IG: a strong heritage, a bright future

For over 45 years we’ve been at the forefront of innovation in trading, with our award-winning technology offering both high-speed execution and unparalleled access to liquidity. Our clients trust our status as a FTSE 250 company, our £3.2 billion market cap,1 and our exceptional balance sheet strength.

IG: a strong heritage, a bright future

For over 45 years we’ve been at the forefront of innovation in trading, with our award-winning technology offering both high-speed execution and unparalleled access to liquidity. Our clients trust our status as a FTSE 250 company, our £3.2 billion market cap,1 and our exceptional balance sheet strength.

IG: a strong heritage, a bright future

For over 45 years we’ve been at the forefront of innovation in trading, with our award-winning technology offering both high-speed execution and unparalleled access to liquidity. Our clients trust our status as a FTSE 250 company, our £3.2 billion market cap,1 and our exceptional balance sheet strength.

An innovative market leader

Over 45 years of trading expertise

Founded in London in 1974, we began by offering investors a new way to trade on the price of gold. Since then we’ve grown into a respected market leader, with cutting-edge technology and global connections that helped us to become the first choice for ambitious and sophisticated traders.

Serving institutional clients since 2006

In 2006 we expanded our range of innovative trading products to launch prime institutional services. We’ve been delivering tailored solutions for new and established hedge funds, family offices and private investment vehicles, banks and brokers, asset managers and introducing brokers ever since.

A global leader in online trading

Over the years we’ve developed a range of award-winning platforms for professional and retail use, as well as offering access to our formidable back-end via APIs. Today we’re the world’s No.1 retail CFD provider,2 giving clients both DMA and OTC access to over 17,000 markets.

Strong and reliable

Well-capitalised balance sheet

We’ve grown steadily since our inception. We’re now an established member of the FTSE 250, with a market cap of £3.2 billion, revenue of £853.4 million and net own funds of £422.8 million.3

Tier 1 partnerships

Our strong relationships with global Tier 1 banks enables us to deliver a range of solutions to our clients – including execution, custody and real-time reporting.

Cutting-edge platforms

Engineered for speed, stability and resilience, our trading platforms are capable of processing 15 million trades per month, with 100% uptime.4

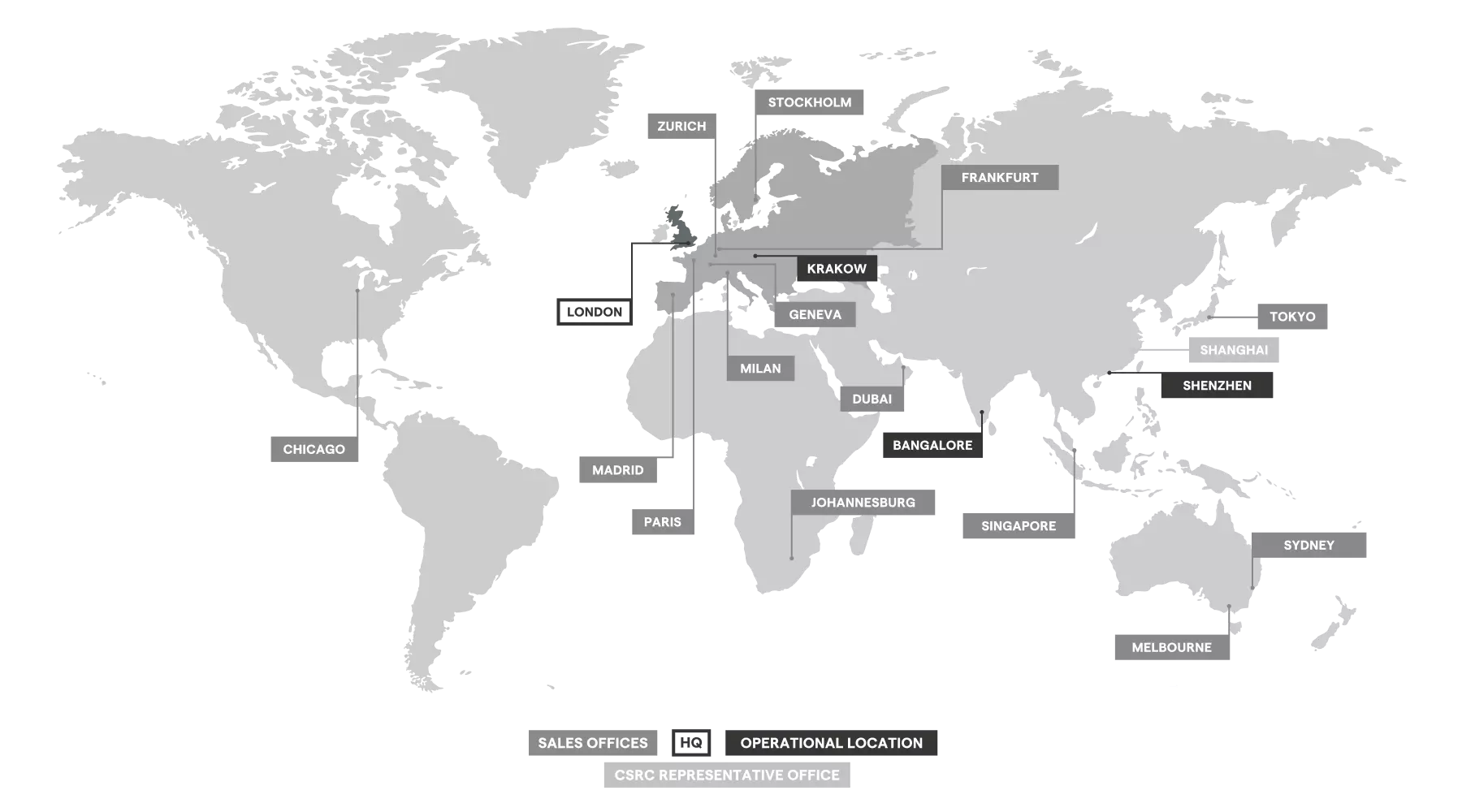

Global presence

313,300 active clients worldwide

2000 employees in 20 countries

Regulated by the FCA, FINMA, BaFin, ASIC, MAS and others

Contact us

Let us create a solution tailored for your needs. Get in touch with our team by phone or email to discuss your objectives, or request a brochure.

1 Based on the share price at 28 May 2021.

2 Based on revenue excluding FX (published half-yearly financial statements, June 2019).

3 Annual report, August 2021.

4 Average for FY 2021.

Tel: +27 (0)11 0610 183

Email: prime.za@ig.com