AUD/USD gains amidst hawkish signals: focus on CPI data and RBA outlook

AUD/USD gains 1.07%, reaching four-month high. Hawkish RBA, softer USD, and economic data drive momentum.

Last week saw a second straight week of gains for the AUD/USD, closing 1.07% higher at .6585, its highest weekly close in four months.

The AUD/USD rally persisted as the USD slid post-weaker-than-anticipated US CPI data. Improved global risk sentiment, coupled with hawkish RBA tones and news of Chinese government support for struggling property developers, further fuelled the local unit's strength.

Whether that run will be extended will depend, to some extent, on the release of two key pieces of Australian economic data. The first of which is retail sales on Tuesday and the monthly CPI indicator on Wednesday.

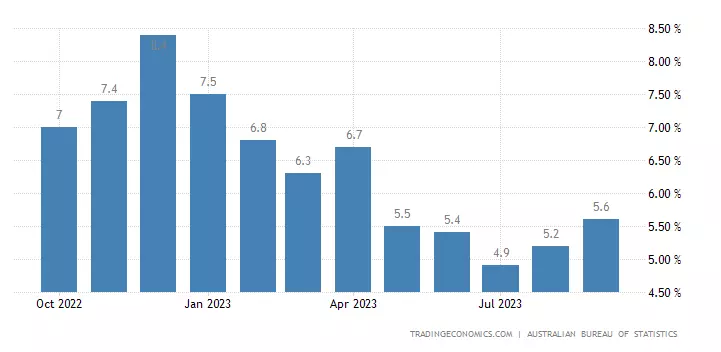

What to expect from monthly CPI indicator

Earlier this month, the RBA raised the cash rate by 25bp to 4.35%. The RBA's first rate rise since June was widely expected after Q3 inflation surprised to the upside.

The past week, RBA communique has taken a more hawkish tilt, with the minutes from the board meeting noting that the bank's latest forecasts "were predicated on an additional one to two increases in the cash rate over coming quarters."

Speaking at the annual ABE dinner in Sydney last Wednesday night, RBA Governor Michele Bullock struck another hawkish note, stating that inflation remains too high and is "increasingly homegrown."

This week, the market is looking for the monthly CPI indicator to fall to 5.2% YoY from 5.6% in September. Presuming the monthly indicator does not surprise to the upside, the RBA will more than likely stay on hold at its meeting in December.

However, with inflation still well above the RBA's 2-3% target, there is good reason why the interest rate market is assigning a 45% chance the RBA will hike rates by 25bp in February to 4.60%.

Monthly CPI indicator chart

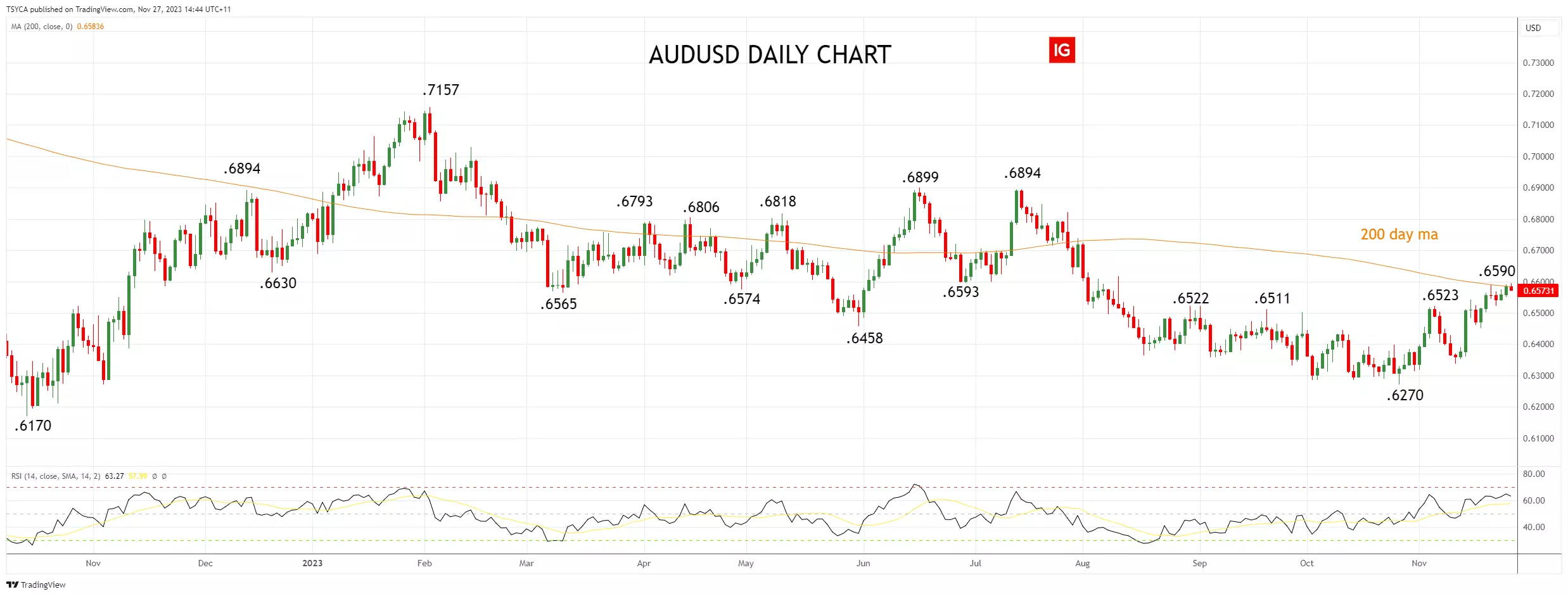

AUD/USD technical analysis

After four unsuccessful attempts, the AUD/USD broke through the .6520/30 resistance last week, only to encounter resistance at .6590, stemming from the 200-day moving average

While there is a likelihood that the AUD/USD could establish a medium-term low around October's .6270, we refrain from initiating new long positions before crossing the 200-day moving average (currently at .6585) and ahead of crucial Australian and US inflation data releases

However, post the data, should the AUD/USD see a sustained break above the 200-day moving average at .6585/00, it opens the way for the rally to extend towards the next important layer of resistance at .6800/20. Downside support is viewed at .6520/00.

- Source Tradingview. The figures stated are as of 27 November 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Explore the markets with our free course

Discover the range of markets you can trade CFDs on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this shares strategy article, and try it out in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Trade over 11,000 popular global stocks

- Protect your capital with risk management tools

- Trade on 140+ key US stocks out-of-hours, so you can react to news

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices