S&P 500 Momentum Report

Following three straight weeks of losses in Wall Street, early performance into the new week suggests that dip-buyers are trying to avoid a fourth.

Risk sentiments remain on tenterhooks ahead of big tech earnings

Following three straight weeks of losses in Wall Street, early performance into the new week suggests that dip-buyers are trying to avoid a fourth, but much will still revolve around a series of big tech earning releases lined up ahead. Notably, last week has presented some rotation from growth sectors into laggard sectors, creating a divergence between the DJIA and Nasdaq, with one to watch if the divergence can continue to play out this week.

Geopolitical tensions are taking more of a backseat, given Iran’s tamed response to Israel’s retaliation. That places corporate earnings in the spotlight, alongside Federal Reserve (Fed)’s policy outlook with the release of the US core personal consumption expenditures (PCE) data this week, which is the Fed’s preferred inflation gauge.

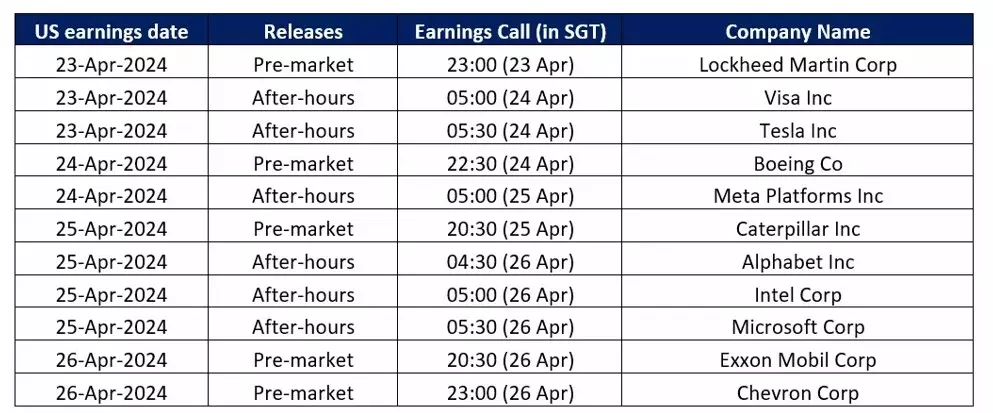

What to watch: Busy week of big tech earnings

Several tech behemoths (Tesla, Meta, Alphabet, Microsoft) will be releasing their results this week, with eyes on whether the artificial intelligence (AI) tailwind can continue to drive a more positive outlook and whether earnings can still hold up amid current economic conditions. The recent retracement in Wall Street has helped to bring the broader tech valuation down, but earnings expectations remain high, with companies expected to deliver on all fronts. Netflix has provided an early glimpse of market sentiments, with a 9% sell-off following a weaker revenue forecast.

Source: Refinitiv

S&P 500 technical analysis: Back to retest its key psychological 5,000 level

The S&P 500 has broken below a rising channel pattern in place since the start of the year, with the index retracing more than 6% from its April 2024 peak to retest its key psychological 5,000 level. Oversold technical conditions may raise the odds of a near-term bounce, alongside a slew of big tech earning releases which has the tendency to surprise on the upside.

That said, the broader downward bias remains intact for now, which may leave market participants to watch for any signs of weakness in rallies to sell the rip. Any dip below last Friday’s low may pave the way for a wider retracement towards the 4,830 level, where a 38.2% Fibonacci retracement level stands.

Source: IG charts

Nasdaq 100 technical analysis: Attempt to stabilise from near-term oversold conditions

The Nasdaq 100 index has retraced more than 7% from its March 2024 peak, breaking below an upward trendline support in place since the start of the year. While there has been some attempt for technical conditions to moderate from oversold conditions, the near-term downward trend may leave the formation of any lower high on watch, with eyes at the 17,400 immediate resistance level.

For now, sellers remain in broad control, with its daily relative strength index (RSI) touching to its lowest level this year, while its daily moving average convergence/divergence (MACD) dips into negative territory for the first time since November 2023. Any move below last Friday’s low could reinforce the downward bias and may leave its year-to-date low at the 16,300 level on watch next.

Source: IG charts

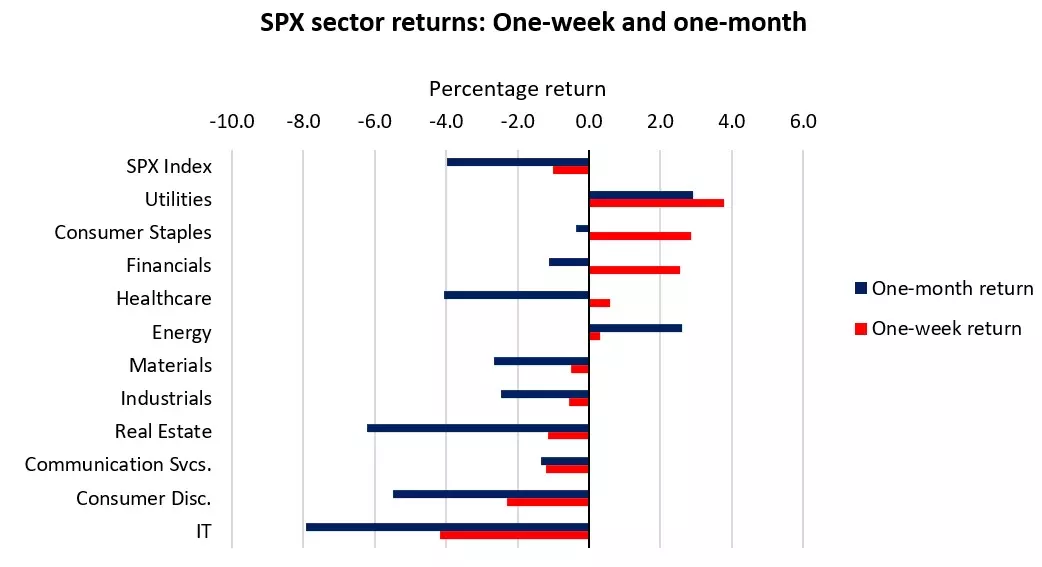

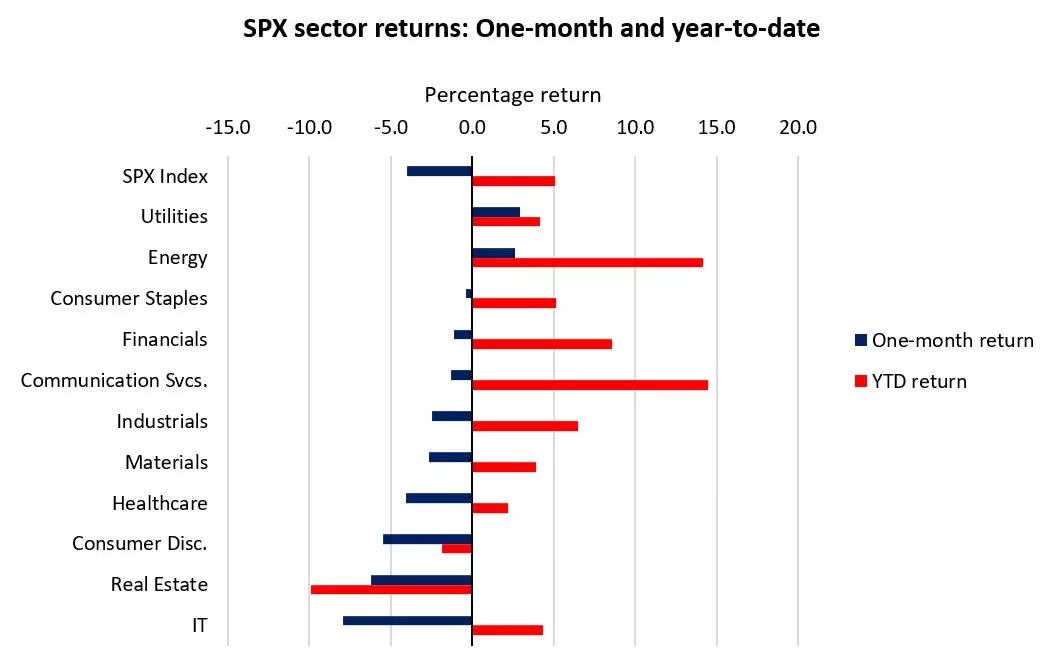

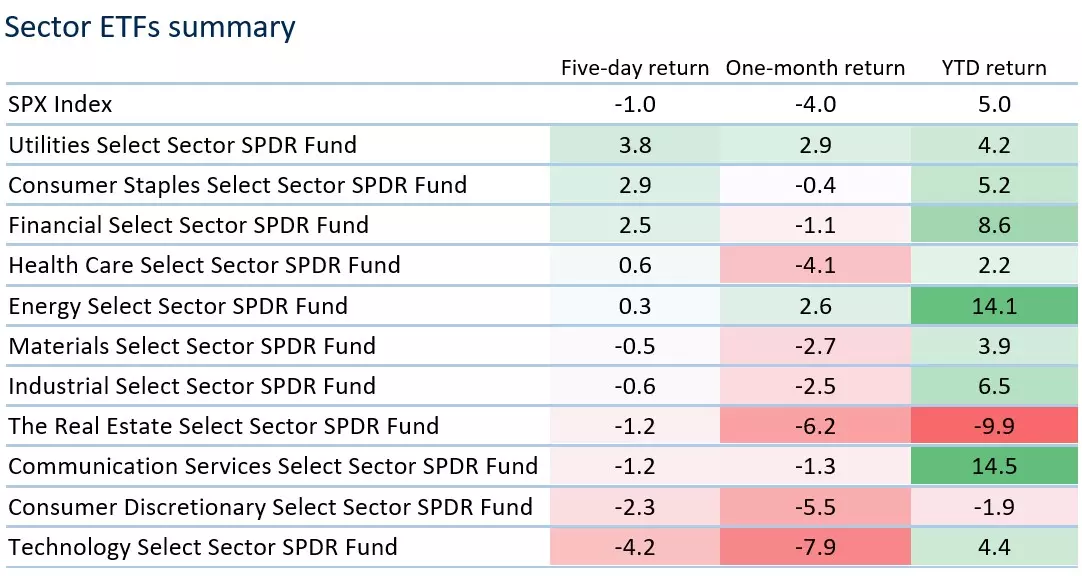

Sector performance

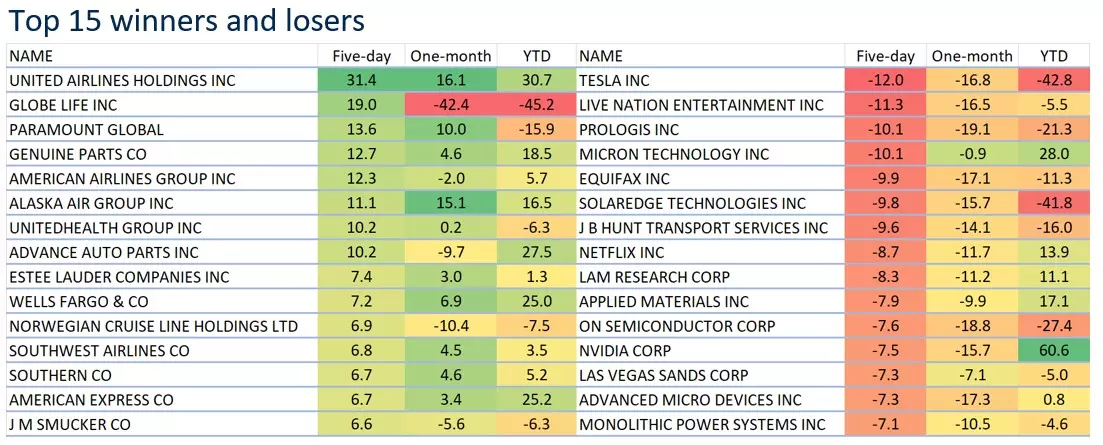

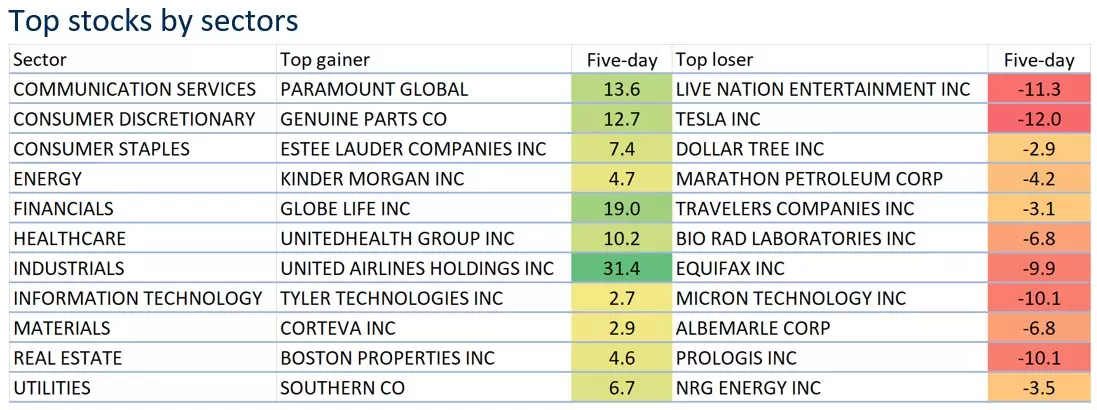

Market participants had a clear lean on the defensive last week, with outperformance in the utilities (+3.8%), healthcare (+0.6%) and consumer staples (+2.9%) sectors, while laggard sectors like financials (+2.5%) were finding some renewed traction as well. On the other hand, this marked a rotation away from growth sectors, particularly in the ‘Magnificent Seven’ stocks, which all closed the week in the red (other than Alphabet). Nvidia was down 7.5%, Tesla was down 12.0%, while Amazon, Microsoft, Apple and Meta were all down more than 3%. Higher Treasury yields could be the driver as rate-cuts expectations are scaled back, while market participants also took the chance to de-risk ahead of key tech earnings releases, in which a high hurdle for outperformance may lead to some unease.

Source: Refinitiv

Source: Refinitiv

Source: Refinitiv

*Note: The data is from 16th – 22th April 2024.

Source: Refinitiv

*Note: The data is from 16th – 22th April 2024.

Source: Refinitiv

*Note: The data is from 16th – 22th April 2024.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.