Find out more or choose another breakaway

In collaboration with Dr Robert Hancké of the London School of Economics, Singapore’s No. 1 retail forex provider,1 IG, has considered...

Breakaway region Karnataka

Parent country India

Old currency Indian Rupee (INR)

New currency Karnatakan Rupee

Karnataka is home to some of India’s biggest industrial success stories. Should it build on this by becoming financially independent, or are the risks too great?

The effects would likely diverge along sector lines: Modern parts of the state’s economy would probably benefit from an independent currency

But workers in more traditional sectors could suffer

Globalisation would likely lead to economic growth but could also lead to calls for a more redistributive economy

The Indian economy would lose a significant chunk of its world-class ICT industry

It is unclear if and how the loss of that export revenue could be compensated for

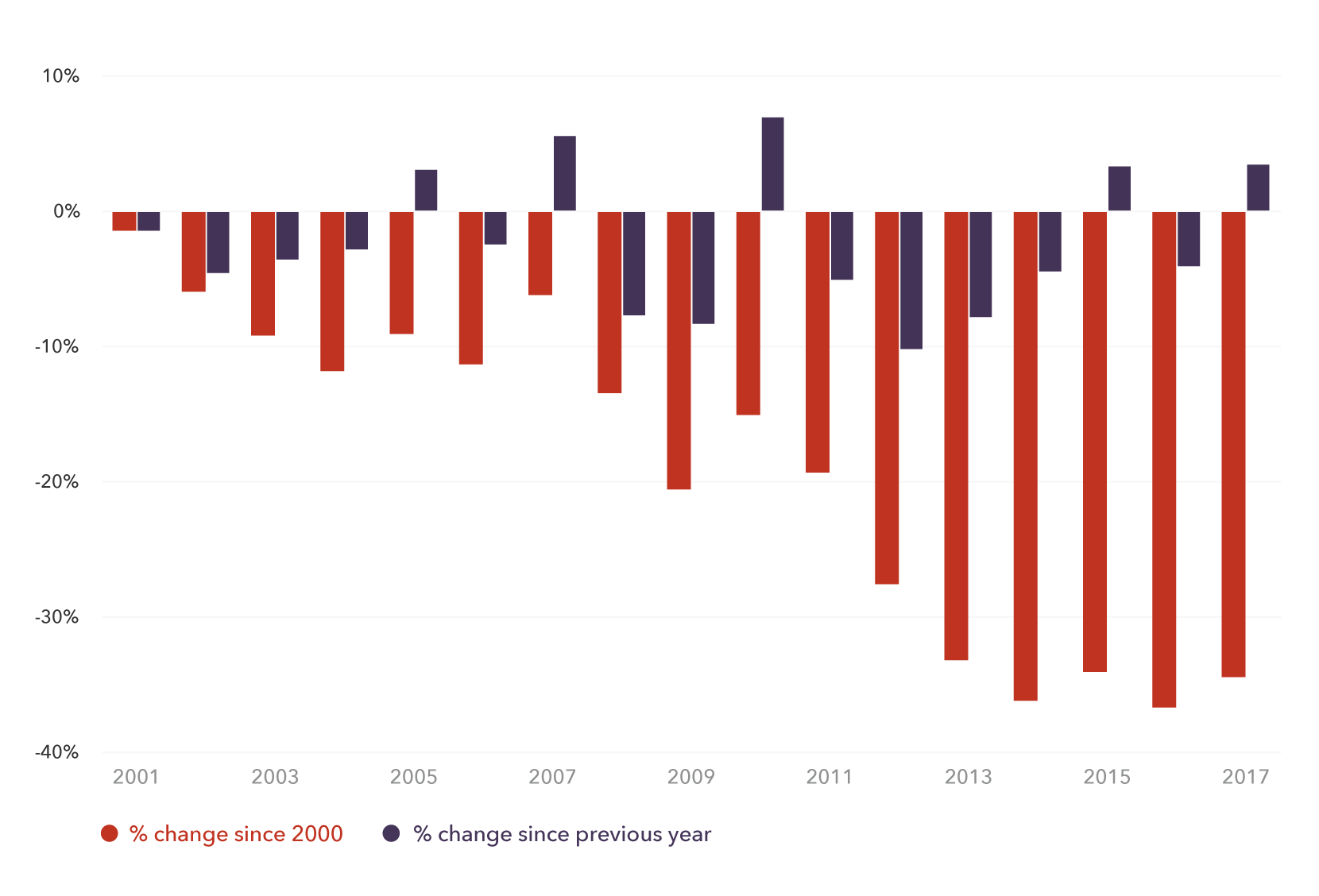

Change in value of Indian rupee (INR) since 2000, based on SDRs per currency unit source

Dr Robert Hancké

“The political gains of monetary sovereignty are small at best, and probably outweighed by the negative consequences. The new currency would evoke tensions both within the region and with the central Indian state.”

For half the state’s population, which depends on the agricultural industry, an independent currency would almost certainly lead to a rise in the cost of living

Unless economic growth can be shared somehow, there are likely to be protests from the poorer parts of the population

Delhi would likely attempt to deny Karnataka monetary sovereignty, which could lead to significant political tensions

The benefits of monetary independence for Karnataka are unclear

The rupee has been a relatively stable currency in recent decades, and a gentle fall in its value has increased the competitiveness of the state’s export industries