Ahead of the game: 27 November 2023

Your weekly financial calendar for market insights and key economic indicators.

In a Thanksgiving holiday-shortened week, US equity markets gained for a fourth straight week. The remarkable rebound in November saw the Nasdaq close at its highest level since January 2022, while the S&P 500 traded to its highest price since July 2023.

In Australia, the ASX 200 is still flat (ex-dividends) for the year as hawkish RBA communique this week and falls in Consumer-facing, Real Estate, and IT stocks weighed on the market.

- US durable goods orders dropped -5.4% in October, its second-largest decline since April 2020

- US inflation expectations spiked by 4.5% within the University of Michigan survey

- EA composite flash PMI rose to 47.1 in November, surpassing the expected level of 46.9

- UK composite flash PMI inched into expansion at 50.1, up from 48.7

- RBA Governor Michele Bullock sounded more hawkish at the ABE annual dinner, highlighting elevated inflation concerns

- Chinese property stocks climbed 7% on reports of financial support to alleviate the housing crisis

- Crude Oil hovered around $76 per barrel as the market awaited the likely extension of existing cuts in the delayed OPEC+ meeting

- Gold retested $2010 high before retracting below $2000 amid support for the US dollar and yields

- VIX fell 6.88% to 12.86, marking its fourth consecutive week of declines.

- AU: Retail Sales (Tuesday, November 28th at 11:30 am AEDT)

- AU: Monthly CPI Indicator (Wednesday, November 29th at 11:30 am AEDT)

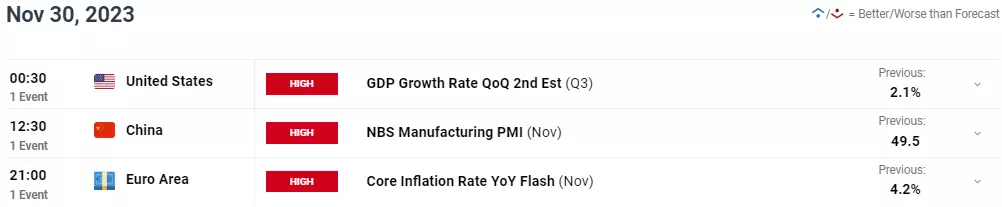

- NZ: RBNZ Interest rate decision (Wednesday, November 29th at 12 pm AEDT)

- AU: Building Approvals (Thursday, November 30th at 11:30 am AEDT)

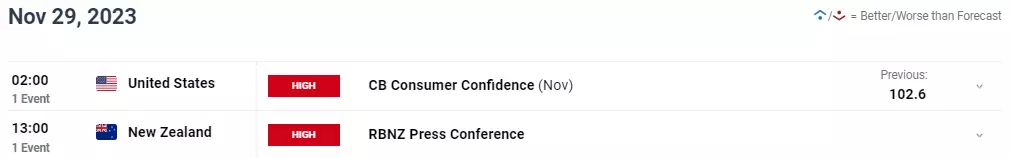

- CH: NBS Manufacturing PMI (Thursday, November 30th at 12:30 pm AEDT)

- CH: Caixin Manufacturing PMI (Friday, December 1st at 12:45 pm AEDT)

- US: Core PCE Price Index (Friday, December 1st at 12:30 am AEDT)

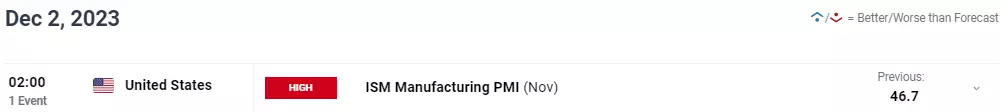

- US: ISM Manufacturing PMI (Saturday, December 2nd at 2 am AEDT)

- GE: GFK Consumer Confidence (Tuesday, November 28th at 6 pm AEDT)

- GE: Inflation (Thursday, November 30th at 12:00 am AEDT)

- EA: Inflation (Thursday, November 30th at 9 pm AEDT)

-

AU

Monthly CPI indicator

Date: Wednesday, 29 November at 11.30 am AEDT

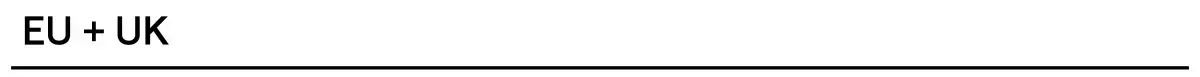

Earlier this month, the RBA raised the cash rate by 25bp to 4.35%. The RBA’s first rate rise since June was widely expected after Q3 inflation surprised to the upside.

In the past week, RBA communiqué has taken a more hawkish tilt, with the minutes from the board meeting noting that the bank's latest forecasts "were predicated on an additional one to two increases in the cash rate over the coming quarters."

Speaking at the annual ABE dinner in Sydney on Wednesday night, RBA Governor Michele Bullock struck another hawkish note, stating that inflation remains too high and is "increasingly homegrown."

Next week, the market is looking for the monthly CPI indicator to fall to 5.2% YoY from 5.6% in September. While the RBA is not expected to hike rates again before year-end, inflation is still well above the RBA’s 2-3% target, and the rates market is assigning a 45% chance the RBA will hike rates by 25bp in February to 4.60%.

Monthly CPI indicator chart

-

EA

Inflation

Thursday, 30 November at 9 pm AEDT

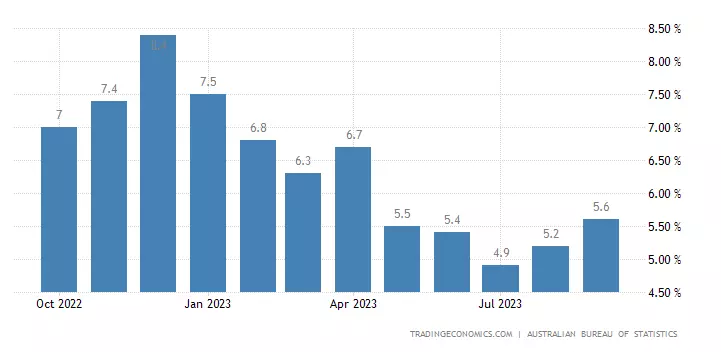

In October, Eurozone’s headline inflation has registered a two-year low, dipping below the 3% mark. Its core inflation has also moderated to its lowest level in 15 months at 4.2%, overall supporting the European Central Bank (ECB)’s decision to keep policy rates on hold in October after ten consecutive hikes.

But with both inflation measures still a distance from the ECB’s 2% goal, ECB President Christine Lagarde has warned against any premature inflation celebration. She maintained that the central bank is ‘not done’ yet in its inflation fight, which points to an extended period of elevated borrowing costs.

Further inflation progress in the coming week may back expectations for the ECB to keep borrowing costs on hold into 2024 and allow more room for the central bank to consider rate cuts if economic risks persist.

Eurozone inflation rate % year-on-year chart

-

US

Core PCE price index

Date: Friday, 1 December at 12.30 am AEDT

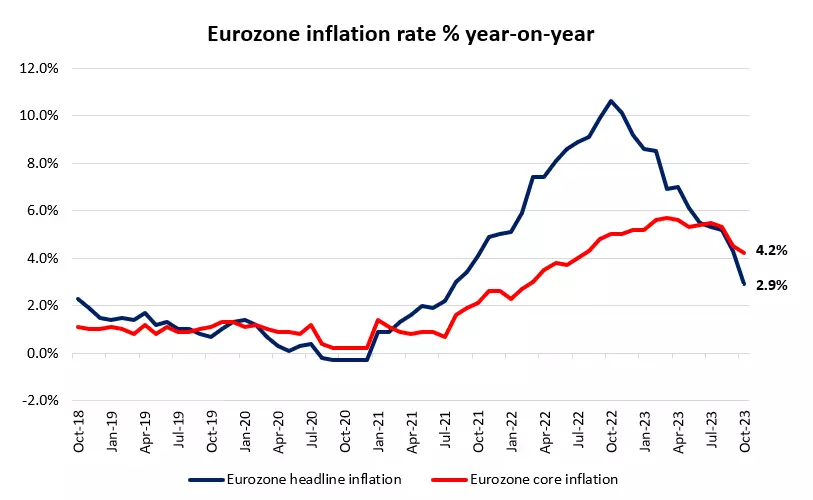

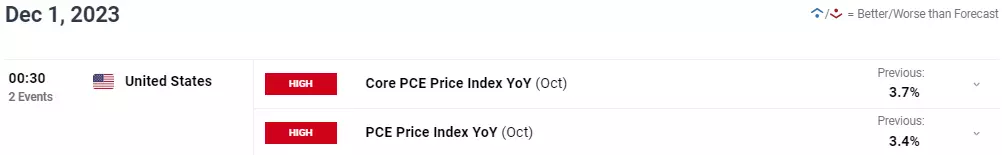

As widely expected, the Fed maintained its target rate for the Fed Funds at 5.25% - 5.50% at its November meeting.

