Ahead of the game: 16 October 2023

Your weekly financial calendar for market insights and key economic indicators.

US equity markets rallied this week, as the sharp increase in yields in recent months and geopolitical tensions in the Middle East led a series of Fed speakers to adopt a more cautious tone.

In Australia, the ASX 200 advanced on each of the first four days of this week. The index was buoyed by positive momentum from Wall Street and a safe-haven bid, attributed to Australia's geographical isolation from current hotspots in Europe and the Middle East, as well as its abundant energy and resource reserves.

- Wall Street's VIX down 4.24% to 16.70 on cautious Fed tones

- US inflation hotter at 3.7% vs 3.6% expected

- US core inflation hit target, up 0.3% MoM, annual rate down to 4.1%

- Crude retracts after 5% gain Monday, high US stockpiles offset Middle East tension

- Gold jumps 2% to $1870 on safe-haven flows

- US core PPI beats forecast, 0.3% MoM vs 0.2% expected

- In Australia, Westpac consumer confidence up 2.9% to 82, NAB Business Confidence flat at 1

- UK GDP rebounds, up 0.2% in August.

- NZ: Q3 Inflation (Tuesday, October 17th at 8:45 am AEDT)

- AU: RBA Meeting Minutes (Tuesday, October 17th at 11:30 am AEDT)

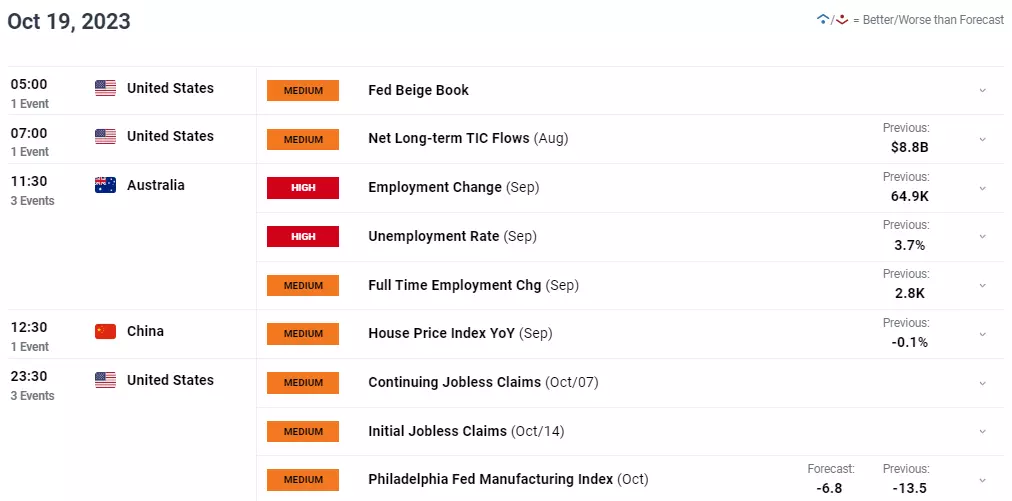

- AU: Employment Report (Thursday, October 19th at 11:30 am AEDT)

- NZ: Balance of Trade (Friday, October 20th at 8:45 am AEDT)

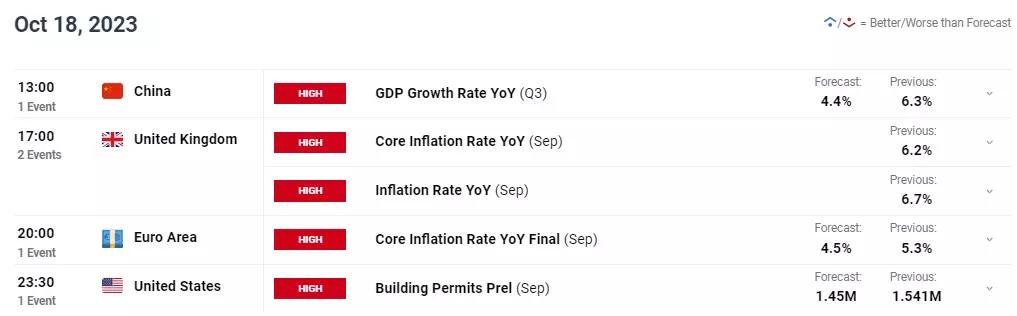

- CN: Q3 GDP, IP, and Retail Sales (Wednesday, October 18th at 1:00 pm AEDT)

