What are corporate bonds?

Corporate bonds – one of the world’s most widely traded financial assets. Discover how corporate bonds work.

What are corporate bonds?

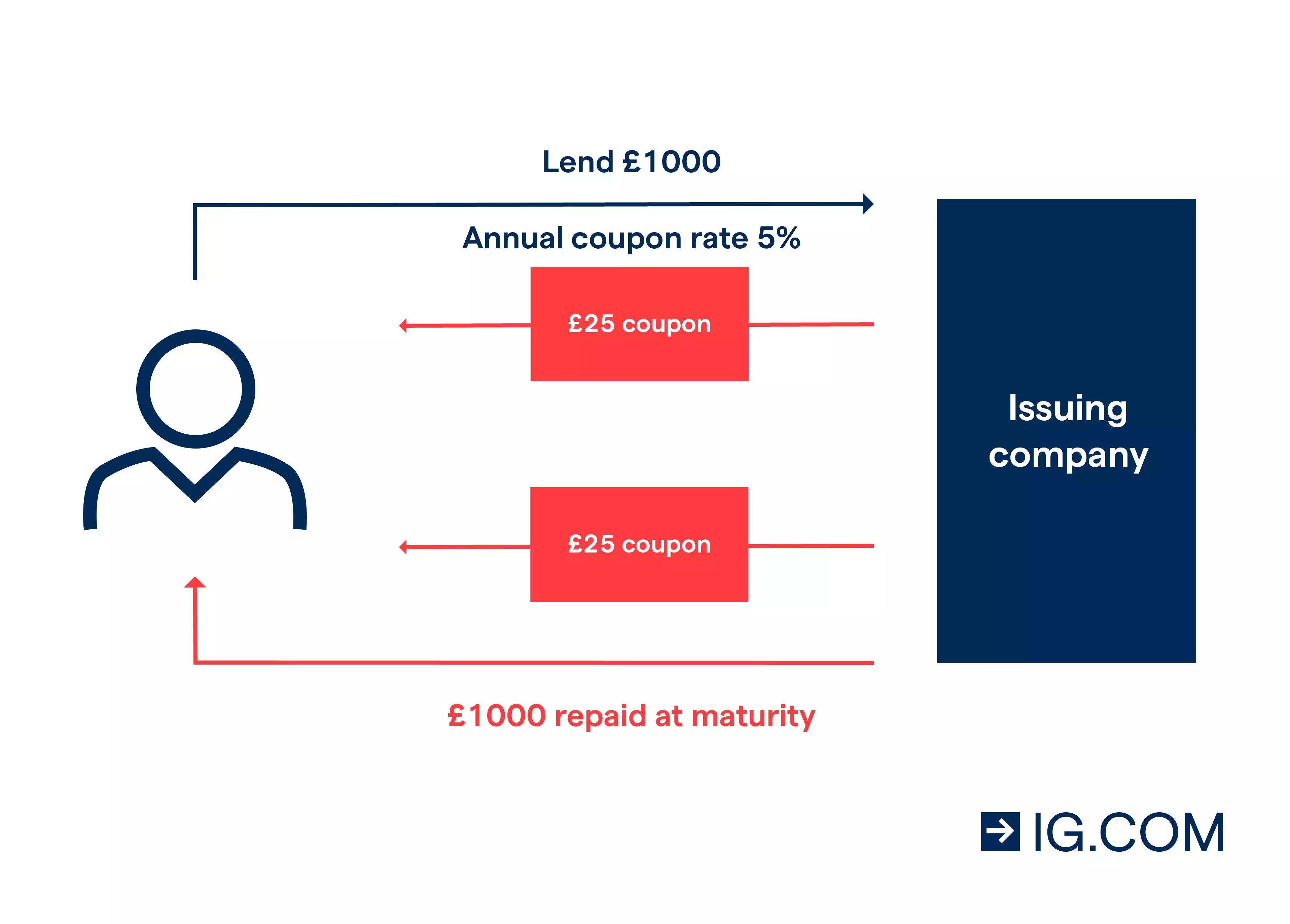

A corporate bond is a debt instrument, much like a loan, where the buyer of the bond (the ‘bondholder’) lends money to a company (the ‘bond issuer’). The company makes regular interest payments until a set date in the future, at which point there is a repayment of the initial loan amount.

This final amount paid by the bond issuer to the bondholder is referred to as the ‘principal’, ‘face value’ or ‘par value’ of the bond. The interest payments are known as the ‘coupon’.

Corporate bond coupons are paid at fixed intervals, typically on a semi-annual or quarterly basis. The coupon rate is the annual coupon amount expressed as a percentage of the bond’s face value. For example, a corporate bond with a face value of £1000, paying a coupon of £25 twice a year (£50 per year in total), has a coupon rate of 5%.

Coupon rates are usually fixed for the lifespan of the bond, but some bonds offer floating rates that reset periodically in line with changes in prevailing market interest rates. Floating rates may be pegged to a bond index or a benchmark such as a government bond (called government ‘gilts’ in the UK).

Like government bonds, corporate bonds are ‘negotiable securities’ – meaning that they can be bought and sold in a secondary market. Whereas many corporate bonds in the secondary market are listed on an exchange like the London Stock Exchange (LSE), the majority are traded over-the-counter through institutional broker-dealers.

Why do companies sell bonds?

Companies sell bonds to raise funds for a wide variety of purposes, including:

- Buying capital equipment or property

- Funding research and development

- Refinancing debt

- Buying back issued shares from shareholders

- Paying dividends on existing shares

- Financing mergers and acquisitions

The issuing company may find more favourable conditions in the bond market than they would through traditional lending channels, like banks.

How do corporate bonds work?

Corporate bonds are issued by companies to secure external funding for investment or expenditure. The bondholder essentially loans capital to the issuing company, who then repays the loan in a manner outlined by the bond.

In most cases, the issuing company makes a series of fixed interest payments – called coupons – on a regular basis. When the bond reaches its expiration date or ‘matures’, the face value or principal amount of the loan is repaid.

The quality of a corporate bond is assessed by rating agencies like Standard & Poor’s, Moody’s and Fitch Ratings. These evaluate the likelihood of a company defaulting on the bond – this is known as credit risk. For example, using Fitch Ratings’ scale, the lowest risk long-term bonds are given a AAA rating, while sub-investment grade (or ‘junk bonds’) begin at BB+.

The higher a bond’s rating – or the lower its credit risk – the lower its coupon rate will be. Equally, the higher the bond’s credit risk, the higher its yield will need to be to attract investors.

