Where next for BrainChip shares?

Losses rose in full-year results, but BrainChip shares have still nearly doubled in 2024 thus far.

BrainChip (ASX: BRN) shares remain one of the more volatile stocks on the ASX. The company was changing hands for as much as $1.76 in January 2022 during pandemic-era trading, but has since fallen to $0.36 today.

For perspective, it is remains up by 788% over the past five years, down by 23% over the past year, and up by 97% year-to-date. Where next?

BrainChip share price: full-year results

In what BrainChip described a ‘transformational year as the Company focused on delivery and marketing of Akida 2.0,’ the group made a net loss after tax for the year ended 31 December 2023 of US$28.9 million. This reflected lower revenue as its focus moved to the development and marketing of Akida 2.0, alongside a small increase in operating expenses.

For context, the company lost only US$22.1 million in FY22. At the end of 2023, the company had consolidated net assets of US$16.3 million, including cash and equivalents of US$14.3 million, down from US$23.2 million in 2022.

Operationally, BrainChip spent 2023 refining and executing its commercial strategy — this included expanding the sales & marketing and engineering teams, increasing its pipeline of qualified commercial engagements, and accelerating product development, in addition to building up customer support capabilities.

The ASX tech company noted that significant progress was made, with ‘strong customer engagement, expansion of technology ecosystem partnerships, the release of Akida 2.0 and the silicon-ready reference design for Akida1500, while continuing to strengthen the Company’s patent portfolio.’

CEO Sean Hehir enthused ‘While the bottom-line loss increased year over year, the results reflect the large transformation BrainChip underwent in 2023 as we invested heavily in developing our 2nd Generation Akida technology… These investments are indicative of our continued confidence in the market potential and our detailed plans to capitalize on that opportunity.’

Where next for BrainChip shares?

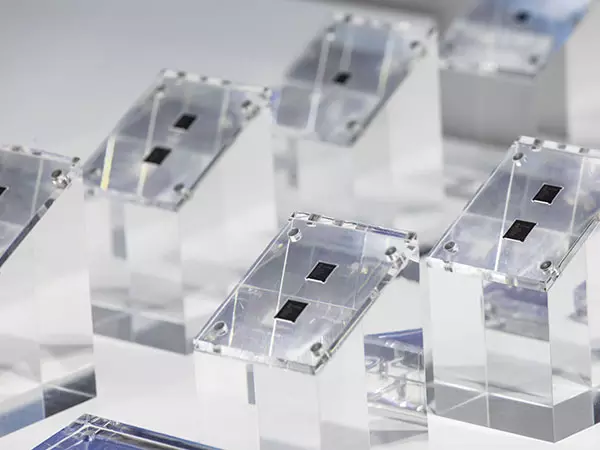

BrainChip describes itself as ‘the worldwide leader in edge AI on-chip processing and learning.’ Its unique selling point is the first-to-market neuromorphic processor, Akida, which mimics the human brain to analyse only essential sensor inputs at the point of acquisition. BrainChip keeps the machine learning local to the chip and independent of the cloud, which has the effect of reducing latency, and improving privacy and data security.

The company exited the ASX 200 index in September — a month later Akida 2.0 became available as IP, but the company did not manage to secure royalty-based IP sales agreements last year.

The business is competing with NASDAQ titans including Nvidia, which recently spent US$10 billion on developing its new Blackwell artificial intelligence chips. The business spent US$8.7 billion on research and development in the past financial year alone, and there may be a perception that BrainChip lacks the financial firepower to effectively rival its larger competitors.

In late March, BrainChip made use of its put option agreement with LDA Capital, whereby LDA Capital will subscribe for up to 40 million shares. It informed investors at the time that available funding under this agreement is worth $50.2 million, with the company committed to drawing down a minimum of $12 million by the end of the calendar year.

Hehir noted that ‘the proceeds raised from the capital call will be used to solidify our go-to-market capabilities by augmenting our machine learning personnel and solution architects who are necessary to support accelerating market adoption of the Akida 2.0 IP offerings.’

While the CEO also noted that the cash would help to ‘ensure we remain the industry leaders in hyper-efficient Edge AI,’ it perhaps signals there will still be some time until significant revenue generation gets underway.

But in an investing landscape where artificial intelligence remains arguably the dominant theme, BrainChip shares could continue their rise in 2024.

Past performance is not an indicator of future returns.

Take your position on over 13,000 local and international shares via CFDs or share trading – all at your fingertips on our award-winning platform.*

Learn more about share CFDs or share trading with us, or open an account to get started today.

* Winner of 'Best Multi-Platform Provider' at ADVFN International Finance Awards 2022

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get commission from just 0.08% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices