Share dealing: charges and fees

Pay zero commission on US share trades and just £3 on UK share trades when you trade three or more times a month.1

Call 0800 195 3100 or send us an email newaccounts.uk@ig.com with any questions about opening an account between 8am and 6pm (UK time) on weekdays.

Contact us 0800 195 3100

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Call 0800 409 6789 or email helpdesk.uk@ig.com if you have any questions about investing. We're available 24/7 between 8am Saturday and 10pm Friday.

Contact us 0800 409 6789

Call 0800 195 3100 or send us an email newaccounts.uk@ig.com with any questions about opening an account between 8am and 6pm (UK time) on weekdays.

Contact us 0800 195 3100

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Call 0800 409 6789 or email helpdesk.uk@ig.com if you have any questions about investing. We're available 24/7 between 8am Saturday and 10pm Friday.

Contact us 0800 409 6789

Remember: the value of investments can go up or down. You could get back less than you invest.

Why buy and sell shares at IG?

Low dealing costs

Zero commission on US shares, and just £3 on UK shares, with a foreign exchange fee of just 0.5%

Huge choice of investments

Invest in 13,000+ shares, funds and investment trusts

Out-of-hours US share dealing

We are unique in offering clients the opportunity to invest in a number of US shares while the market is closed

Out-of-hours trading involves a number of risks including lower liquidity than during the main market session, higher volatility which can lead to greater losses and wider spreads.

Investing fees

Zero commission on US shares if you place 3 or more trades in the previous calendar month, and just £3 per trade on UK shares.

| Number of trades in previous calendar month2 |

Phone dealing |

||

| 0 - 2 | 3+ | ||

| US shares | £10 | £0 | £50 |

| UK shares | £8 | £3 | £40 |

| European shares3 | 0.1% | 0.1% | £50 |

| Australian shares3 | 0.1% | 0.1% | A$50 |

Note for multi-currency accounts: The trading fees above apply to clients who opt for the default setting of 'instant currency conversion'. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $15 on US stocks. Changing your currency conversion settings influences the amount of commission you pay. Our team reviews these changes on a monthly basis, so it may take some time to update your account. Please be aware that changing from converting on 'instant' to 'manual' means that you'll no longer qualify for commission-free trading.

Foreign exchange

Our foreign exchange fee is very competitive compared to other brokers which is why IG is the platform to use to invest in US stocks. See here for a comparison to other brokers.

When you buy and sell shares in a currency different to your account currency, we will convert currencies at the time of execution based on the best available bid / offer exchange rates, plus our spread of 0.5%.

| Foreign exchange fee | 0.5% |

Custody fee

Our custody fee is a flat fee which means it does not grow as your investments grow, unlike at other brokers. It is also reduced by any trading fees you pay during the quarter.

If you place 3+ trades during the quarter, there is no custody fee to pay.

| Trades per quarter | ||

| 0 | 3+ | |

| Custody fee | £24 | Free |

You are also automatically exempt from the share dealing custody fee if you invest £15,000 in an IG Smart Portfolio account. See more information on our range of expertly managed portfolios here.

Note for custody fee: If a custody fee is due, we’ll debit it from your share dealing account first. If sufficient funds aren’t available, we’ll then deduct from your ISA account. If there is insufficient cash on both accounts, the account with the highest asset value will be taken overdrawn.

Other fees

Transaction |

Fee |

Standard bank transfer |

Free |

Voting on company matters |

Free |

Same-day bank transfer |

More than £100: Free |

International bank transfer |

Free (although there may be a charge from the bank side) |

Physical share certificate dematerialisation |

Each £100 (inclusive of VAT) |

Rematerialisation |

Each £100 (inclusive of VAT) |

Additional services4 |

Each £100 plus VAT |

Deposit fee |

Free if you make a deposit via credit card or PayPal |

Additional notes:

4 Additional services include repair or voiding of an ISA and the following optional services: recertification, arranging AGM attendance and receiving hard copies of company reports.

There may be additional charges and taxes for particular instruments that you trade that are charged by the particular market. Please call us on 0800 028 8550 for further details.

We may charge you a fee if we are required to perform a service on your behalf that is not set out in our product details.