Corporate bond example

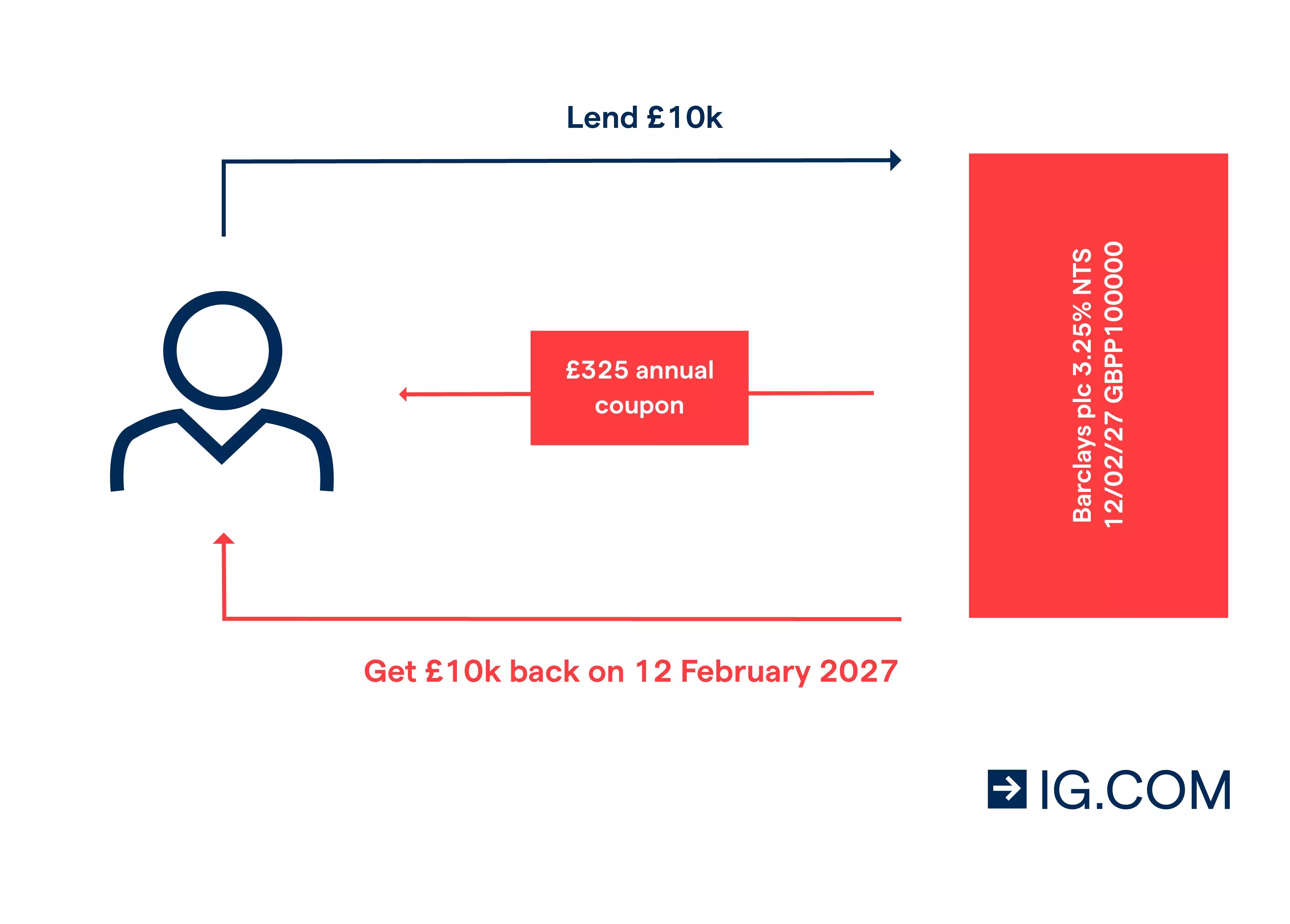

Consider the example of a corporate bond issued by Barclays – the ‘Barclays plc 3.25% NTS 12/02/27 GBP100000’. Here, the bond matures on 12 February 2027 and pays a fixed coupon of 3.25%.

This coupon is paid annually, so if you hold £10,000 nominal of the bond, the bondholder would receive a once yearly payment of £325 until maturity. At maturity, or on the bond’s expiration date, the bondholder would receive the last interest payment and the principal amount back.

Corporate bonds vs stocks

While many corporate bonds may list on an exchange and be bought and sold like stocks, the two types of securities are fundamentally different to one another.

When investors buy stocks, they become a part-owner of a company. This means they are given voting rights and are entitled to a portion of the company’s profits – paid in the form of share dividends (if offered). The upside is that if the company performs well, their dividends may be high and their shares should appreciate in value, allowing them to sell at a higher amount than the original buy price.

The downside is that they could lose part of their initial investment if the share price drops. Additionally, they incur the risk of losing the total amount they paid for their shares if the company becomes insolvent.

By contrast, when an investor buys a corporate bond, he or she becomes a creditor, giving him or her more protection from loss than shareholders – ie if the company is liquidated, bondholders are compensated before shareholders.

But, the level of protection is defined by the terms of the bond. Some corporate bonds are collateralised, which means that specific assets serve as collateral for the bond; others may not be. Some bonds may be classified as senior debt, which means that the bondholder´s debt is paid before more junior creditors in the case of insolvency.

The downside to this lessened risk, however, is that no matter how well the company performs, the bondholder´s earnings are restricted to the principal amount and its interest.

What affects the price of corporate bonds?

