What is short-selling and how does it work?

Short-selling goes against the traditional mantra of buying low and selling high. But it can be a useful tool, helping traders to find opportunity even in falling markets. Find out what short-selling means and how it works.

What is short-selling?

Short-selling, also known as ‘shorting’ or 'going short’, is a trading strategy used to take advantage of markets that are falling in price. The traditional way to short-sell involves selling a borrowed asset in the hope that its price will go down and buying it back later for a profit.

Borrowing the asset comes at a cost, which is normally a small percentage of the asset’s price.

Short-selling can also be done via CFD trading or spread betting. Both are derivatives, which enable you to speculate on the price movements of the underlying asset without taking ownership of it.

Most short-selling takes place on shares, but you can short-sell many other financial markets, including forex, commodities and indices.

Find out how to short-sell different markets

What makes short-selling different is that you would take the position only if you have a negative outlook on the asset’s performance. You most likely believe that there is no potential for price growth, and you think the market is entering a downswing.

If you didn’t, you would take a long position. Then there’s hedging; short-selling can also help you to hedge against potential downward movements in markets you have a long position in. Read on to find out how you can hedge your long positions with short-selling.

How to start shorting

To start shorting using derivatives, follow these simple steps:

- Open an IG trading account: it only takes a few minutes to open an account. You can even do it on your smartphone

- Find an opportunity: we offer various tools including the IG market screener, to help you find what you’re looking for

- Place your trade: when you’re ready to trade, open your first position by selecting the market you want to short and choosing ‘sell’ on the deal ticket

Ready to start short-selling? Open an account with us to get started, or practise shorting strategies in our demo account.

How does short-selling work?

Short-selling works in two different ways, depending on how you want to trade. Traditional short-selling involves borrowing the underlying asset from a trading broker, immediately selling it at the current market price, and then buying it back at a later date to return to the lender. If the market does fall, you can profit from the decline, but if it rises, you’ll have to buy back the asset at a higher price and accept the loss.

An alternative way to short-sell is to speculate on price movements with derivatives such as CFDs and spread bets.

Traditional short-selling comes with a few limitations. For instance, because you don’t own the assets that you are going to trade, you’ll need someone to lend them to you. This means that you could encounter issues like an unborrowable stock – the term for an asset that no one is willing to lend you. The second method – using derivatives products such as CFDs and spread bets – does not require the exchange of an underlying asset.

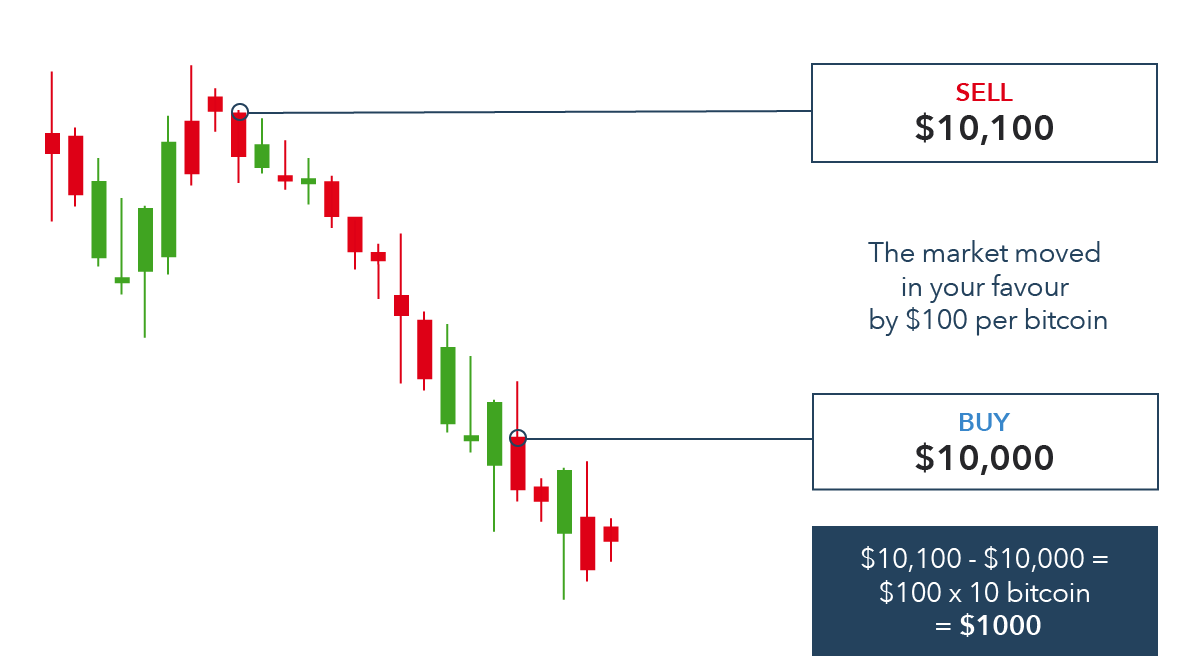

With CFD trading, you are agreeing to exchange the difference in price of your chosen asset from when the position is opened to when it is closed. When you short-sell a CFD, you open a position to ‘sell’ the asset. For example, if Apple shares are trading at $150 a share, and you short-sell 100, you could close your position when the price reaches $145 a share and make a profit of $500 (($150 - $145) x 100).

