The Dow Industrials drops GE. Jeremy Naylor looks at the fall in GE stock

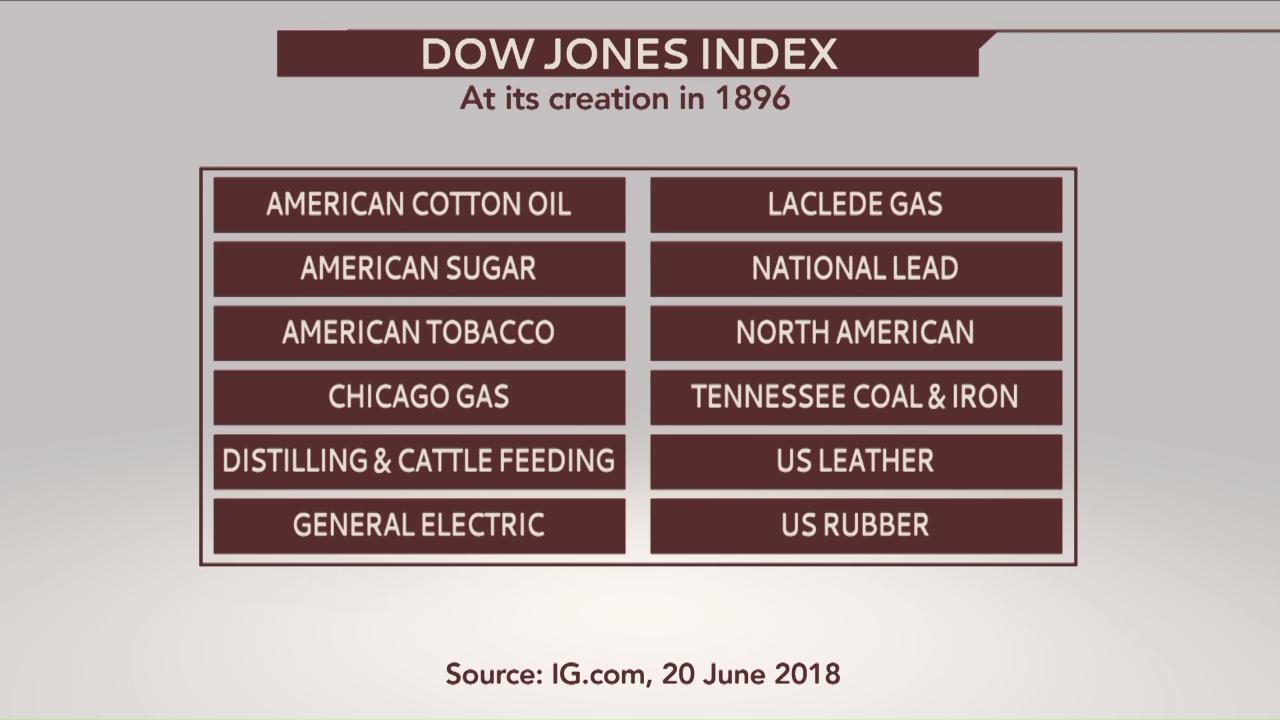

Apart from General Electric (GE), the list includes few names (if any) that will be recognised by many in the markets today. Some, such as American Tobacco, have ended up as part of other companies. Others, such as Laclede Gas, still operate but do so as local companies that have been taken off the market.

But this index was more than just a way to group together of some of the biggest US companies that were around at the time. It was to form the central pillar of modern technical analysis.

In his book, ‘Technical Analysis of the Financial Markets’, author John J Murphy says that ‘much of what we call technical analysis today has its origins in theories first proposed by (Charles) Dow around the turn of the century’.

Dow theory is generally regarded as having six tenets that are sub-divided:

- The markets discount everything: the price of a security represents all known knowledge of the past, the present and the future

- Markets have three trends: primary (the main establishing trend), secondary, or intermediate (a corrective phase) and minor (a market move that is relatively short in duration compared to the previous two)

- Trends have three phases: accumulation (the phase that represents professional investors), public participation (when most trend traders place positions) and distribution (when everyone appears to be talking about the move)

- Averages must confirm each other: this references the point at which the Dow Jones Index became Dow Industrials, Dow Utilities and Dow Transportation indices. When all three of these indices were moving together, the trend was confirmed.

- Volume must confirm the trend: as a secondary indicator, Dow said that the volume of trades should expand when a trend is underway

- A trend is in place until a signal is given that it has reversed: perhaps the most subjective of the six tenets. There is little consensus amongst Dow theorists on when a trend pauses and when it begins to reverse, until it becomes obvious.

This last part of Dow theory highlighted the need for statisticians to come up with other tools to establish when a trend is broken: the use of moving averages, stochastics, convergence and divergence signals, significant retracement levels, and more.

But with the demotion of GE from the Dow Jones Industrial Average, so leaves the last of the companies once part of the grouping of stocks that was to change the way the entire world looked at the markets. That link, albeit a sentimental one, has now gone.

.jpg)