While the FOMC statement left the door open for rate hikes, the Fed noted that tighter financial conditions were likely to weigh on activity and mentioned that the risks of doing Too Much vs Too Little on inflation were "more balanced."

The statement and softer data across PMIs, Non-Farm Payrolls, and inflation have raised hopes that the Fed's rate-hiking cycle is over, and the US rates market is pricing in rate cuts from the middle of next year. The Fed's preferred measure of inflation, Core PCE, will influence whether the expected timing of the Fed's first hike is pulled forward or pushed back.

The consensus expectation is for core PCE to increase by 0.2% in October, which would see the annual rate ease to 3.5% from 3.7%, the lowest rate since April 2021. Headline PCE is expected to rise by 0.1% in October, with the annual rate moderating to 3.1% from 3.4%.

Headline PCE inflation chart

-

CN

NBS Manufacturing PMI

Date: Thursday, 30 November at 12.30 pm AEDT

Caixin manufacturing PMI

Friday, 1 December at 12.45 pm AEDT

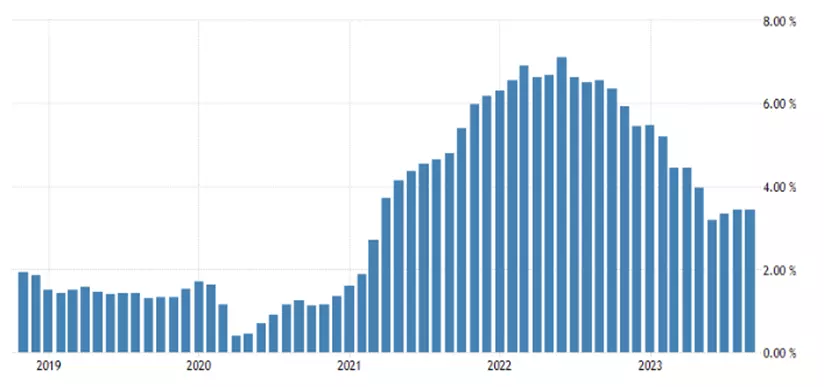

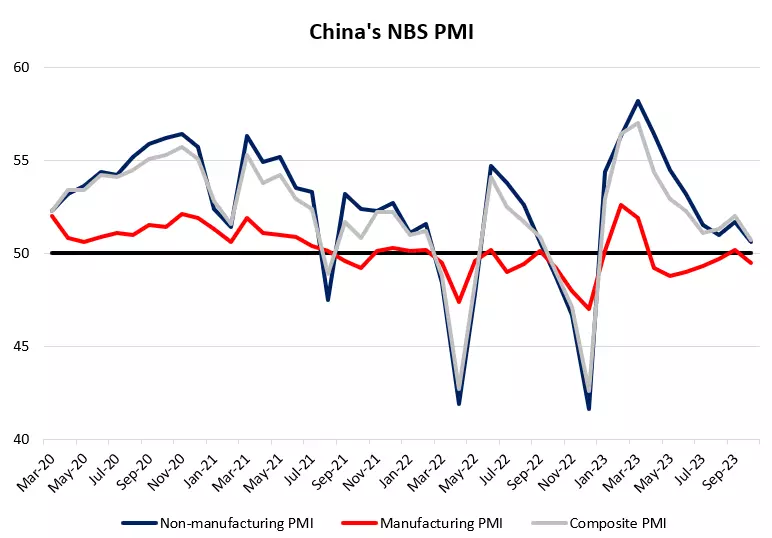

The recovery in China’s economic conditions remains uneven, with its October manufacturing PMI dipping back into contractionary territory after a short-lived expansion (49.5 versus 50.2 in September). Services sector activities have turned in its slowest growth this year as well (50.6 versus 51.7 in September), overall highlighting the challenges that authorities continue to face in stimulating the economy.

Ahead, expectations are for China’s manufacturing PMI to improve slightly to 50.0 from the previous 49.5, while non-manufacturing PMI is expected to improve to 51.5 from the previous 50.6. Still-weak data may see authorities laying more options of policy support on the table, while markets continue to seek conviction for a sustained recovery in the world’s second-largest economy.

China's NBS PMI chart

Economics calendar

All times shown in AEDT (UTC+10).

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.