- JP: Inflation (Friday, October 20th at 12:30 pm AEDT)

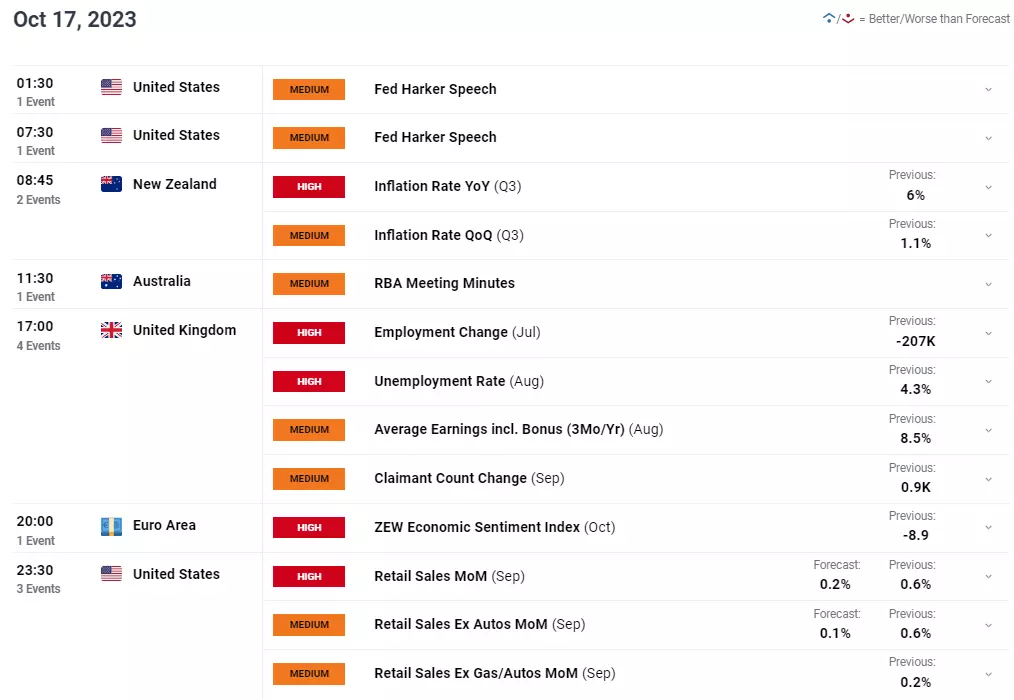

- US: Retail Sales (Tuesday, October 17th at 11:30 pm AEDT)

- US: Building Permits (Wednesday, October 18th at 11:30 pm AEDT)

- UK: Unemployment Rate (Tuesday, October 17th at 5:00 pm AEDT)

- GE: ZEW Economic Sentiment Index (Tuesday, October 17th at 8:00 pm AEDT)

- UK: Inflation Rate (Wednesday, October 18th at 5:00 pm AEDT)

- UK: Retail Sales (Friday, October 20th at 5:00 pm AEDT)

-

Australia

RBA meeting minutes

Date: Tuesday, October 17th at 11.30 am AEDT

The minutes from the Reserve Bank's meeting in October are scheduled to be released on Tuesday, October 17th at 11:30 a.m. At its October meeting, the RBA kept its cash rate on hold at 4.10% for a fourth consecutive month.

Apart from updates on recent inflation and GDP data, the message from the new RBA Governor, Michele Bullock, was little changed from former Governor Lowe's last statement. A tightening bias was retained, and future rate hikes will depend on "the data and evolving assessments of risk."

