Ahead of the game: June 12, 2023

Your weekly financial calendar for market insights and key economic indicators.

Profit taking in the tech-heavy Nasdaq and rotation into the small-cap cyclical Russel 2000 continued this week as the Russell 2000 gained 2.72% while the Nasdaq lost 0.43%.

Supporting the Russell 2000, May's strong labour market report eased concerns about a hard landing for the US economy. Additionally, banking stress has been less than feared. Lending volumes appear solid and deposit outflows have slowed to a trickle.

After the RBA’s rate hike on Tuesday was followed by a rate rise from the Bank of Canada, the US rates market is having second thoughts about its dovish pricing for next week’s FOMC meeting and is now pricing in a 25% chance of a 25 bp rate hike next week.

As explained in detail below, the risk of a rate rise next week appears underpriced.

Locally the ASX 200 appears set for a third consecutive weekly decline after a hawkish RBA and higher yields weighed heavily on the interest rate-sensitive sectors of the market. The RBA’s emphasis on inflation risks, particularly around expectations, wages, and poor productivity, has the rates market almost fully priced for another 25bp rate hike to 4.35% by August.

Next week the key event will be Tuesday’s US inflation report, a labour market report in Australia and three central bank meetings, the FOMC, ECB and Bank of Japan.

- The RBA raised rates by 25bp to 4.10%

- The Bank of Canada raised rates by 25bp to 4.75%

- Q1 2023 Australian GDP rose by just 0.2% for an annual rate of 2.3%

- The ASX 200 fell for a third straight week

- Crude oil failed to hold onto its gains after Saudi Arabia’s announced a voluntary production cut of 1mn barrels per day in July

- Profit taking in the tech-heavy Nasdaq and rotation into the small-cap Russel 2000 continued

- Gold edged higher to $1965, ahead of next week’s US inflation data and FOMC meeting

- The measure of fear on Wall Street, the Volatility (VIX) index, fell 6.50% to 13.66, its lowest level since February 2020.

- AU: Westpac Consumer Confidence (Tuesday, June 13, 10:30 am AEST)

- AU: NAB Business Confidence (Tuesday, June 13, 11:30 am AEST)

- AU: Labour Force Report (Thursday, June 15, 11:30 am AEST)

- JP: BoJ Interest Rate Decision (Friday, June 16 – no set time)

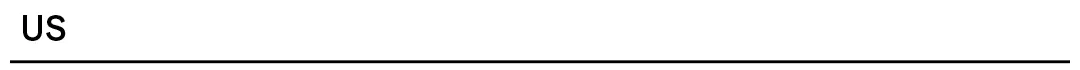

- US: CPI (Tuesday, June 13, 10:30 pm AEST)

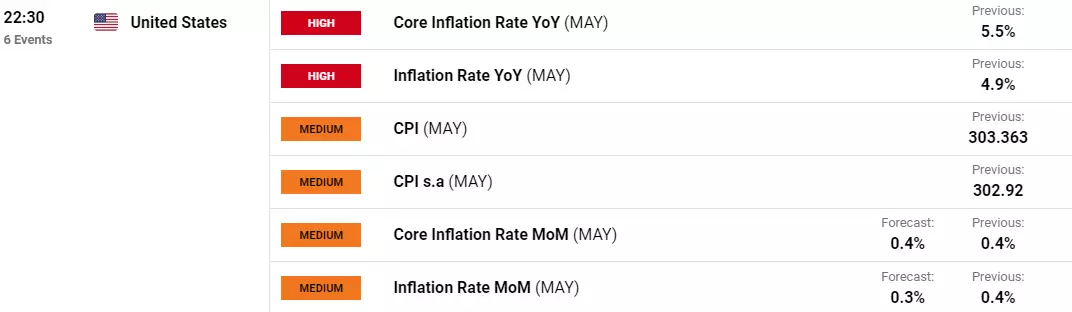

- US: PPI (Wednesday, June 14, 10:30 pm AEST)

