What is spot oil and how do you trade it?

Oil is a very volatile commodity, especially in times of economic and political instability. You can trade spot oil whether the price goes up or down. Discover what spot oil is and how you can trade it with us using our award-winning platform.1

What’s on this page?

What is oil spot trading?

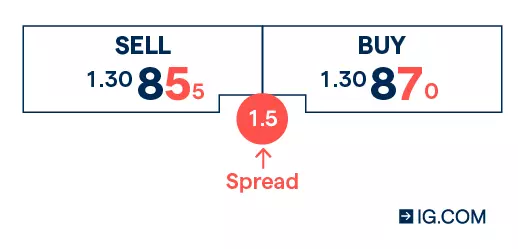

Oil spot trading is a technique used to buy and sell underlying oil assets at the current market level, called the spot price. Spot trading doesn’t have fixed expiry dates and tend to have lower spreads, making it popular among day traders.

With us, you can trade the oil spot market, also known as the cash or undated market, through derivative products like spread bets and CFDs. This means that you don’t have to own the spot oil outright or take delivery of it, instead you can trade exclusively on its price movements.

For example, let’s assume you’ve got a spread betting account with us and you decide to trade spot Brent crude oil since you expect it to rise beyond the current market price of 115.00 per barrel over the next few days. You log into the platform and see that the buy price is 115.20 and the sell price is 114.80.

You could open a spread bet to buy the market at £10 per point of movement. Note that every point of movement in the underlying market is now worth £10 to you, meaning if the spot oil price rises by 20 points to 135.20, you’d make a £200 (£10 x 20 points) in profit.

However, if the spot oil price falls by 10 points to 105.20, you’d make a loss of £100 (£10 x 10 points).

On the other hand, if you had reason to believe the spot oil market would fall, you could opt to open a spread bet to sell the market. If the price of the oil spot market were to fall by 12 points from 114.80 to 102.80, then you’d make a profit of £120 (£10 x 12 points). If the price rose by 8 points to 122.80 instead, you’d make a loss of £80 (£10 x 8 points).

Note that derivatives trading is high risk, and you should understand how they work and manage your risk carefully before opening a position.

Access real-time pricing

When trading oil on the spot, you’ll access prices which reflect the current market in real-time. The spot price is unlike the oil futures market, which specifies a price and date for a future transaction.

Get tight spreads

Oil spot spreads are tighter than those of futures, making them ideal for opening short-term positions. Note that overnight funding fees will apply if your position is open past 10pm (UK time).

With us, your account will have its interest adjusted to reflect the cost of funding your position. If you want to avoid paying overnight funding, you might want to consider opening longer-term positions such as trading futures or options.

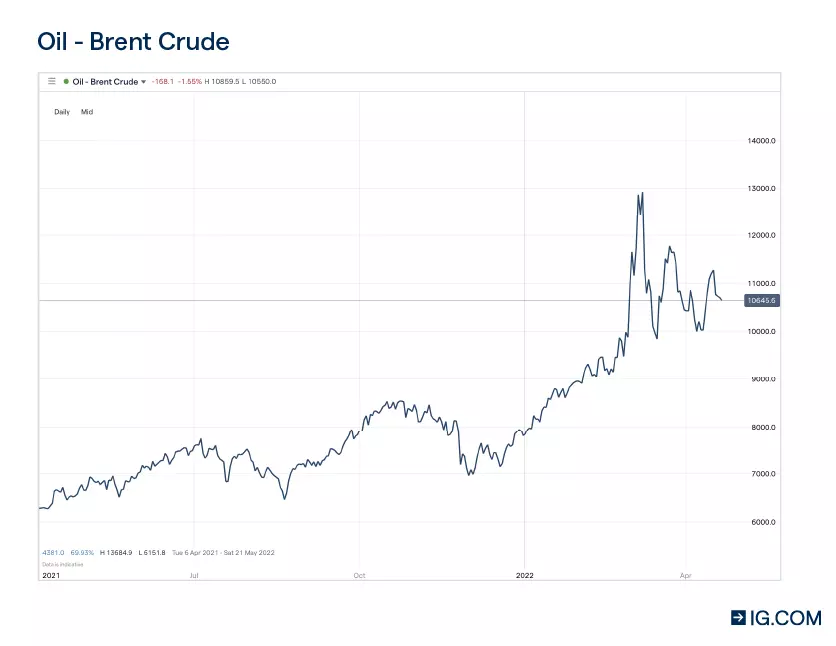

Benefit from continuous charting

When trading spot oil, you can benefit from using continuous charts that not only track the current rise and fall of the market, but the historic price movement as well. This is different to the futures charts, which only track the price movement of the oil market over its lifetime until it reaches expiry.