The Board Meeting Minutes are expected to reiterate the sentiments outlined above. They will be closely scrutinized to understand what factors could prompt the RBA to act on its tightening bias and what factors might lead to an extension of the RBA's pause for a fifth consecutive month.

RBA cash rate chart

-

CN

GDP

Date: Wednesday, October 18th at 1 pm AEDT

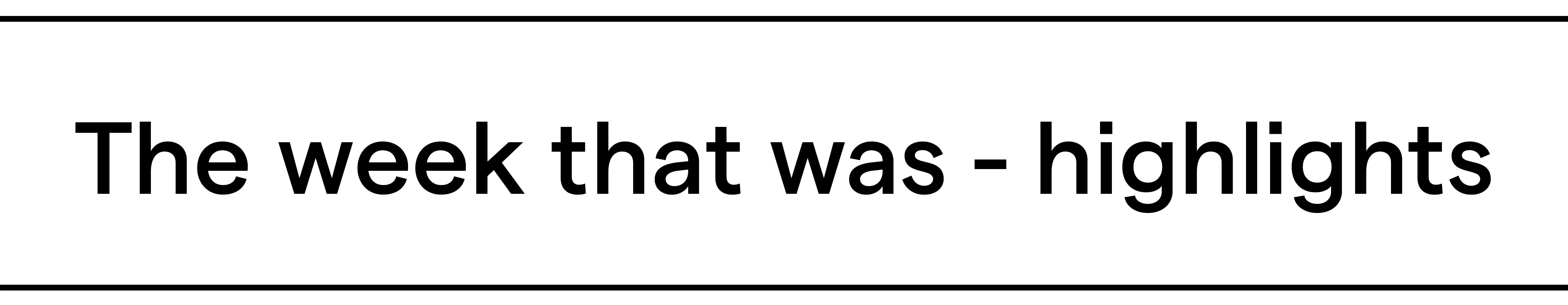

The Chinese economy grew by 6.3% YoY in Q2 2023, faster than the 4.5% growth rate recorded in Q1 but below market expectations of 7.3%. This quarter, Q3, the market is looking for GDP to increase by 4.5%.

However, the Q3 GDP slowdown is not expected to garner lasting attention as recent economic data in China indicate the worst for the Chinese economy is in the rearview mirror as the impact of incremental stimulus announced in recent months gains traction.

An example of this is Chinese PMIs for September released last week, which point to a recovery in the manufacturing and construction sectors. On top of this news, this week suggests that Chinese policymakers are considering another round of stimulus equivalent to 0.8% of GDP to help the economy reach its 5% annual growth target.

China GDP chart

-

UK

UK inflation

Date: Wednesday, October 18th at 5 pm AEDT

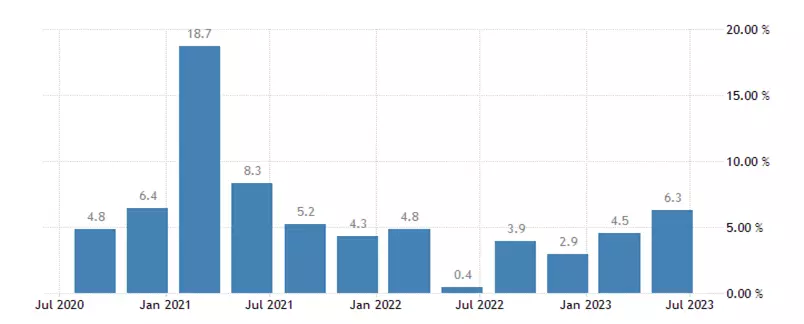

In August, UK headline inflation slowed to 6.7%, surprising markets which had expected a rise to 7.0%. The decrease was driven by a slowdown in food inflation and reduced accommodation service costs. Additionally, core inflation dropped to 6.2%, significantly lower than the consensus forecast of 6.8%. Now, in the current month, the market anticipates headline inflation to reach 6.2%, marking the lowest level in nine months since January 2022.

