Macro Intelligence: Australian agribusiness sector sees growth amid global headwinds

Amidst a challenging global economy, Australia's agribusiness sector outshines with robust growth forecasts and positive trade developments, signaling a lucrative era for investors in the organic and sustainable produce markets.

Article written by Nadine Blayney (ausbiz)

Agri stocks surpass benchmarks

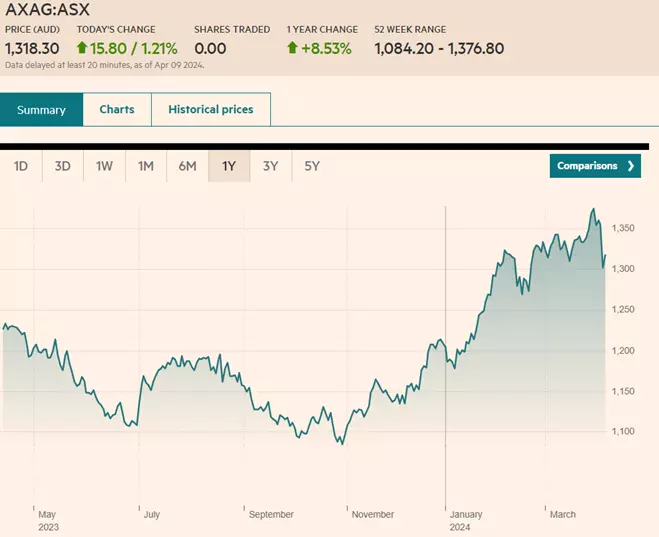

The S&P/ASX Agribusiness sector rose 8.5% over the past year, outperforming the overall S&P/ASX200 index which has gained 7%.

S&P/ASX Agribusiness Index (AXAG) one-year chart

Stock spotlight: defensive assets with growth potential

The S&P/ASX Agribusiness Index (AXAG) serves as the local benchmark for tracking the performance of the agribusiness sector. Its constituents are companies engaged in the primary production of agricultural products and in producing commodities used as inputs for the primary production of agricultural products.

Notable examples include Treasury Wine Estates, Elders, GrainCorp, and Bega. Agribusiness stocks can act as defensive assets and offer long-term growth potential. Additionally, some agribusiness stocks provide attractive dividends. However, these stocks are known for their cyclical nature and are susceptible to fluctuations in weather conditions and supply/demand dynamics. The agricultural sector is also influenced by market trends, including the growing demand for organic and sustainably produced products, as well as evolving consumer preferences.

Index Sector weight distribution chart

Index performance overview table

Official sector forecasts are favourable

Agricultural businesses are at the mercy of weather conditions, global demand, and consumer preferences. Nevertheless, there is no denying that much of what the sector produces is essential for sustaining life. The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) forecasts that the value of agricultural production will increase by 6% to $85 billion in 2024-25. This outlook is based on improving weather conditions, which are expected to bolster crop production.

Additionally, it anticipates a recovery in livestock prices and a high global demand that will support rising international prices for livestock products. ABARES is also predicting average farm cash income to rebound from a significant decline in 2023-24, with a projected increase of 47% in 2024-25. In nominal terms, the gross value of production is expected to decrease by 15% in 2023-24 (from historical highs), before recovering.

Forecasted trends in Australian farm production

Confidence crop: Australian farmers' optimism grows

Rabobank is also reporting Australian farmers have begun the year with a “surge” in confidence after widespread, better-than-expected summer growing conditions and positive signs from key commodity markets.

Agricultural Sector confidence chart

China trade improves while global outlook dims

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) is not alone in anticipating that global economic growth will remain subdued in 2024, as consumers rein in spending in response to higher interest rates and inflation. This is expected to lead many households to trade down to more affordable agrifood products.

However, ABARES notes that strong population and income growth in Asia could bolster food consumption. Further aiding Australia's agricultural sector are macroeconomic and policy developments, including the easing of substantial Chinese tariffs on Australian wine and barley. In the beef market, global demand is projected to outpace supply in 2024-25, with US demand for beef imports set to rise significantly and Australian beef exports to America expected to see robust growth.

Expectations for Australian Agribusiness stocks

Despite optimistic demand and supply projections, public companies are always vulnerable to upgrades and downgrades based on actual conditions. Elders (ELD), an exemplar of an Australian listed agricultural company, is particularly noteworthy given its diverse exposure to livestock, agricultural chemicals, rural property, crop protection, and financial services for the agricultural industry.

This week, Elders revised its market outlook, adjusting its first half underlying EBIT forecast to between $120 million and $140 million for FY24. The company reported that trading had been "significantly below expectations" in the first half, with customer confidence impacted by an erroneously predicted El Niño by the Bureau of Meteorology, reduced crop protection prices, declining cattle and sheep prices, and margin pressures in some agricultural chemical products.

Elders daily chart

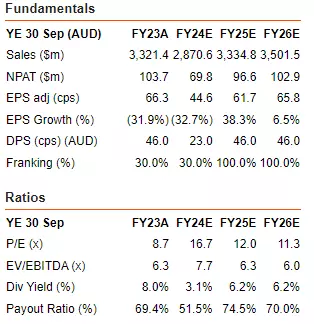

Elders' financial forecast and analyst upgrades

Just two days after Macquarie elevated Elders to 'Outperform' from 'Neutral', along with a revised target price of $10.45 per share up from $7.12, Elders delivered a trading update. Following Elders' own downgrade, Macquarie maintained its position that improved seasonal conditions and internal company initiatives are still valid, "albeit from a lower base."

Despite the challenging market conditions encountered in the first half of the year, Shaw and Partners remains optimistic that the latter half will align more closely with "normal" expectations, guided by company communications and the outlook provided by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES). Consequently, Shaw and Partners has reduced its FY24 earnings before interest and taxes (EBIT) forecast by 22.5% and has decreased its target price from $10.00 to $9.00. However, it maintains a 'Buy' rating for Elders.

Financial projections table

Citi elevates Elders to 'Buy', raises price target

Citi has upgraded its recommendation for Elders to 'Buy' from 'Neutral', despite reducing its forecast for FY24 underlying earnings before interest and tax (EBIT) by 26% to $130 million. Citi remains optimistic that the first half's underperformance will not affect FY25 projections. "Given that earnings have now been rebased, coupled with an improving outlook in the near term, we believe it is appropriate to assign higher valuation multiples at this point," stated Citi. Consequently, it has increased Elders' price target to $8.50.

Refinitiv data indicates that brokers collectively maintain a 'Buy' stance on Elders (ELD) with a consensus price target of $8.70 for the shares.

Stock performance and volume chart

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Speculate on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

Put learning into action

Try out what you’ve learned in this commodities strategy article risk-free in your demo account.

Ready to trade commodities?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Deal on our wide range of major and niche commodities

- Protect your capital with risk management tools

- Get some of the best spreads on the market – trade Spot Gold from 0.3 points

Inspired to trade?

Put what you’ve learned in this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.