p. Bracket orders (US options and futures)

Eligible position types for bracket orders

- Stocks*/ETFs

- Single-leg equity/ETF options

- Multi-leg equity/ETF options

- Futures (including micros & Smalls)**

*OTOCO orders are not available when shorting Hard-to-Borrow (HTB) stocks due to the potential of no share availability. However, OCO orders may be used on an already established short stock position that is HTB. Additionally, when using an OCO or OTOCO for any futures position, please be aware that stop market orders are subject to CME's Market Order with Protection handling.

Bracket order types

OTOCO: One Triggers a One Cancels Other

OTOCO orders are used when creating a bracket on a new position. OTOCO's allow you to open a trade and simultaneously set up a profit and a stop-loss target.

OCO: One Cancels Other

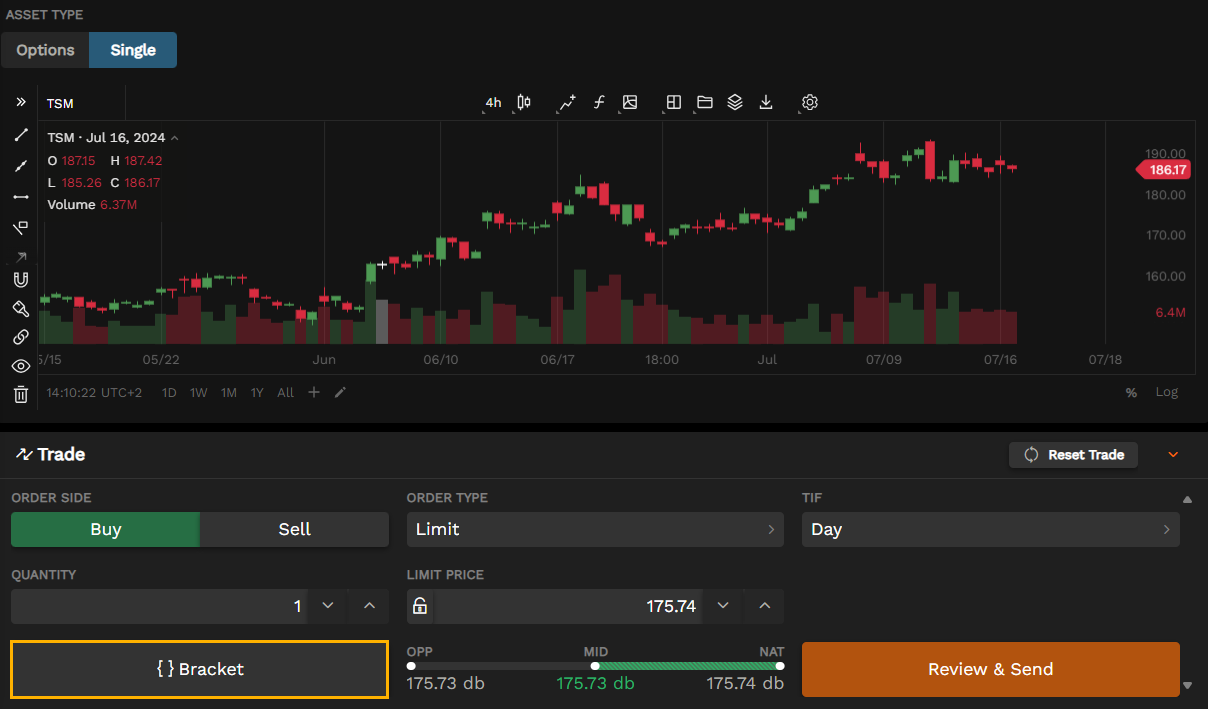

Bracket order setup steps:

Web platform:

Mobile platform

Replacing a working bracket order

Web platform

Replacing a bracket order is similar to any other working order. To replace or edit a bracket order, start by locating the working order. You can view your working orders in the Activity tab, Positions tab (with the working filter enabled), and the orders window of the right-hand sidebar. Whether you're replacing an OTOCO or an OCO order, all you need to do is right-click on the working order and select "replace order". After clicking replace, you will be able to adjust the price and re-send the order to replace it.

Mobile platform

Viewing your bracket order

Web platform

You can view all components of your bracket order by visiting the "activity" tab or wherever you prefer to see your working orders. If you have multiple bracket orders working and made an adjustment to any portion of the bracket order, then you may notice that the bracket order may no longer display together. The "activity" tab sorts orders by the time they were initially submitted. However, you can view all working orders associated with a bracket order by locating any portion of the bracket order, right-clicking, and selecting "view complex order."

