Greggs sets its sights on more expansion

Greggs is already well-known across the UK, but it has its eyes on an even bigger bakery empire.

Ambitious UK growth targets

Greggs, the beloved UK bakery chain, has set its sights on an ambitious expansion plan to rapidly grow its national presence. The company, which will publish its full-year results on Tuesday 5 March, aims to reach just over 2,900 stores across the UK by 2026, an increase of around 150 net new locations per year since 2022. Looking even further ahead, management believes the company can eventually operate significantly more than 3,000 UK stores.

Greggs faces competition from big global names

However, Greggs' bold growth strategy will inevitably bring it into more direct competition with global food and beverage giants like McDonald's and Starbucks. As the bakery chain ventures further into the casual dining space, it will increasingly find itself vying for the same customer base as these well-established multinational brands.

Market share rising as store formats evolve

Despite the looming competitive challenges, Greggs has already made impressive strides in capturing market share within the fragmented £25 billion UK food-to-go market.

To support its expansion ambitions, Greggs is adapting its traditional store formats. The company is opening larger locations with dedicated seating areas, catering to evolving consumer preferences. It is also investing in delivery and drive-through capabilities, although this space is intensely competitive.

Greggs has identified central London as an area ripe for growth. The company sees an opportunity to extend operating hours to capture more trade in this key market.

Franchising growth

A key pillar of Greggs' expansion strategy involves rapidly growing its franchised store base. The goal is to have over 600 franchised locations by 2026, accounting for roughly 20% of the company's total footprint, up from 503 franchised stores as of December 2022.

Greggs is actively pursuing partnerships to open franchise locations in travel hubs like rail stations and airports as well as fuel station forecourts. A recent deal with SSP, which has a strong presence in rail stations and motorway service stations, is a good example of this move.

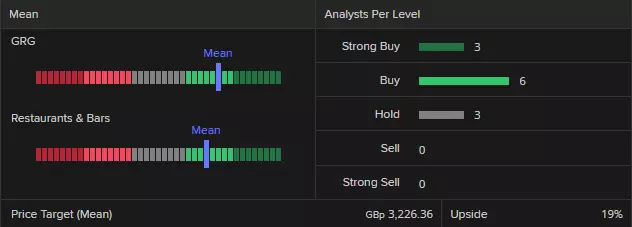

Analyst ratings for Greggs

LSEG (formerly known as Refinitiv) data shows a consensus analyst rating of ‘buy’ for Greggs with 3 strong buy, 6 buy and 3 hold – and a mean of estimates suggesting a long-term price target of 3,226p pence for the share, roughly 18% higher than the current price (as of 4 March 2024).

Technical outlook on the Greggs share price

The around 20% recovery in the Greggs’ share price from its mid-October low at 2,244p has so far taken it to its 2,858p February peak which was made close to the 2,914p May 2023 peak.

For a long-term bull market to be confirmed the 2,858p to 2,914p resistance area will need to be overcome. In this case the Greggs share price all-time high at 3,444p would be back in the picture.

Greggs Weekly Candlestick Chart

Last week the Greggs share price dipped to the 55-day simple moving average (SMA) at 2,640p which acted as support and from which it has resumed its ascent.

While the next lower October to March uptrend line at 2,604p underpins, the medium-term uptrend will remain intact.

Greggs Daily Candlestick Chart

Only a currently unexpected fall through the next lower 2,557p to 2,540p 200-day SMA and February low would lead technical analysts to question their medium-term bullish outlook.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.