You can conduct an in-depth market analysis when trading spot oil. It’s essential to carry out both fundamental and technical analysis before opening your spot oil position.

Through the use of fundamental analysis you can make an assessment of the spot oil market based on macroeconomic indicators and market forecasts. On the other hand, technical analysis will make use of oil spot chart patterns, technical indicators and its historical price movement.

Trade with leverage

With us, you can trade spread bets and CFDs, which are leveraged products. This means you’ll only be required to commit an initial deposit or margin to open a position that’ll give you increased exposure to the spot oil price market.

Remember that when trading with leverage, your profit or loss is calculated based on the entire size of your position, not just margin. This means that while leverage can magnify your profits, it’ll amplify your losses. It’s important to manage your risk carefully.

Before trading leveraged products, ensure you understand how they work. Also give some consideration as to whether you can afford to risk losing your money.

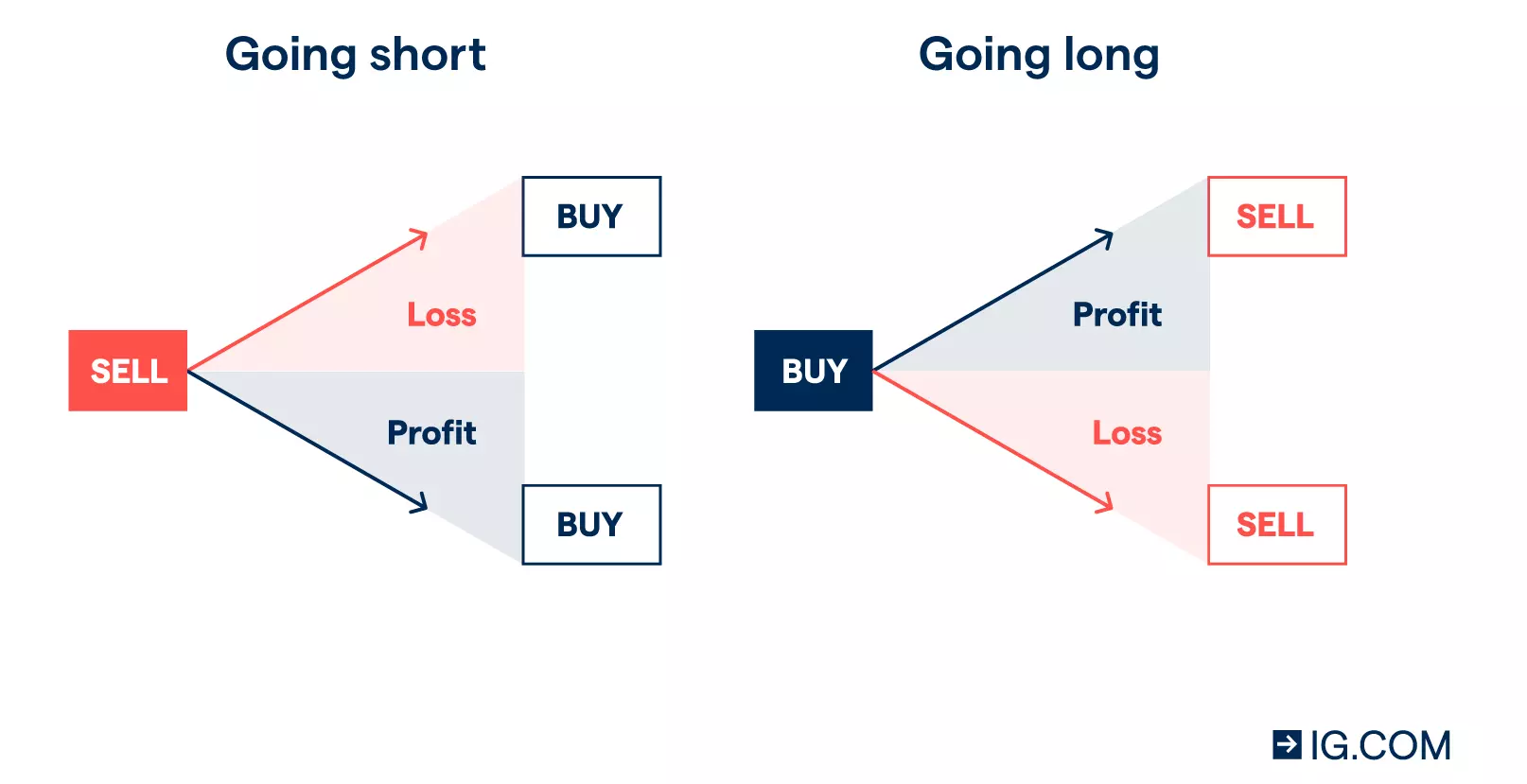

Go long or short

When trading the oil spot price, you have the option to either go long (‘buy’) or short (‘sell’). You’ll go long if you believe that the spot oil market price will rise and go short if you think it’ll fall.

