How does IG make money?

We make most of our money through spreads, with a small portion of our revenue coming from other fees. We aim to build lasting relationships with traders, and provide a range of tools to help you on your trading journey.

The essentials

Although the risk of loss is always present, we want our clients to trade profitably

We make most of our money from the spreads that clients pay to trade with us

We’ve invested heavily in tools to help our clients trade profitably

If clients’ account balances go negative, we are obliged to bring them back to zero at no extra cost1

We hedge only when overall client exposure is skewed in one direction

We aim to build long-lasting relationships with our clients based on trust

Where does IG’s income come from?

The main way we earn money on our leveraged products – eg options, spread betting and CFDs – is through the spreads that we wrap around the market price.

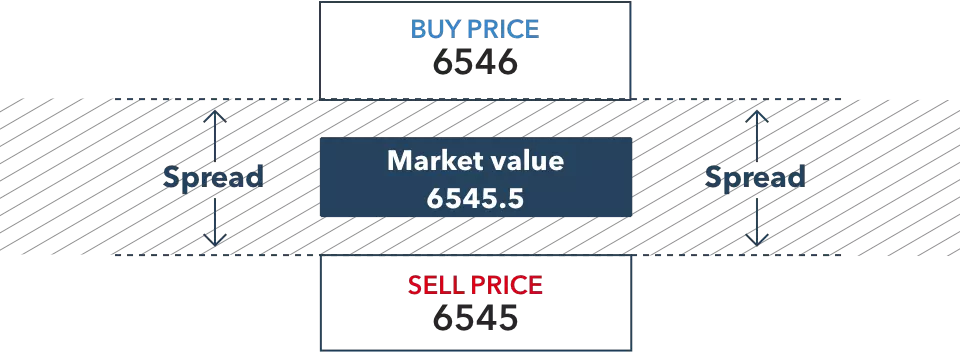

The costs of any given trade are factored into the offer (buy) and bid (sell) prices – so you’ll always buy slightly higher than the market price, and sell slightly below it.

If the FTSE 100 is trading at 6545.5 and has a one point spread, for example, it might have an offer price of 6546 and a bid price of 6545.

You might also need to pay some additional fees when trading with us:

- Share CFD commission

- FX conversion fees

- Overnight fees

You can find out all about these on our charges page.

Does IG aim to profit from client losses?

No. Our business model is based on providing individuals with the opportunity to trade the world’s financial markets, in exchange for fair and proportionate transaction fees. It’s a well-known fact that trading successfully is difficult, and most speculative traders tend to lose. However, we don’t typically benefit from trading losses that an unsuccessful client may experience.

Mostly, our clients offset each other’s positions. For example, if client A buys one lot of the DAX and client B sells one lot of the DAX, both sides of the trade are covered. This means we’re not exposed to the profit or loss of either client. Instead, we make our money via the spread (ie the transaction fee) that each client pays to trade.

Sometimes, a large majority of clients will trade in one direction. When this happens, we’ll protect our exposure to risk by hedging in the underlying market. For example, if client A and client B both buy the DAX, we may buy actual DAX futures. This then covers the amount we’ll pay out if both clients are successful.

Resources to assist your trading

We’ve invested in plenty of resources to ensure we offer the right balance of educational tools and personal support for your trading.

Personal service

You’ll have a dedicated account manager on hand during your initial time with us.

24-hour availability

Our friendly team is available from 8am Saturday to 10pm Friday

Best execution

We consistently aim to get you the best possible result when executing orders on your behalf

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Try these next

All retail client funds are held in segregated bank accounts, in line with FCA rules.

Find out how we aim to achieve the best result for you on every trade.

Discover the tools we offer to help you manage your exposure.

1 Negative balance protection applies to trading-related debt only, and is not available to professional traders.

2 You'll pay a small premium if your guaranteed stop is triggered.