And with spread betting, you are placing a bet on the direction of the market price (by going short if you think it will fall). You choose a certain currency value per point when you open your position, which will determine your profit. For example, if you go short on Apple shares at $5 per point, you will earn $5 for every point that the stock moves down.

You can practise your trades on a demo account or open a live trading account if you’re ready to take on the markets.

Which markets can I short-sell?

You can short-sell a variety of markets, depending on your interests, knowledge and appetite for risk. Click on the market below to learn more.

Example of short-selling

Suppose Lloyds shares are currently trading with a sell price of 51.600 (51.6p), and you think the price will go down. So, you decide to open a short CFD position on 150 Lloyds share CFDs. A week later, the buy price reaches 49.150 (49.5p) and you close your position. This means you have made £367.50 in profit ([51.600 - 49.150] x 150 = £367.50), excluding additional costs.

If the price rises, you would run a loss. For example, if Lloyds shares rose to a buy price of 54.05, you'd have made a £367.50 loss instead, excluding additional costs.

Why short-sell?

The main benefit of short-selling is that it increases the number of trading opportunities. The two most popular reasons for short-selling are speculation and hedging.

Find out why short-selling is important for efficient markets.

Short-selling to make a profit

Short-selling gives traders a whole new dimension of market movements to speculate on – as traders can make money even if the underlying asset drops in price. If many people are short-selling a specific stock, it could mean that the company is in trouble. On the other hand, short sellers are often blamed for causing or aggravating a downswing to make more profit. Evidence suggests that if companies take defensive measures against short sellers, it is likely that the firm’s returns may be lower than expected.

Short-selling to hedge open positions

Hedging is another way to use short-selling. This is the practice of holding two positions at the same time to offset losses from one position with gains from another. With hedging, traders with a short position can protect against losses on a long position. For example, if the stock is at a risk of a decline, you could use a short derivative position to offset the risk. While hedging your positions may not necessarily prevent a loss, it can lessen the impact.

But short selling also has its disadvantages. There is higher exposure to losses if the asset’s price doesn’t behave as you expect. If an asset’s price increases, your losses could potentially be unlimited. And if this happens, a short squeeze can occur, which means short sellers all try to cover their positions at once – pushing the price of the stock up even further and amplifying losses. This makes it important to have a risk management strategy in place.

Why are short-sellers viewed with suspicion?

Short sellers are often blamed for causing or aggravating a downswing in the market to make more profit. They have been said to deliberately decrease the value of a stock, pressuring other traders to go short, further impacting the share price. However, this is a misconception – as short selling has little or no effect on the share price if it is already dwindling.

A recent example of this is the battle between short sellers and management on Tesla stock (TSLA). Elon Musk, Tesla’s CEO, has frequently criticised short-sellers, labelling them 'value destroyers' and suggesting that short-selling should be made illegal.

Another factor causing short-sellers to be viewed with suspicion is the ban on short-selling during times of economic distress. During the 2007 financial crisis, regulators in the US, UK, Germany and Japan restricted short-selling. They do this when they try to protect falling markets, which leads to short-sellers being perceived in a negative light because their activities are banned.

Why short-selling is important for efficient markets

Short-selling is important for efficient markets because it helps to ensure they are priced correctly through price discovery. This can include forex markets, stock markets, and all other financial markets.

Shorting stocks helps increase market liquidity, as thousands of people are short-selling shares on any given trading day. This means that it is much easier for a buyer to trade the asset because there is a constant supply. Studies have shown that restrictions on short-selling lead to lower trading volumes, making short-selling integral to financial markets. Liquidity from short-selling also leads to a significant narrowing of spreads, which ultimately results in reduced costs for investors. A study of the 2008 financial crisis showed that the spread on stocks with a short ban increased by 150% more than on stocks without such restrictions.

Another benefit that short-sellers bring to financial markets is an intense scrutiny of a company’s financial statements, operating model and future prospects. The uncovering of any sensitive information is highly beneficial as it allows investors to better assess their investment decisions.

Short-selling tips

In order to get the most out of the market via short-selling, it’s important that you do extensive planning and have a solid strategy. We’ve put together a few tips to get you started.

- Do a complete fundamental analysis on the market before you decide to go short

- Consider the company’s business model before you short stocks – is it still relevant or are competitors overtaking them?

- Keep an eye on management structure and accounting irregularities. A company that changes its management often and engages in aggressive earnings management may be struggling

- Be mindful of your position size – the larger it is, the more risk is involved. However, if the position is very small, you might not make a visible profit

- Set up trading alerts that will notify you when your market hits a certain level and then lets you decide what to do next

- Place trailing stops that will follow your position if it earns a profit and close if it reverses

- Place guaranteed stops to close your position once it rises to a certain point. This puts a limit to your downside and you’ll only have to pay a small charge if your stop is triggered

Short-selling summed up

We’ve summarised a few key points to remember on short-selling below.

- You can go short on markets of your choice, including shares, indices, commodities and forex

- With IG, you can go short in your chosen market via CFD trading or spread betting

- If the underlying market price dips, you could make a profit. If the market price rises instead, you will make a loss

- It’s important to have the appropriate risk management tools in place to avoid big losses

- You can open an IG trading account in just a few minutes and start shorting today

In a nutshell, you can use short-selling to speculate on falling market prices – giving you the opportunity to profit from bear markets as well as bull runs.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.