Mobile platform

You can view any working bracket order in the mobile app by navigating to the "activity tab", locating the order, tap any portion, and select "view complex order."

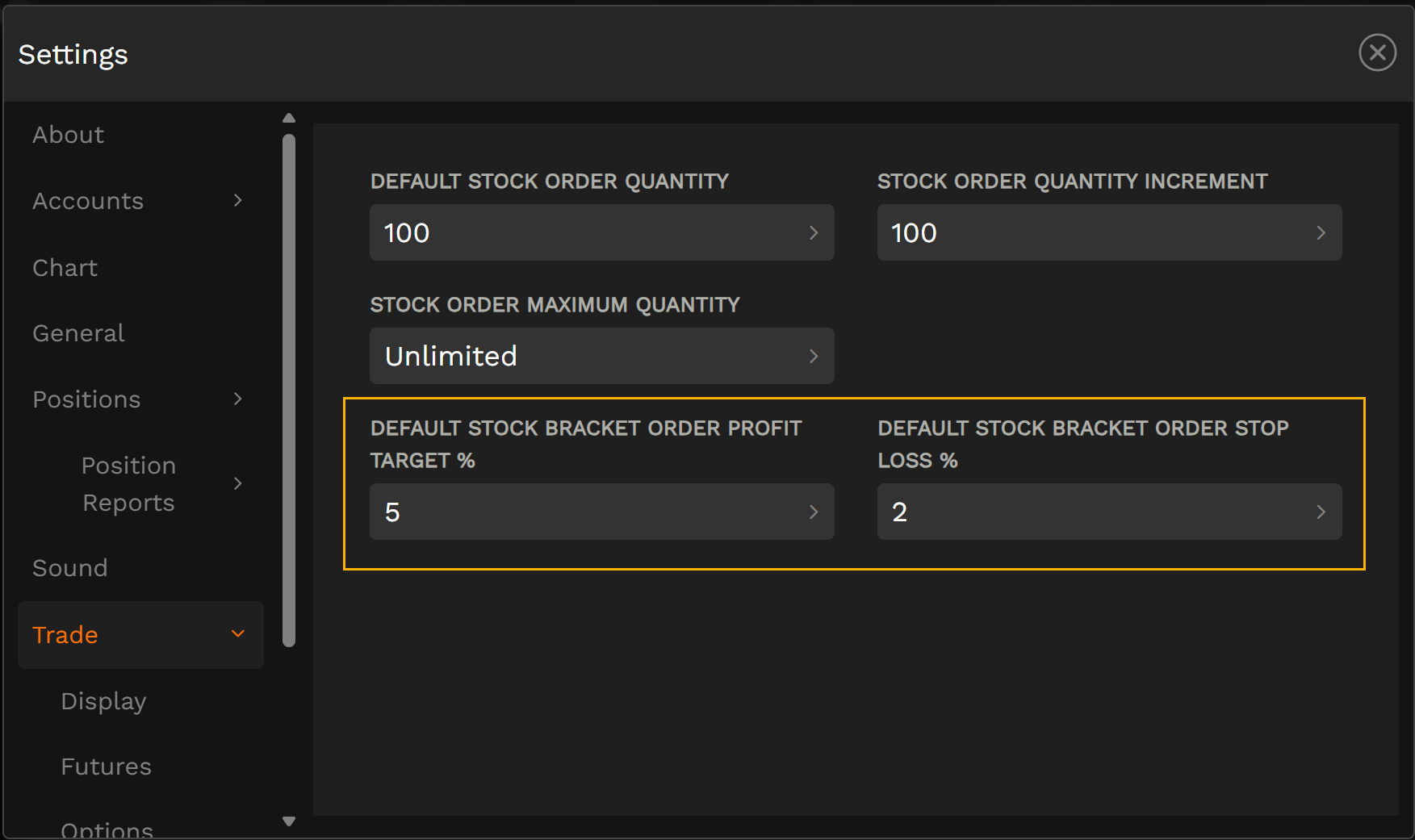

Setting up a default bracket order

You can set a default profit target % and stop-loss % for bracket orders by going to the "settings" menu of the trading platform. To reach the Settings menu, click any gear icon located throughout the trading platform and navigate to the TRADE module. Next, select a position type by clicking the tabs along the top (Stock, Options, or Futures) to set your default target percentages.