UK CPI chart

-

AU

Labour force report

Date: Thursday, October 19th at 11.30 am AEDT

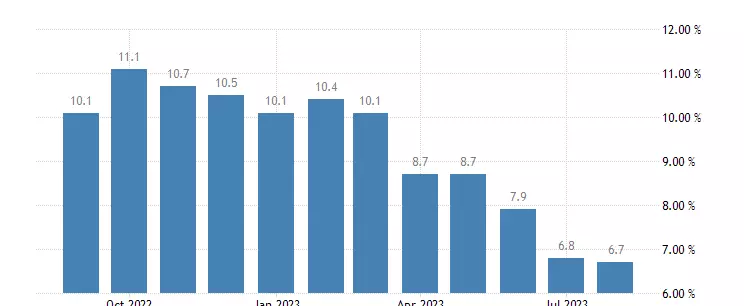

In August, the Australian economy delivered a positive surprise as it added 64.9k jobs, surpassing the expected 25k. The unemployment rate remained stable at 3.7%, despite a rise in the participation rate to 67% from 66.9%.

The Australian Bureau of Statistics (ABS) noted that the significant increase in employment in August followed a minor drop in July, influenced by the school holiday period.

For September, the market is looking for a +25k rise in employment, with the unemployment rate expected to remain stable at 3.7%. The participation rate is also anticipated to remain unchanged at 67.0%.

AU unemployment rate chart

-

US

Q3 2023 earnings season

Q3 earnings season picks up the speed next week with reports set to drop from companies including Bank of America, Johnson and Johnson, Lockheed Martin, Goldman Sachs, Tesla, Netflix, State Street and many more.

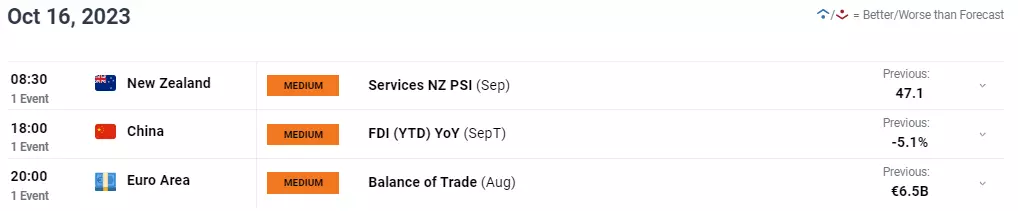

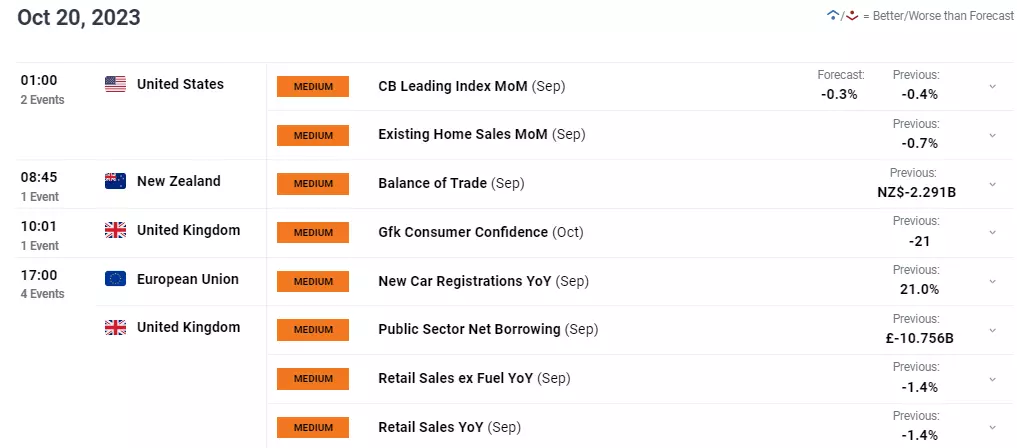

Economics calendar

All times shown in AEDT (UTC+10) unless otherwise stated.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade the markets

Learn how indices work – and discover the wide range of markets you can spread bet on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on the FTSE 100

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.