Open an account now

Open an account now

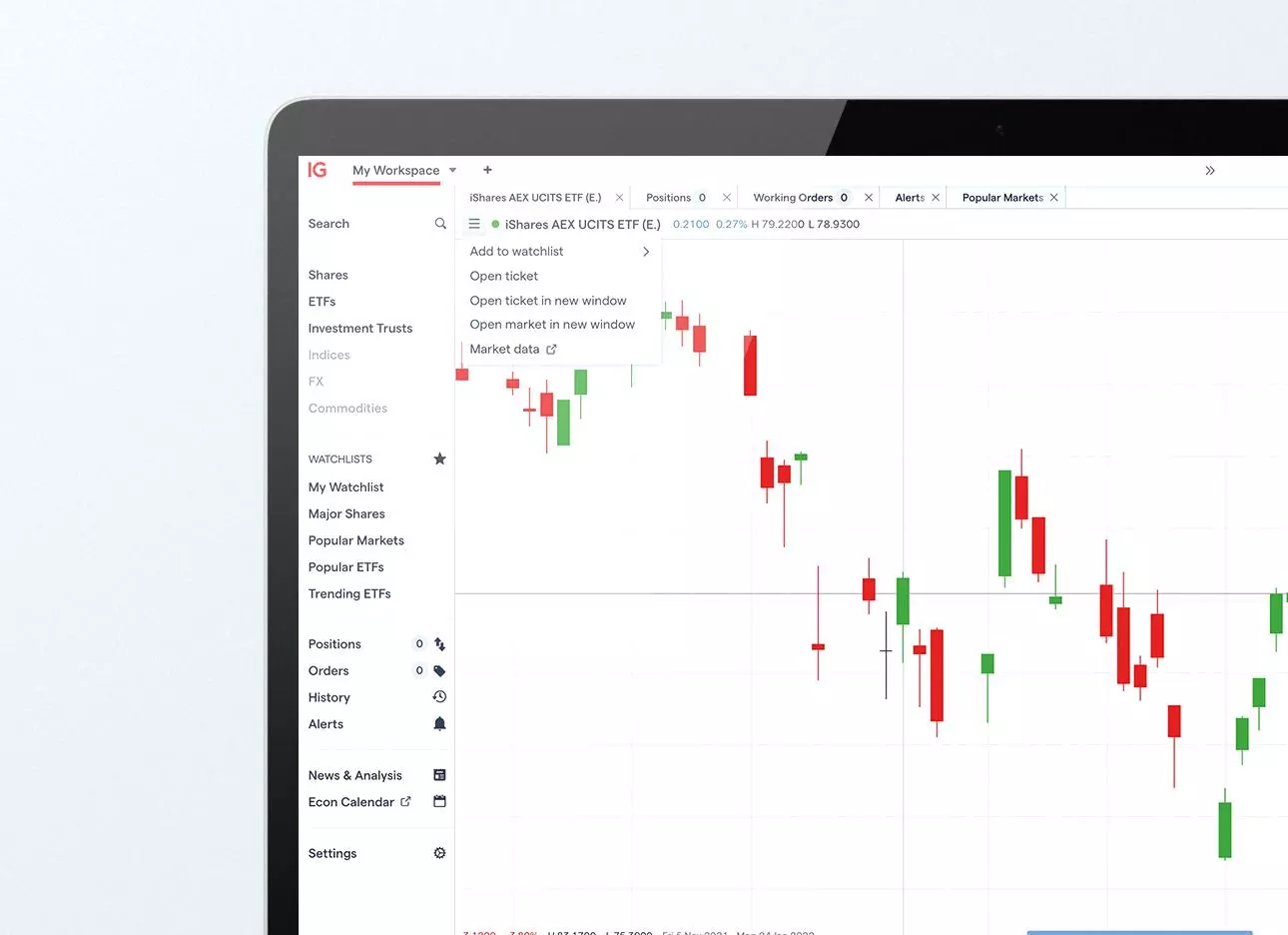

Fast execution on a huge range of markets

Enjoy flexible access to 13,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 47 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 13,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 47 years of experience, we’re proud to offer a truly market-leading service

Additional Information

Click a topic to find out more

We quote more than 16,000 shares from the following stock indices in local denominations.

- UK: FTSE 100, FTSE 250 and many other small cap UK stocks

- US: S&P 500, NASDAQ 100 and many other small cap US stocks

- Germany: DAX, HDAX, MDAX

- Ireland: ISEQ

- Netherlands: AEX

- Belgium: BEL 20

- Austria: ATX, WBI

- Australia: ASX/S&P 300

If you are looking for a specific stock that you can't find on our platform, please call us on 0800 028 8550 to discuss your individual requirements.

See our full share dealing offering

Trading international shares

Buy and sell more than 16,000 international shares with your IG share dealing account.

Prices are offered in local denominations so you know exactly what you're paying, and our fee to convert to your chosen base currency is just 0.5%.

Obtaining live prices from an exchange can incur a monthly fee.

See our full shares list to find your next trade.

PDF (464KB)

Standard margin rate and guaranteed stop premiums

ISA charges and limits are similar to our regular share dealing charges:

- Free set-up, with free transfers for electronic shares1

- Annual allowance of £20,000 for 2023/24

- Commission charges as above

Physical share dematerialisation fee is £100 (inclusive of VAT) per certificate. Electronic shares are transferred free of charge. You may be out of the market for a period while your transfer takes place.

Consolidate your share holdings by transferring any existing stocks to your IG share dealing account, with no charge for electronic shares1:

- Free transfer of UK stocks in / out

- Free transfer of UK stocks and shares ISA in / out

- Free transfer of UK SIPP in / out

See our transfer investments page for more.

1Physical share dematerialisation fee is £100 (inclusive of VAT) per certificate. Electronic shares are transferred free of charge. IG SIPPs are administered by Options Pensions, who charge a £205 annual fee and may charge for transferring investments not currently held in a SIPP. You may be out of the market for a period while your transfer takes place.

For relevant transactions, we will convert currencies at the time of execution based on the best available bid / offer exchange rates, plus our spread of 0.5%.

You may be subject to additional trading fees or taxes depending on the country where the share is listed.

| Description | Charge value. | Direction | Threshold | Transaction history name |

| UK stamp duty reserve tax4 | 0.50% | Buy | n/a | SDRT |

| UK PTM | £1 | Both | £10,000 | PTM levy |

| Ireland stamp duty | 1.00% | Buy | n/a | Irish tax |

| Ireland ITP | €1.25 | Both | €12,500 | ITP Levy |

| US on-exchange fee | 0.00229% | Sell | n/a | Section 31 fee |

4 Non-CREST-eligible and CREST-eligible residual stocks are subject to a minimum stamp duty charge of £5.00, rounded up to the nearest £5.00.

Imagine you’re buying 650 shares of Rio Tinto at £37.25 per share. You’ve traded less than 3 times on your share dealing account, so you don’t qualify for our £3 commission rate. You sell the holding within the same month.

| Description | Costs |

| Market spread | = 0.5p |

| IG commission | = £8 to buy and sell |

| Stamp duty | = 0.5% of trade consideration when buying |

| PTM levy | = £1 when buying and selling |

| Description | Costs |

| Market spread | = 650 x 0.5p = £3.25 |

| IG commission |

= 2 x £8

= £16

|

| Stamp duty |

= 0.5% x 650 x 3725/100

= £121.06

|

| PTM levy |

= 2 x £1

= £2

|

| Total cost | = £142.31 |

Please note that all costs, including commissions, taxes, forex rates and spreads may vary, and are used for indicative purposes only.

Notes to tables

To determine whether a particular charge applies, please call our helpdesk before you trade.

Commission charges are calculated as a flat fee, a percentage of the transaction value or as cents per share for US shares. Where we offer trading on shares that are dual-listed and fully fungible for settlement on both exchanges, the commission charges relevant to the country where the primary listing is held will apply.

We will let you know in writing which commission rates apply at the time you open your account.

Trading hours are as follows:

- UK shares (LSE): 08.00-16.30 (London time)

- US shares: 09.30-16.00 (New York time). US Shares trading under our 'US All Sessions' offering are tradable from 07:00-17:30 (New York Time)

- European shares: Market hours vary depending on the relevant exchange, please call our helpdesk on 0800 028 8550 for details

- Australian shares: 10:00-16:00 (Sydney time)

- Orders may operate differently depending on the third party we send your Order to, in particular in relation to pre- and post-market sessions for US shares. Some US shares may be visible outside of normal market hours but are not currently tradable on our platform. If you would like further details about how Orders work or on the ability to trade US shares outside of normal market hours, please contact one of our dealers

1 Trade in your share dealing account three or more times in the previous month to qualify for our best commission rates. Please note published rates are valid up to £25,000 notional value. See our full list of share dealing charges and fees.

2 Please note that rates are valid up to £25,000 trade consideration. Rates above this trade size are agreed by negotiation. Please call 0207 663 0336.

3 Minimum charge of €10 and A$10 for European and Australian shares, respectively.

4 Additional services include repair or voiding of an ISA and the following optional services: recertification, arranging AGM attendance and receiving hard copies of company reports.