With us, the profit and loss made on spot oil spread bets and CFDs are calculated based on the accuracy of your prediction and the overall size of the market movement.

Speculate on Brent crude or WTI (US crude)

When you trade spot oil prices, you have the choice to do so from two dominant markets – Brent crude and West Texas Intermediary (WTI) known as US crude. Brent crude is manufactured in the European North Sea oil fields, while WTI is mined in North America.

Brent crude is used to set the international standard when trading oil contracts, futures and derivatives, while WTI is the benchmark in Northern America. The spot oil price differences or ‘quality spread’ occurs because of this underlying asset’s varying properties.

Both Brent and US crude oil are light and sweet, which makes them easier for petrol producers to refine and process. With us, you can also trade Heating Oil, London Gas Oil, Natural Gas and Gasoline.

Make sure the spot market is how you want to trade oil

In addition to trading spot oil markets, you can also trade oil futures and oil options

| Oil futures | Oil options | Oil spot price | |

| How it’s priced | Based on listed exchange price | Based on listed exchange price | ‘On the spot’ or current value of oil, with continuous, real-time pricing |

| Ways of trading | Spread betting or CFD trading | Spread betting or CFD trading | Spread betting or CFD trading |

| Can I short oil? | Yes | Yes | Yes |

| Can I speculate on negative oil prices? | Yes | Yes | Yes |

| Commodities energies markets | US crude, Heating oil, No Lead Gasoline, Natural gas, Carbon emissions | US crude, Brent crude, Heating oil, No Lead Gasoline, Natural gas, Carbon emissions | US crude, Brent crude, Heating oil, No Lead Gasoline, Natural gas, Carbon emissions |

| Costs and charges | Larger spread but no overnight funding charges | Higher premium but no overnight funding charges | Narrower spread but with overnight funding charges |

| Risk to capital | You could lose more than your deposit (margin) | Limited to premium if you buy put or call, could lose more than premium if you sell | You could lose more than your deposit (margin) |

| Expiry | Yes | Yes | No |

| Will I pay tax? | Spread betting is completely tax-free, while CFD trading is free from stamp duty2 | Spread betting is completely tax-free, while CFD trading is free from stamp duty2 | Spread betting is completely tax-free, while CFD trading is free from stamp duty2 |

Understand how oil futures trading works

With us, you can use spread bets and CFDs to trade on spot oil price movements. Note that CFDs are traded with the contract’s value set at a specified number of pounds (£) per point or ‘tick’ of the spot oil price.

With spread bets, on the other hand, you have more control because you can set your own number of pounds per ‘tick’. Note that some CFDs are quoted in pounds, while others for oil are in US dollars.

Create your account and log in

You can trade spot oil through spread bets and CFDs. These derivative products can be used to speculate on the rise and fall of the spot oil price. You can choose whether to open a spread betting account, CFD trading account, or both.

With us, you can open both accounts separately, since the way they work differs. If you opt to open both, our award-winning platform will enable you to switch between the two accounts easily.1

You can open a demo account to familiarise yourself with trading spot oil. You’ll get £10,000 in virtual funds to practise your trades in a risk-free environment. When you feel ready to take on the live markets, you can open a live account. You’re not obligated to fund your live account or trade from it unless you’re ready.

Pick your spot oil market

When picking your spot oil market, you’ve the flexibility to choose which you’d like to trade. With us, you can choose to trade Brent crude, US crude (WTI), Heating Oil or London Gas Oil.

