Cost of carry definition

What is cost of carry?

Cost of carry is the amount of additional money you might have to spend in order to maintain a position. This can come in the form of overnight funding charges, interest payments on margin accounts and forex transactions, or the costs of storing any commodities on the delivery of a futures contract.

Learn about our charges

Find out about the different fees you will incur when you trade with us.

Which markets are impacted by cost of carry?

Forex and commodities are the main markets which are affected by cost of carry, but financial products such as derivatives can be affected as well. Each of these incur different forms of cost of carry. For example, forex transactions might be subject to overnight funding charges as well as fees if the interest rate changes.

Commodities might incur cost of carry charges for the transport, storage and insurance of the asset – assuming that a trader takes ownership of the commodities which they have a position on.

Derivatives such as CFDs incur cost of carry as overnight funding fees. At IG, we make an interest adjustment to your account to reflect the cost of funding your position. We debit your account if the position is long, and we credit your account if the position is short.

Cost of carry in forex trading

With IG, the cost of carry on forex trading is slightly different to the rest of our offering. For one, we will charge you funding costs based on the current tom-next rate, which shows the difference – in points – between the interest paid to borrow the currency that is being notionally sold, and the interest received from holding the currency.

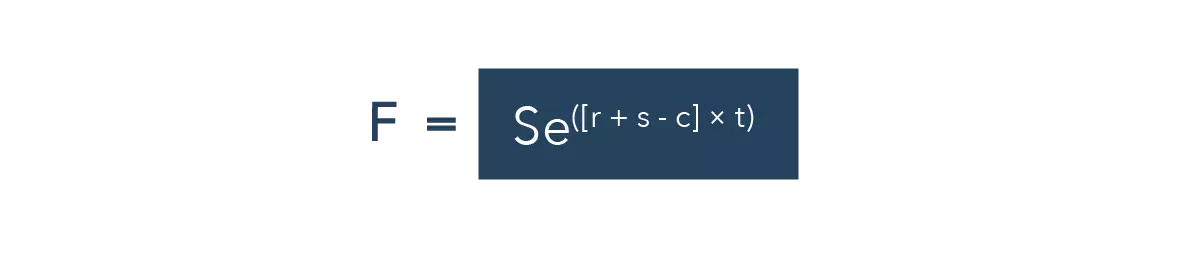

Cost of carry futures calculation

For futures contracts, a special calculation is required in order to calculate the cost of carry. This is because futures incorporate the storage costs associated with the commodity in question, as well as the risk-free interest rate – the rate of return on an investment which has no risk of financial loss. This is a hypothetical concept, since all trades and investments involve some risk of loss, no matter how negligible that may be. However, for practical purposes the rate available on a low-risk government bond is often used.

In the calculation below, ‘convenience yield’ refers to the premium associated with holding a physical commodity, rather than the associated derivative product or contract, as part of a futures contract:

The symbols mean the following:

- F = the future price of the commodity

- S = the spot price of the commodity

- e = ‘base e’, a mathematical constant approximated to 2.718

- r = the risk-free interest rate

- s = the storage cost (as a percentage of the spot price)

- c = the convenience yield

- t = the time to delivery of the contract (as a fraction of one year)

How does cost of carry affect net return?

Cost of carry is an expense that has the potential to affect your net profit. As a result, you should be aware of any cost of carry charges that you might incur while trading, as this will affect the net return on your trades or investments.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.