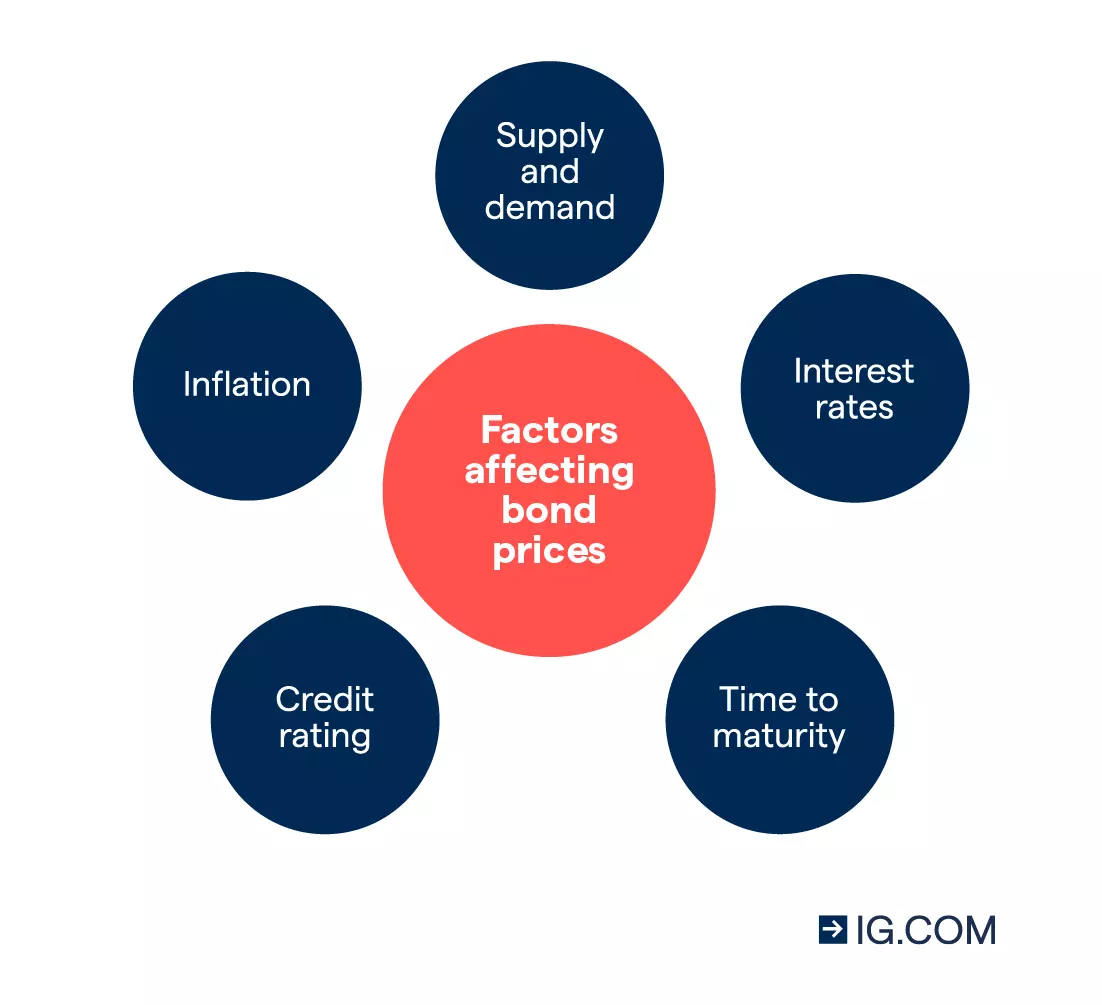

Supply and demand

As with all marketable assets, corporate bond prices depend on supply and demand. Demand is subject to the attractiveness of a bond relative to other available investment opportunities.

Supply is subject to the financing needs of a company and the cost of borrowing given alternative credit channels. Interest rates play a key role in both sides of the market dynamic.

Interest rates

Interest rates are a central factor in both the supply and demand for bonds. If interest rates are lower than the coupon rate on a bond, the bond offers a better return and demand will likely rise. If interest rates rise above the coupon rate, demand for the bond is likely to drop. On the supply side, companies will be hesitant to issue bonds if interest rates are too high.

