See more forex live prices

News and trade ideas

News and trade ideas

-

Market update: diverging PMI data - US struggles, Europe recovers

Surprising US PMI drops contrast with Europe’s gains in services, pushing EUR/USD higher as markets recalibrate economic outlooks and monetary policy ...

Commodities

-

Ahead of the game: 19 April 2024

Your weekly financial calendar for market insights and key economic indicators.

Indices

-

ASX 200 afternoon report: 23 April 2024

Find out below who have been the shakers and movers in today’s session on the ASX 200.

Forex

-

Market update: diverging PMI data - US struggles, Europe recovers

Surprising US PMI drops contrast with Europe’s gains in services, pushing EUR/USD higher as markets recalibrate economic outlooks and monetary policy ...

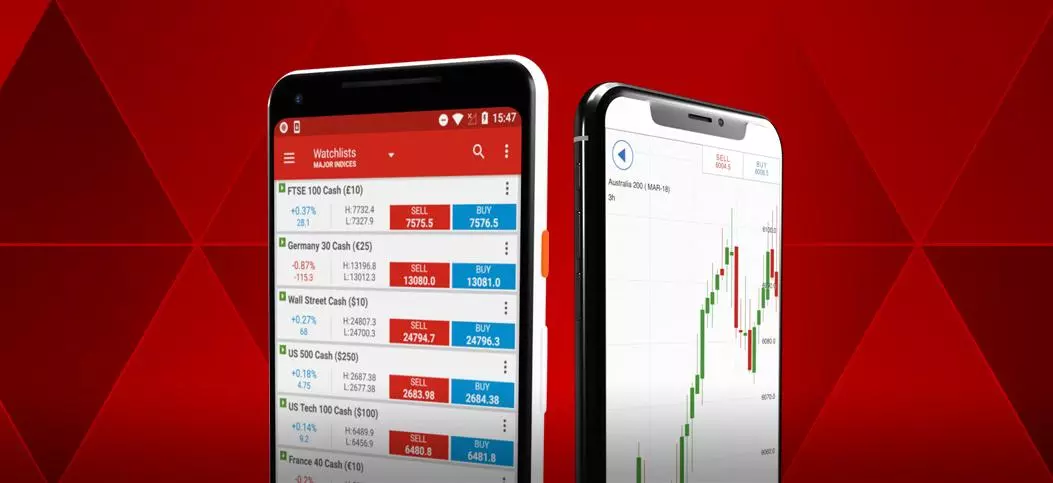

See an opportunity to trade?

Go long or short on more than 17,000+ markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Tweets by @MONTE_IG

Shares

-

Asia Day Ahead: Risk sentiments improve, AUD/USD higher on Australia’s inflation

The weaker US PMI data and a strong auction for two-year Treasuries dragged Treasury yields lower, along with a weaker US dollar, which may bode well ...

bitcoin

-

Demystifying bitcoin: a closer look at cryptocurrency ETFs

Explore how the approval of Bitcoin ETFs by the US SEC opened unprecedented doors for investors and how this pivotal change is set to revolutionise cr...

You might be interested in…

Trade CFDs – decide which of our products is best for you.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs.

Find out what charges your trades could incur with our transparent fee structure.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.