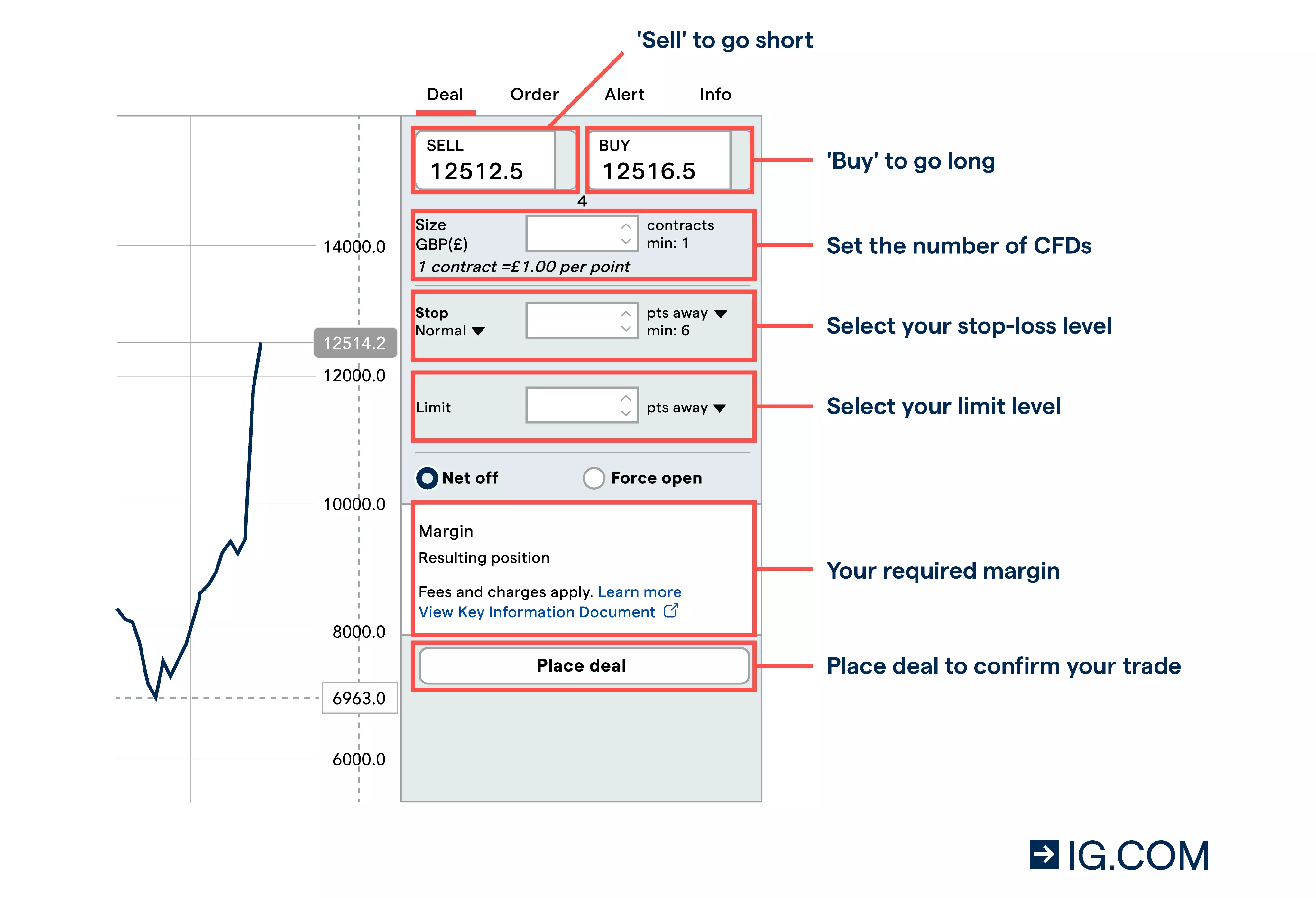

Set your position size and manage your risk

Once you’re ready to take your position, go long by clicking ‘buy’ or go short by ticking ‘sell’. Then you can set your position size. Manage your risk by selecting your limit and stop-loss levels in the deal ticket. With us, there are several risk management tools at your disposal such as a normal stop-loss as well as guaranteed and trailing stops.

By selecting a normal stop-loss, you’re giving our platform an instruction to close your position when it reaches a price less favourable than the price at which you opened your position. Note that if slippage occurs, your order won’t be carried out at the specified price.

Guaranteed stops are implemented at the exact price you specify. These stops are similar to basic stops, they differ in that they’ll always be completed at your set level whether rapid price movements or gapping occur.

Trailing stops are set to adapt to market movements automatically by following your position. It works by locking in your gains when the market moves in your favour and by shutting your position if it moves against you.

Place your spot oil trade

Once you’re content with the spot oil size you’d like to trade and your risk management orders, open your trade by clicking on ‘place deal’. You can follow this step by monitoring your position.

Try these next

Discover everything you need to know about trading oil futures

Discover everything you need to know about commodity trading

Learn how get exposure to gold, step by step

1 Best trading platform as awarded at the ADVFN International Financial Awards 2021 and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2021.

2 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.