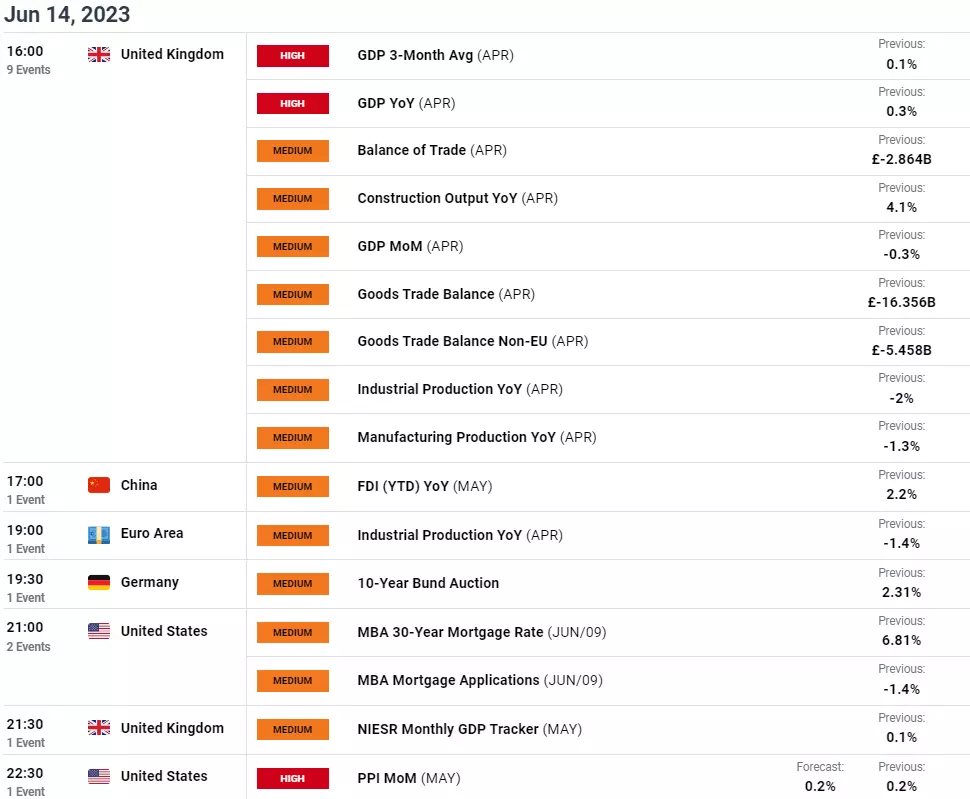

- US: FOMC meeting (Thursday, June 15, 4:00 am AEST)

- UK: Unemployment (Tuesday, June 13, 4:00 pm AEST)

- UK: GDP (Wednesday, June 14, 4:00 pm AEST)

- EA: ECB interest rate meeting (Thursday, June 15, 10:15 pm AEST)

Break down

-

Australia

Labour force report

Thursday, June 15 at 11.30 am AEST

Last month (April), employment fell by 4.3k, missing forecasts for a rise of 25k.

The slight fall in employment followed an average monthly increase of around 39,000 people during the first quarter of 2023. As the number of unemployed people increased by 18k, the unemployment rate unexpectedly rose to 3.7% from 3.5% in March.

This month (May), the market is looking for a +15k rise in employment and for the unemployment rate to remain stable at 3.7%. The participation rate is expected to remain unchanged at 66.7%, just below record highs.

Unemployment rate chart

-

US

FOMC meeting

Thursday, June 15 at 4.00 am AEST

At its meeting in May, the Fed raised the Fed Funds rate by 25bps to a range of 5-5.25%, to its highest level since September 2007.

The minutes from the meeting showed that members were divided about whether to continue to hike rates or to pause at next week’s meeting. “Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.”

The minutes also noted that “some” officials said that the persistence of high inflation meant that “additional (rate hikes) would likely be warranted at future meetings.”

However, since the May meeting, five notable developments have occurred.

- The debt ceiling was raised before the X-date avoiding costly disruptions

- The impact of the banking crisis has been less meaningful than feared

- Core PCE increased by 4.4% YoY from 4.2% previously

- Non-farm payrolls increased by a robust 339k in May

- Two early pausers, the RBA and the BoC, hiked rates this week.

The net impact of the five developments above narrowly tips the scales in favour of a 25bp rate hike to 5.25%-5.5% before an extended pause.

Fed funds rate chart

-

EU

ECB meeting

Thursday, June 15 at 10.15 pm AEST

As we moved through May, there was a discernible deceleration in the European economy's momentum. A series of lukewarm data points - including industrial production, PMI, and the German Ifo survey - cast long shadows, particularly given the accompanying economic slowdown in China, the Euro Area's (EA) primary trading partner.

Adding to the complex picture was the release of softer-than-anticipated EA inflation figures for May. The headline inflation dipped to 6.1% YoY, a decline from the previous 7%, largely propelled by a reduction in prices for energy, food, alcohol, and tobacco. The core inflation rate, which judiciously excludes these volatile components, also slipped from 5.6% YoY to 5.3% YoY.

Despite signs of disinflation, hawkish comments from ECB President Christine Lagarde this week signal that another ECB rate hike is likely next week. She stated, 'The latest available data suggest that indicators of underlying inflationary pressures remain high and, although some are showing signs of moderation, there is no clear evidence that underlying inflation has peaked.'

The interest rate market is fully priced for a 25 bp rate hike in June before another 25bp rate hike in July which would take the ECB’s deposit rate to 3.75%. The ECB is expected to start cutting rates in early 2024 in response to slower growth.

ECB’s deposit rate chart

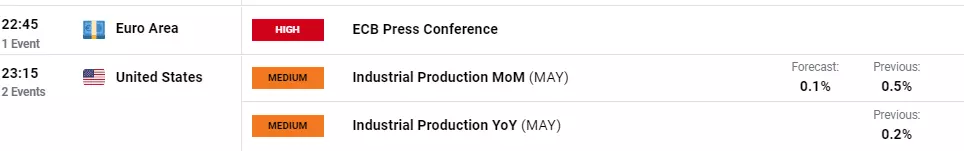

Economics calendar

All times shown in AEST (UTC+10) unless otherwise stated

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Live prices on most popular markets

- Forex

- Shares

- Indices