The general rule is that interest rates and bond prices are inversely correlated – as one rises, so the other falls.

How close the bond is to maturity

New bonds will always be priced taking current interest rates into account. This means that they’ll usually trade at or near their face value. During the bond’s lifespan, its price should fluctuate with movements in the interest rate. By the time a bond has reached maturity, however, it’s just a pay out of the original loan – meaning that a bond will move back towards its par value as it nears this point.

Credit ratings

Whereas bonds are often thought of as conservative investments, defaults can still happen – especially with corporate bonds. The main way of determining the risk of a corporate bond issuer defaulting is through its rating from agencies like Standard & Poor’s, Moody’s and Fitch Ratings. A riskier bond will usually trade at a lower price than a bond with lower risk profile and a similar coupon.

Inflation

High inflation can negatively affect the price of a bond. There are two reasons for this. Firstly, the bond’s fixed coupon payment amount becomes less attractive when money loses its purchasing power. Secondly, monetary authorities like the Bank of England (BoE) often raise interest rates when inflation is high. Because interest rates and bond prices are inversely related, higher interest rates result in a lower market price for the bond.

What are the risks of corporate bonds?

The credit risk of a corporate bond is assessed by reputable rating agencies like Standard & Poor’s, Moody’s and Fitch Ratings. The better the rating, the less the bond’s risk of default. With that said, corporate bonds are generally considered to be more risky than government bonds. Bonds also carry other risks, such as interest rate risk, inflation risk and liquidity risk:

Credit risk

Credit risk refers to the possibility that the company issuing the bond will default on their coupons or principal repayment. Rating agencies assess the creditworthiness of bonds and bond issuers, and are looked to as authoritative sources for credit risk information. The credit risk on a corporate bond may change over the bond’s active lifespan – for example, a company’s risk of default could increase in adverse business conditions.

Interest rate risk

Interest rate risk is the chance that rising interest rates will result in a depreciation of your bond’s market price. This is because when interest rates are higher than the bond’s coupon rate, investors can earn better returns elsewhere. If this occurs, demand for the bond will likely decrease.

Inflation risk

Inflation risk refers to the potential for rising inflation to negatively affect your bond’s market price. High inflation means that the coupon amount is less valuable in terms of purchasing power. It also means that monetary authorities may raise interest rates. In a worst case scenario, if the rate of inflation rises over the coupon rate of your bond, your investment will lose money in real terms.

Liquidity risk

Liquidity risk is the possibility that the market may not have enough buyers to purchase your bond holdings quickly and at the current price. You would then risk selling the bond at lower price than what it should be worth given its coupon rate and face value.

Currency risk

Currency risk only occurs if you buy a bond that pays out in a different currency to your reference currency. If you do this, then fluctuating exchange rates may see the value of your investment drop.

Call risk

Call risk arises when the company issuing the bond has the right, but not the obligation, to repay the bond’s principal before its official expiry date. If this happens, as the bondholder, you’d lose future coupon payments. Additionally, you may not be able to reinvest the principal in an asset that pays the same level of interest.

FAQs

Are corporate bonds safer than stocks?

Bonds carry a different set of risks than those associated with stocks. With this said, bondholders are company creditors in the event of insolvency, so their debt is senior to shareholder claims on equity. This means that bondholders receive payments on their bonds before shareholders are entitled to any monies based on their part-ownership of the company.

‘Guaranteed bonds’ are bonds whose terms have been guaranteed by a third party, like an insurer or parent corporation, which may lessen the chances of default.

What is the difference between a bond and a stock?

A bond is a debt instrument, whereas a share is a claim on a company’s equity. Bondholders lend money to the borrowing company and receive interest payments in addition to the eventual repayment of the loan amount.

Shareholders are part-owners in a company, which gives them a right to the company’s profits (if dividends are offered). While profits can be large if the company does well, shareholders don’t have the same protections as bondholders and other company creditors in the case of insolvency.