Futures weaken and oil prices surge on news of war in the Middle East

The solid payrolls report on Friday prompted gains for stock markets, but these have been unwound slightly after the events of the weekend. Meanwhile, oil prices have surged.

Risk-off mood prevails following outbreak of Middle East war

The outbreak of conflict in the Middle East has caused a risk-off mood in the markets. As expected, oil prices have surged in response, but it appears that supply disruptions are unlikely at the moment.

While some may draw parallels to the 1973 oil embargo following the Yom Kippur war, it's important to note that Organisation of the Petroleum Exporting Countries's (OPEC) influence on global output has diminished since then. Additionally, the ongoing talks between Saudi Arabia and Israel to normalize relations present a different situation than what was seen in 1973.

The main concern right now is the risk of the conflict widening. The Wall Street Journal recently reported that Iran had given the green light to the operation, according to Hamas/Hezbollah sources. However, it's crucial to consider that these sources are backed by Iran and may have a vested interest in drawing Iran into the conflict. It will be up to US and Israeli intelligence to determine the extent of Iran's involvement.

US futures weaker following Friday’s surge

In terms of the post-NFP (Non-Farm Payrolls) bounce on Friday, we saw a very strong payrolls report. However, despite the rally in stocks, there doesn't seem to be a significant increase in expectations for a November interest rate hike. This could be because the report indicates that the US economy is still very strong, pushing recession expectations further out.

The report may not be strong enough to prompt the Federal Reserve (Fed) to make another move. The bar for further rate hikes has been set quite high, and it's unlikely that rates will come down until around mid-June next year. However, it's worth noting that a hot Consumer Price Index (CPI) report this week could potentially change the current outlook, prompting more gains for the US dollar.

WTI analysis & chart

West Texas Intermediate (WTI), which gapped higher by around 4% on Monday morning on heightened Middle East tensions, faltered around the 55-day simple moving average (SMA) at $87.62 per barrel before slipping back towards Friday’s “Doji” candlestick $84.54 high.

If the oil price were to indeed slip all the way down to this level, this week’s gap will have been filled with further downside likely to be seen in such a scenario. The 200-day SMA at $91.91, together with the August low at $81.68, represent possible downside targets.

WTI Daily Candlestick Chart

Resistance above the 55-day SMA at $87.62 comes in at Monday’s $88.46 intraday high, above which the breached June-to-October uptrend line – now because of inverse polarity resistance line - at $89.34 should act as resistance, were it to be reached at all.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

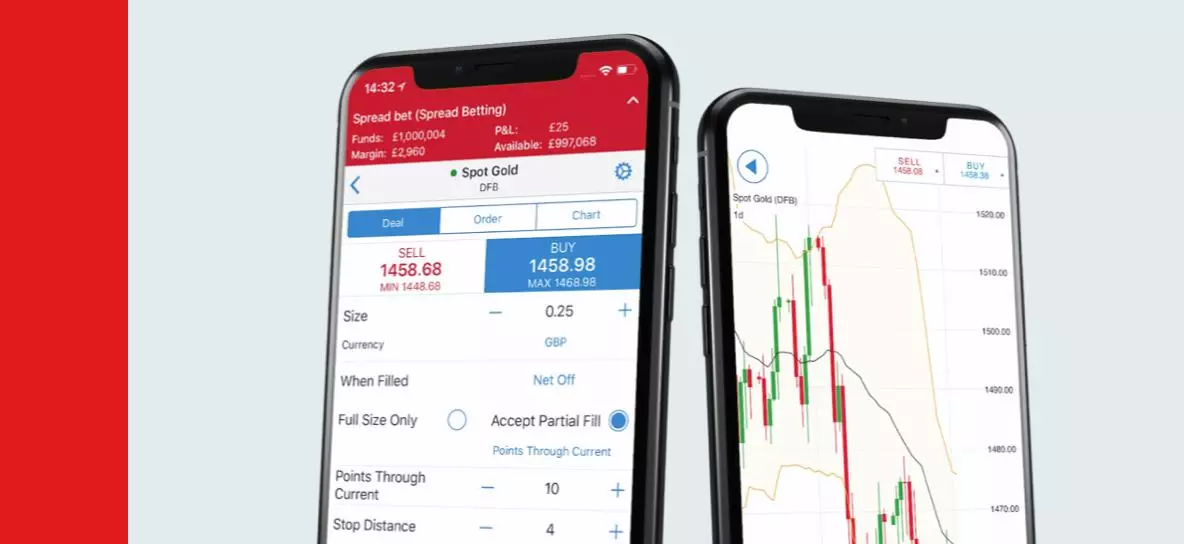

See your opportunity?

Seize it now. Trade over 15,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.