Hang Seng breached six-year-low as China lockdowns 17.5 million-populated city

The Heng Seng index is under the pump this week as China’s recent surge in COVID-19 cases has sent Shanghai and Shenzhen into lockdown.

The Heng Seng index is under the double whammy this week mounting pressure from global geopolitical tension increases and China’s new Covid wave weighed heavily on investor's sentiment.

The Hang Seng index dived over 2% for the third straight day to breach its six-year-low level since March 2016. Hang Seng Tech marked a new all-time low.

China’s recent surge in COVID-19 cases has sent two of the country’s most developed cities and economic powerhouses, Shanghai and Shenzhen into half-lockdown. The new wave of Covid in China has affected over 50 million people across 27 provinces so far.

Shenzhen, one of the most developed cities with a 17.5 million population, became the largest Chinese city in lockdown since the pandemic started two years ago. As the world’s tech factory and China’s busiest ports, Shenzhen is home to the headquarters of the tech giants Huawei and Tencent and Foxconn, the major supplier for Apple’s iPhone.

The new wave has raised concerns over the beleaguered global supply issues and threatened the country’s economic growth. More importantly, the hope that China would follow the rest of the world to exit their 'zero-case' covid strategy has broken as the top authority has shown great determination in keeping the largest-populated nation virus-free.

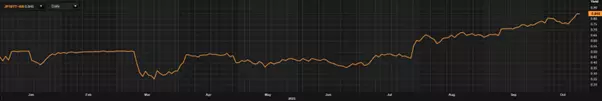

Hang Seng index

The Hang Seng index was the 'worst-performer' during the calendar year of 2021, dropping by over 20% while most of the global index enjoyed double-digit growth. Unfortunately, the woe for the Hong Kong listed stocks continues in the New Year: the index has evaporated over 34% from its recent high up to this week, the worst crash since 2008.

The broad-range selloff shows that global investors are escaping from Hong Kong's stock market, which used to be viewed as a golden opportunity to enjoy the Asian dragon’s explosive growth. Apart from signs of economic slowdown, the country’s extreme Covid-19 curbs and the lack of clarity on the end of regulatory crackdowns are the culprits to douse global investors’ enthusiasm.

Hang Seng monthly chart

From a technical standpoint, the falling of Hang Seng was accelerated by the months-long broken trend line and now entered into a steeper descending trajectory.

For the near term, the index has found its support near 19000. The next significant support needs to look back to June 2012, around 18513. The upper boundary of the moving tunnel will limit the high should the index seek for a rebound. At the moment, 19897 will the first target to conquer.

Hang Seng daily chart

Follow Hebe Chen on Twitter @BifeiChen

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices