EUR/USD, GBP/USD try to stabilize amid heightened Middle East tensions while EUR/GBP pauses

Outlook on EUR/USD, EUR/GBP and GBP/USD amid the ongoing Israel/Hamas crisis.

EUR/USD tries to hold amid heightened Middle East tensions

Last week’s EUR/USD rejection by the upper July-to-October downtrend channel resistance line at $1.0639 has been followed by a swift sell-off as US consumer price index (CPI) inflation came in slightly higher-than-expected and heightened Middle East tensions led to safe haven flows into the US dollar.

Below Friday’s low at $1.0496 lies the key $1.0484 to $1.0444 support zone, made up of the mid-November high, 7 December and 6 January lows. Provided it holds, the pair may still bottom out from a medium-term perspective.

Minor resistance sits at Friday’s $1.0558 high and further up at the previous Friday’s high at $1.06 and then the late September high at $1.0617. Further resistance sits at the May low and mid-September low as well as this week’s high at $1.0632 to $1.0639. Only a rise and daily chart close above these levels would confirm a bottoming formation.

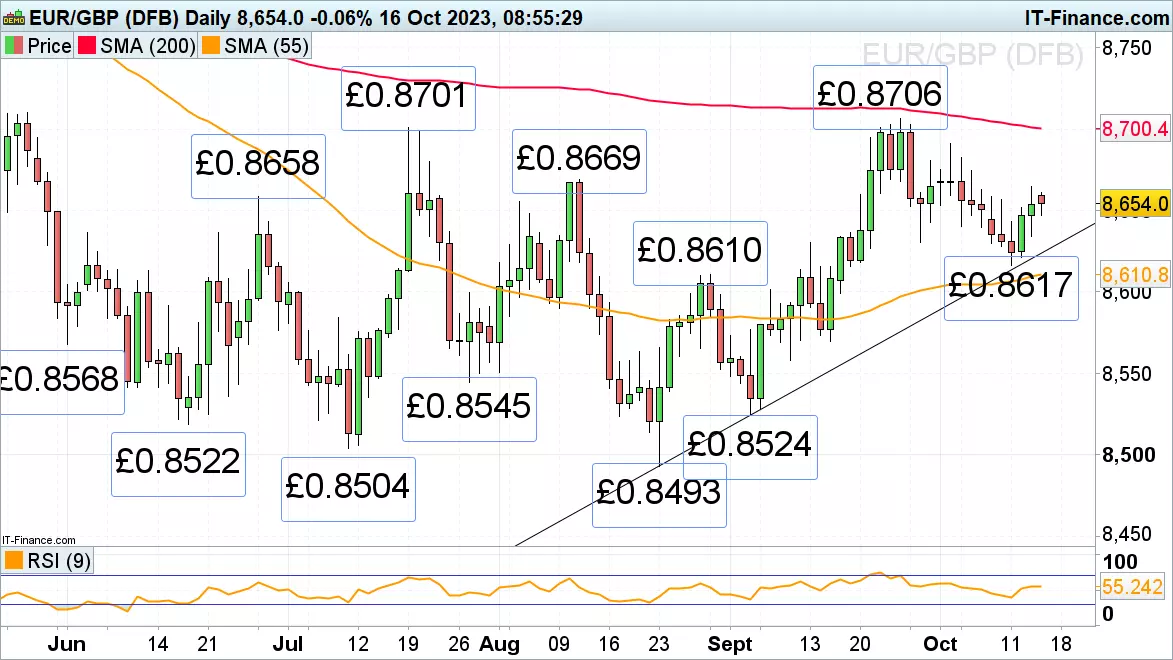

EUR/GBP recovers from last Friday’s £0.8617 low

EUR/GBP’s descent from its £0.8706 September high has taken it to last week’s £0.8617 low from where the cross is currently recovering ahead of Wednesday’s UK inflation data.

Good support now sits between the late August high, late September low and last week’s low at £0.8631 to £0.861 while minor resistance comes in at last week’s high at £0.8664. Above it sit the late June and mid-August highs at £0.8658 to £0.8669 which are likely to cap, if reached.

GBP/USD tries to stabilize following last week’s sharp sell-off

GBP/USD’s rise from its early October seven-month low at $1.2038, for six straight days to last week’s $1.2337 high was followed by a sharp sell-off as the Israel/Hamas war led to flight-to-safety flows into the greenback.

A drop through Friday’s low at $1.2123 and the next lower $1.2106 previous Friday low could lead to the early October low at $1.2038 and the psychological $1.20 mark being revisited.

While Friday’s low at $1.2123 underpins, though, Friday’s high at $1.2225 may be retested. If overcome, the late September high at $1.2271 would be back in the frame.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices