Invest

Transfer investments

Open a share dealing account with us and transfer your existing stocks, shares and investments. Explore how to transfer your existing electronic shares.1 Your capital is at risk. The value of shares, ETFs and ETCs can fall as well as rise, which could mean getting back less than you originally put in.

Call +35 318 009 95362 or send us an email newaccounts.uk@ig.com with any questions about opening a trading or investment account between 8am and 6pm (GMT) on weekdays.

Why transfer your stocks and investments to us?

No hidden charges

Transfer your share dealing portfolio quickly and simply, with no charge for electronic shares1

Grow your portfolio for less

Zero commission on all global stocks*

FX conversion from just 0.15%

Buy and sell international shares in local denominations, and pay just 0.15% to convert to your chosen base currency

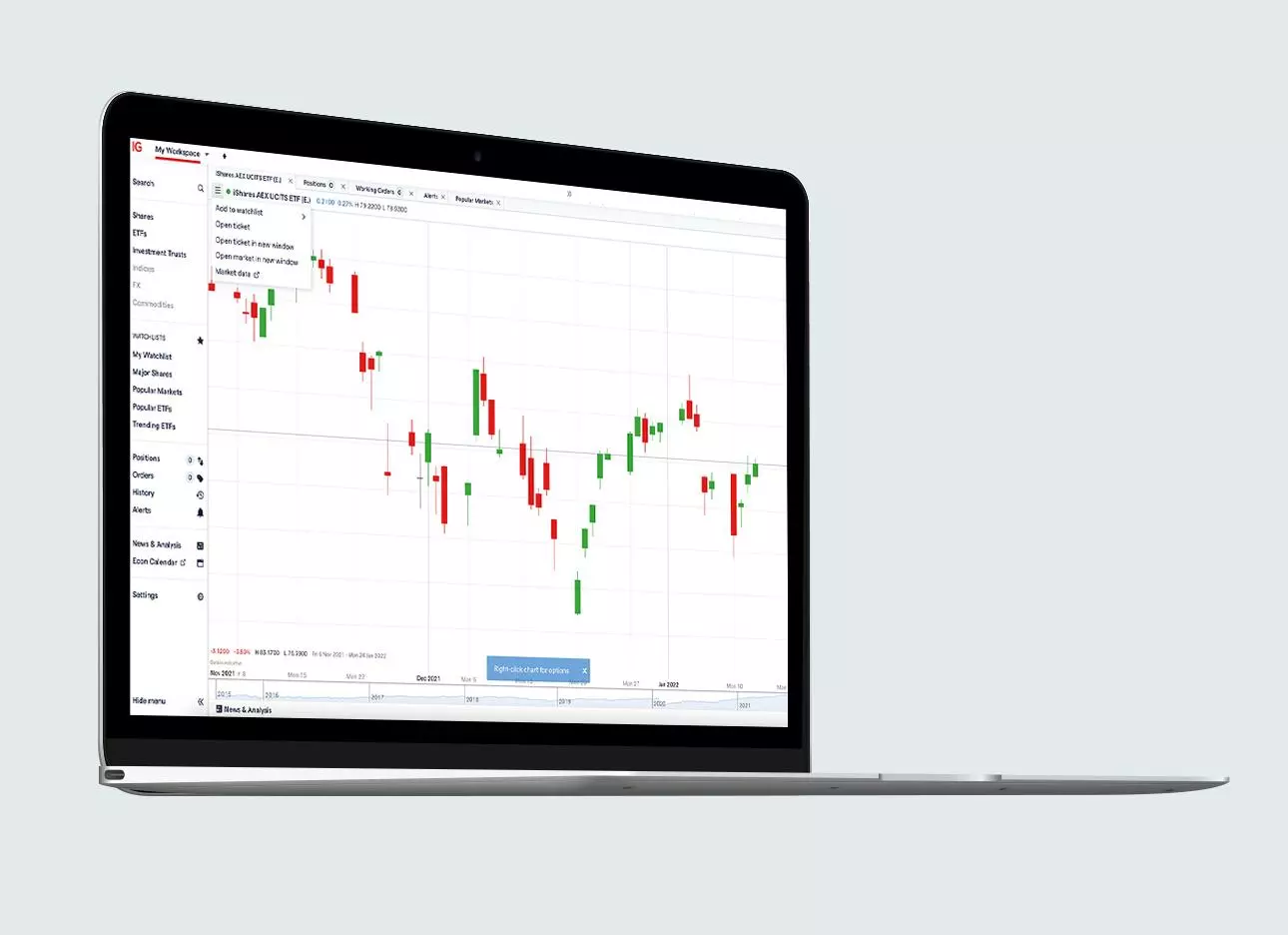

Innovative platform

Our award-winning platform2 was built by traders for traders, making it smart and intuitive to use.

Trade out-of-hours

Access markets like forex and indices out-of-hours. Trade US shares on extended hours.

Great customer service

Our trading services team is available to provide you with support 24 hours a day from 8am Saturday to 10pm Friday.

Compare us

Illustrative fees for a €5k equity trade in a foreign currency

| IG | Davy | Goodbody | |

|---|---|---|---|

| Fee (€) | 7.5 (fx) | 175 | 100 |

| Commission (€) | 0 | 25 | 50 |

| Total (€) | 7.5 | 200 | 150 |

| % Investment | 0.15% | 4% | 3% |

Information based on data from providers’ websites in November 2025. Where relevant, the FX fees have been calculated based on each provider’s applicable percentages (in relation to investment value) that are used as the standard to work out these charges.

How to transfer your stocks to us

- Shares

- Share certificates

How to transfer to us from another UK broker

- Open an account with us

- Log into your IG dashboard (if you hold an active share dealing account with us)

- Go to the ‘live accounts’ tab

- Click on the drop-down list and select the relevant share dealing account you’d like to switch to

- Transfer to a share dealing account by selecting ‘stock transfer’

- Select ‘start request now’ and respond to the prompts that follow

- Download, print and sign the pre-populated document

- Scan and email the signed document from your registered email address to: giatransfers@ig.com

* Note that wet signatures are required to initiate your transfer request - electronic signatures won’t be accepted. Transfer requests via post aren’t accepted.

Transfer your investments to IG | IG Ireland

Open a share dealing account and transfer your existing shareholdings with no charge for electronic shares. Or you can find the transfer form here. Download, print and sign the pre-populated document

- Scan and email the signed document from your registered email address to:

giatransfers@ig.com – for all non-ISA (general investment account) transfers

How to transfer to us when your broker is outside of Ireland

Transferring stocks to another broker is easy and simple. Here’s how to transfer your stocks to us if your broker is based in the following regions:

- Transfer from brokers in Europe, Australia or the US: get in touch with your broker and inform them to initiate the transfer request. They’ll guide you accordingly and contact our transfers team on your behalf

For issuer sponsored transfers (Australian broker/registrar): fill out an issuer-sponsored transfer form available for download here. Sign the form with a wet signature and email a copy to giatransfers@ig.com for processing and further instructions

How to transfer share certificates to us

If you hold original physical share certificates, these can be converted into an electronic version (de-materialised) and transferred to the share dealing account you hold with us. There’s a charge of €115 (incl. VAT) per certificate. We offer this service for UK shares.

Follow this process to convert your share certificates:

- Ensure you have an active and funded share dealing account with us

- Download and complete our CREST transfer form

- Print and sign with a pen – electronic signatures aren’t accepted

- Scan and send a copy of the CREST transfer form along with the copy of the share certificate to giatransfers@ig.com. Forms sent via post won’t be accepted

- Once details have been verified, you’ll receive an email confirmation from our team with the further steps

- We’ll deduct €115 (inclusive of VAT) per certificate from your share dealing account and update you via email

Please note:

- The process usually takes three to six weeks, but may take longer as several parties are involved

Do I need any documents?

There are important documents we’d need from you when you transfer your investment from your current broker to us. These documents in PDF format must be printed, completed and returned to the IG physical address that’s available on the form:

- Internal transfer form: these are applicable to shares, ETFs and ETCs between spouses or civil partners

- CREST transfer form: these are applicable to share certificates*

* Note that if all received documents are deemed to be valid, you can expect the CREST transfer will take between three to six weeks to complete.

FAQs

How long does the transfer take?

We aim to complete your transfer within 14 days, but this is dependent on your transferring broker.

There's only one short form you’ll need to complete, and then we'll take care of the rest.

Are there any transfer commissions?

There are no charges or limits on the number of shares you can transfer from your broker to us, provided these are electronic.

With us, you’ll have zero commission on all global stocks (other fees may apply).

How are dividends paid into my account?

With us, dividend payments for shares you own will be credit to your account around the date they’re due. The payment may only reflect in your account a couple of days following the funds being credited to you. This is since these are first paid to our broker before being cleared and transferred to us.

Once the dividend payments reflect in your IG account, you’ve got the choice to hold, divest or reinvest it by buying more shares. A Consolidated Tax Certificate (CTC) will be sent to you. This document provides a summary of any Irish or international dividends and interest paid on securities between the shown dates. You’ll find additional information on statements here.

Note that tax laws may differ for shares held outside the the Republic of Ireland. This is since these are taxed withholding's tax at the source.

1 Physical share dematerialisation fee is €115 (inclusive of VAT) per certificate. Electronic shares are transferred free of charge. You may be out of the market for a period while your transfer takes place.

2 Awarded ‘best finance app’, ‘best multi-platform provider’ and ‘best platform for active traders’ at the ADVFN International Financial Awards 2024

3 Trade in your share dealing account three or more times in the previous month to qualify for our best commission rates.

4 Changing your currency conversion settings influences the amount of commission you pay. Our team reviews these changes on a monthly basis, so it may take some time to update your account. Please be aware that changing from converting 'instant' to 'manual' means that you'll no longer qualify for commission-free trading.