1.8%. This would be the slowest pace of growth since the December quarter of 2020, when Covid lockdowns saw three consecutive quarters of contraction.

Annual GDP growth rate chart

-

US

ISM Services PMI

Thursday, September 7 at 12:00 am AEST

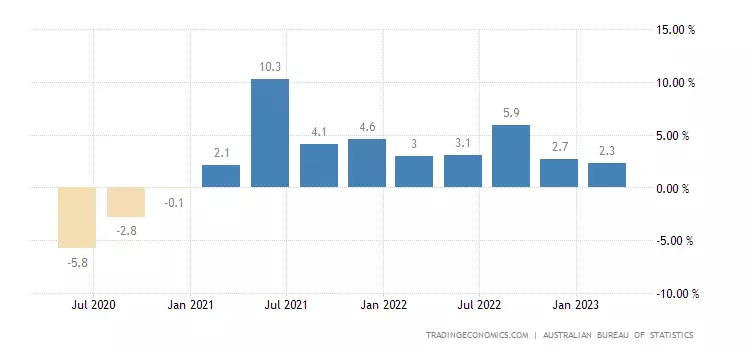

In July, the ISM services PMI remained in expansionary territory at 52.7 for a seventh consecutive month but fell from a four-month high of 53.9 in June. Despite the fall in the headline number, the prices paid sub-index increased to 56.8 from 54.1, and new orders remain relatively stable at 55.

This month, the market is looking for the headline to fall to 52.4. The market will be looking for some moderation in the prices paid component to help give the Fed the flexibility to extend its pause past September.

ISM Services PMI chart

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.