AUD/USD's wild ride: central bank decisions stir volatility, key data ahead

Central bank moves sparked AUD/USD volatility, ending the week lower. Upcoming consumer and CPI data may steer its next trend.

Last week's central bank meetings triggered a roller coaster ride for the AUD/USD, closing down 0.70% at .6514.

The main culprits behind the AUD/USD's wild ride last week were:

- The RBA's dovish tilt at its board meeting on Tuesday.

- Thursday's FOMC meeting, which pointed to a shallow Fed easing cycle.

- A surprise rate cut by the Swiss National Bank on Thursday evening.

- Chinese authorities set a weaker-than-expected USD/CNY fix on Friday, which saw the 7.20 level give way for the first time in 2024.

Whether the AUD/USD can find a trend this week will depend on a data-rich local calendar. It starts with the Westpac Consumer Confidence survey on Tuesday; and rolls into the Monthly CPI indicator on Wednesday before culminating in retail sales data for February, which will be released on Thursday.

What is expected from the monthly CPI indicator (Wednesday, 27 March at 11.30am)

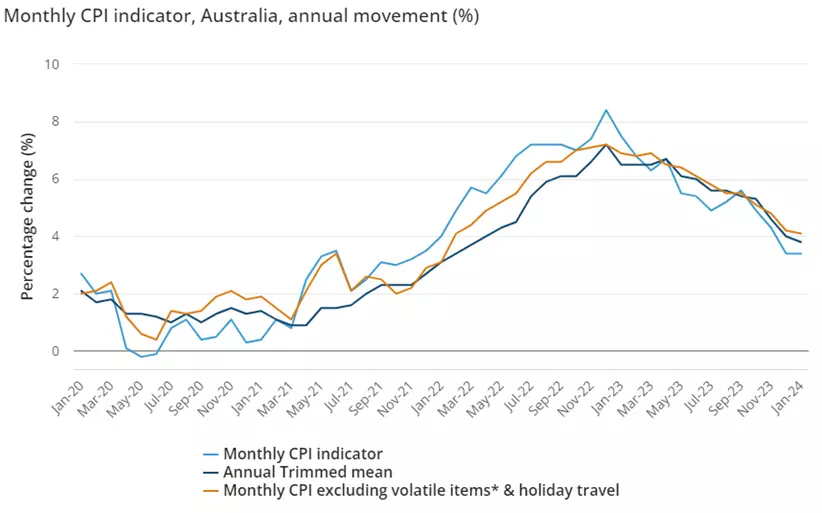

In January, the monthly CPI indicator rose by 3.4% YoY, unchanged from December and below market forecasts of 3.6%. Core inflation, which excludes volatile items, rose by 4.1% YoY easing from 4.2% in December. Annual trimmed mean inflation fell to 3.8% from 4% in December.

The data showed inflation inching towards the RBA's target, but January's CPI, marking the new quarter's start, primarily reflected goods prices, with fewer services costs included.Sticky services inflation has been a key concern and focus for central banks and was highlighted again at this week's RBA board meeting.

"The headline monthly CPI indicator was steady at 3.4 per cent over the year to January, with momentum easing over recent months, driven by moderating goods inflation. Services inflation remains elevated, and is moderating at a more gradual pace," the board said

In February, the monthly CPI indicator is expected to increase to 3.6% YoY due to higher petrol and housing prices; and the unwinding of electricity rebates. This is in line with the RBA's expectations of 3.5% year over year over the quarter.

CPI monthly indicator chart

AUD/USD technical analysis

As viewed on the weekly chart below, the AUD/USD continues its choppy sideways price action within a contracting multi month bearish triangle. Downtrend resistance from the January 2023 .7158 high is at .6795c, and uptrend support from the October 2022 .6170 low is at .6320c. The middle of that range, where the price action would be expected to be most choppy, is at .6557, 20 pips above the current price.

AUD/USD weekly chart

On the daily chart below, the AUD/USD reversed sharply lower from Thursday's .6634 high before testing uptrend support at .6500c, from the October 2023 .6270 low.

For the week ahead, traders will be watching for a break of support at .6500c as an initial indication that the AUD/USD is set to test the year-to-date low of .6442 before a move towards .6320.

On the upside, the 200-day moving average at .6553 will provide short-term resistance, with a sustained break above here needed to open up a move towards the next layer of resistance at .6625/35.

AUD/USD daily chart

- Source:TradingView. The figures stated are as of 25 March 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices