Find out more or choose another breakaway

In collaboration with Dr Robert Hancké of the London School of Economics, Singapore’s No. 1 retail forex provider,1 IG, has considered...

Breakaway region São Paulo

Parent country Brazil

Old currency Brazilian Real (BRL)

New currency São Paulo Real

An independent currency would pave the way for São Paulo to increase its exports, but would that come at the cost of political stability in Brazil?

Goods produced in the state of São Paulo could be sold more competitively if the new currency depreciates

Consequently, rising exports and monetary stability could lead to higher economic growth

Brazil would instantly be considerably poorer, with a massive dent in its trade balance

The Brazilian real could instantly come under pressure

This might produce a recession if the central bank attempts to fend off speculative attacks

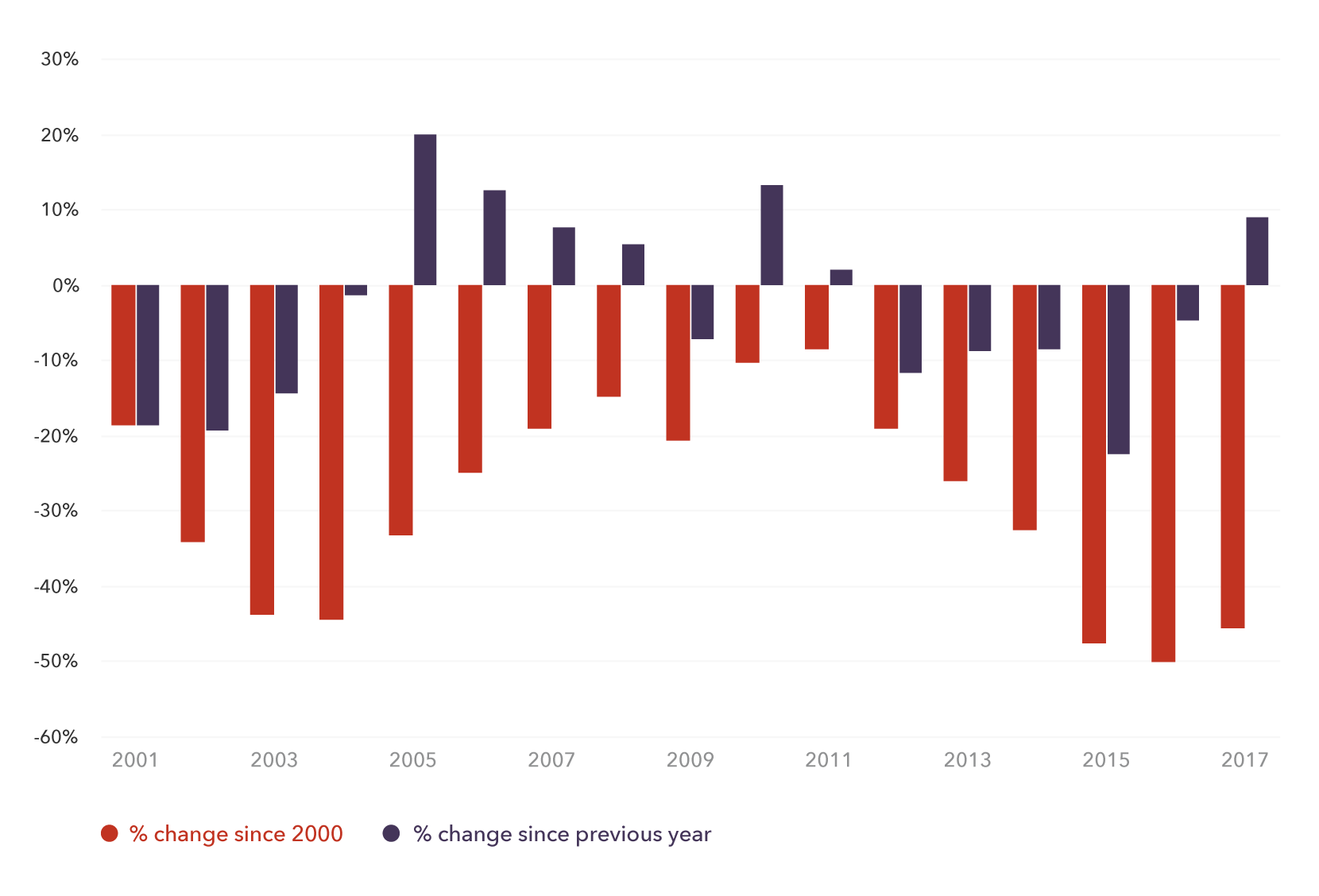

Change in value of Brazilian real (BRL) since 2000, based on SDRs per currency unit source

Dr Robert Hancké

“The benefits of monetary independence are mixed, but a breakaway currency could certainly benefit the State of São Paulo by introducing monetary stability.”

Monetary secession of the strongest region might produce similar centrifugal forces elsewhere in the country

The Brazilian federation might collapse entirely

Depending on the initial exchange rate, a new currency could lead to a temporary jump in competitiveness

However, given that the Brazilian real is a relatively soft currency today (it lost 50% of its value between 2000 and 2018), the export gains would not be large compared to the current situation

A stronger currency might actually be counterproductive